UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

| FORM | |||||

(Mark One)

For the fiscal year ended December 31 , 2025

OR

For the transition period from _ to _

Commission File Number: 001-38753

(Exact Name of Registrant as Specified in Its Charter)

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) | |||||||

| (Address of Principal Executive Offices) | (Zip Code) | |||||||

(617 ) 714-6500

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | ||||||||||||||||||

Emerging growth company | ||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☑ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant's most recently completed second fiscal quarter, was approximately $9.9 billion. This excludes shares of common stock held by each executive officer and director and by each other person who may be deemed to be an affiliate of the registrant. The determination of affiliate status for this purpose is not necessarily a conclusive determination for other purposes. The registrant has no non-voting common stock.

As of February 13, 2026, there were 394,939,424 shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Table of Contents

PART I. | Page | |||||||

| Item 1. | Business | |||||||

| Item 1A. | Risk Factors | |||||||

| Item 1B. | Unresolved Staff Comments | |||||||

| Item 1C. | Cybersecurity | |||||||

| Item 2. | Properties | |||||||

| Item 3. | Legal Proceedings | |||||||

| Item 4. | Mine Safety Disclosures | |||||||

PART II. | ||||||||

Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |||||||

| Item 6. | [Reserved] | |||||||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |||||||

| Item 8. | Financial Statements and Supplementary Data | |||||||

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |||||||

| Item 9A. | Controls and Procedures | |||||||

| Item 9B. | Other Information | |||||||

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |||||||

PART III. | ||||||||

Item 10. | Directors, Executive Officers and Corporate Governance | |||||||

| Item 11. | Executive Compensation | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |||||||

| Item 14. | Principal Accountant Fees and Services | |||||||

PART IV. | ||||||||

Item 15. | Exhibits, Financial Statement Schedules | |||||||

| Item 16. | Form 10-K Summary | |||||||

| Signatures | ||||||||

SUMMARY OF THE MATERIAL RISKS ASSOCIATED WITH OUR BUSINESS

Our business is subject to numerous risks and uncertainties that you should be aware of before making an investment decision, including those highlighted in the section entitled “Risk Factors.” These risks include, but are not limited to, the following:

•Regulatory and market uncertainty have and may continue to impact our business and the markets for our products;

•We may experience difficulties executing our near-term strategy and prioritized pipeline;

•The vaccine market, and pharmaceutical market more generally, is intensely competitive, and we may be unable to compete effectively in the market for existing or new products, treatment methods or technologies;

•We have experienced commercial challenges and may experience additional challenges in the future;

•The commercial success of our products depends on the degree of market acceptance by physicians, patients, third-party payors and others in the medical community;

•Sales of pharmaceutical products depend on the availability and extent of reimbursement from third-party payors, and we may be adversely impacted by changes to such reimbursement policies or rules;

•The market opportunities for our products and product candidates may be smaller than we believe, or we may be unable to successfully identify clinical trial participants;

•If we cannot obtain, or are delayed in obtaining, regulatory approvals and advisory committee recommendations, we will be unable to commercialize, or will be delayed in commercializing, our product candidates;

•Clinical development is lengthy and uncertain, and our clinical programs may be delayed or terminated, or may be more costly to conduct than we anticipate;

•Our products are, and any future products will be, subject to regulatory scrutiny;

•We or our third-party manufacturers may encounter difficulties in manufacturing, product release, shelf life, testing, storage, supply chain management or shipping for any of our products;

•As we grow as a commercial company and our drug development pipeline matures, the increased demand for clinical and commercial supplies from our facilities and third parties may impact our ability to operate;

•We are subject to operational risks associated with the physical and digital infrastructure at our manufacturing facilities and those of our external service providers;

•Our intismeran autogene product candidates are uniquely manufactured for each patient using a novel, complex manufacturing process and we may encounter difficulties in production;

•We are dependent on single-source suppliers for some of the components and materials used in, and the manufacturing processes required to develop and commercialize, our products and product candidates;

•We have entered into strategic alliances with third parties for product development and commercialization. If these alliances are unsuccessful, our business could be adversely affected;

•We may seek to establish additional strategic alliances and, if we are unable to do so on commercially reasonable terms, we may have to alter our development and commercialization plans. Certain of our strategic alliance agreements may restrict our ability to develop certain products;

•We may be unable to obtain and enforce patent protection for our discoveries and the intellectual property rights therein, or protect the confidentiality of our trade secrets;

•Uncertainty over intellectual property in the pharmaceutical and biotechnology industry has been the source of litigation and other disputes, which is inherently costly and unpredictable and can have adverse financial and freedom-to-operate consequences;

•We incurred net losses in 2025 and 2024, and expect to incur additional losses in the future; we have a limited history of recognizing revenue from product sales and may not achieve long-term sustainable profitability;

•Our quarterly and annual operating results may fluctuate. As a result, we may fail to meet or exceed the expectations of research analysts or investors, which could cause our stock price to decline;

•We may encounter difficulties in managing changes to the size, structure and scope of our company;

•We are subject to the risks of doing business outside of the United States;

•Our internal computer systems and physical premises, or those of third parties with which we share sensitive data or information, may fail or suffer security breaches, including from cybersecurity incidents, which could materially disrupt our product development programs and manufacturing operations; and

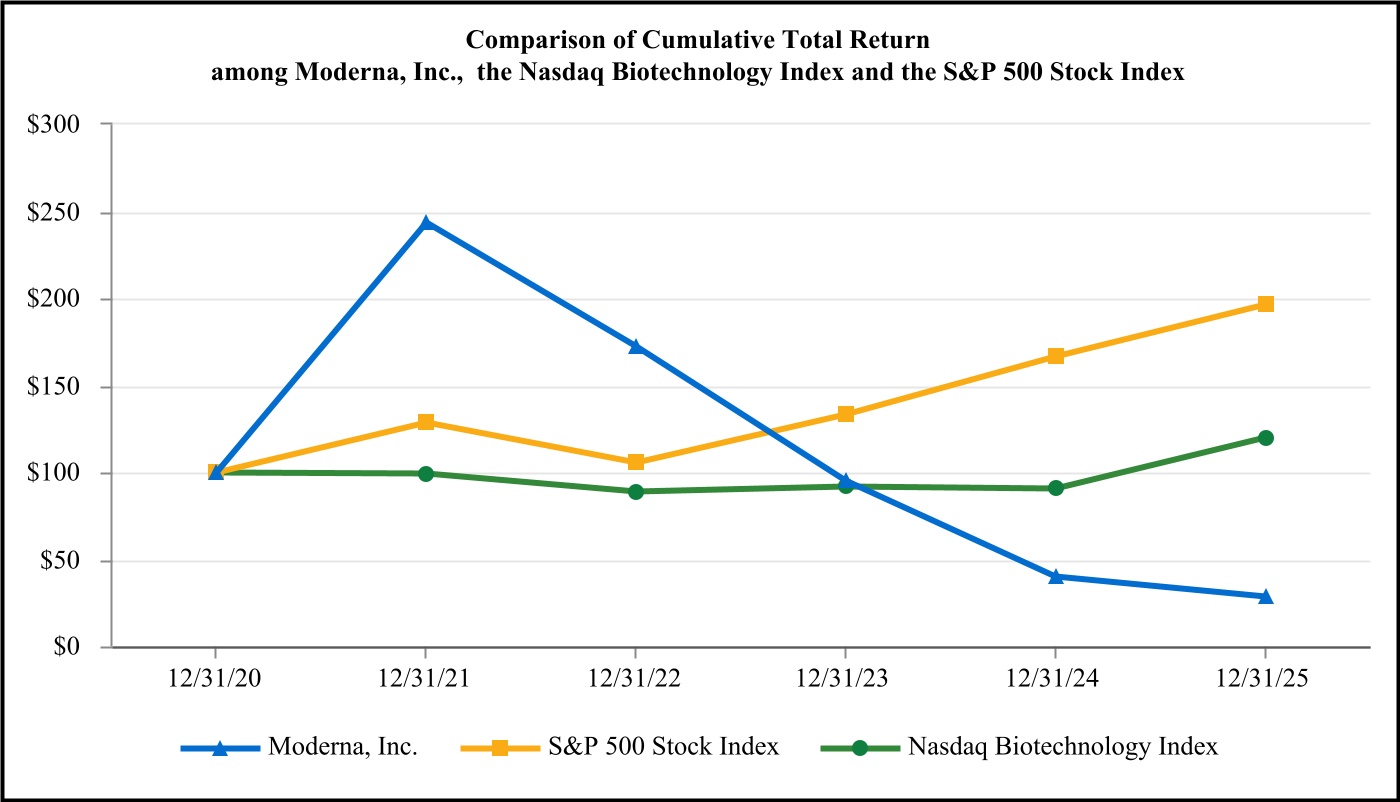

•The price of our common stock has been volatile, which could result in substantial losses for shareholders.

You should consider carefully the risks and uncertainties described below, in the section entitled “Risk Factors” and the other information contained in this Annual Report on Form 10-K, including our consolidated financial statements and the related notes, before you decide whether to purchase our common stock. The risks described above are not the only risks that we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business operations.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K, including the sections entitled “Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains express or implied forward-looking statements within the meaning of the federal securities laws, Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended (the Exchange Act). All statements other than statements of historical facts contained in this Annual Report are forward-looking statements. Forward-looking statements in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our ability to drive sales growth through geographic expansion and new product launches;

•our expectations regarding revenue growth in 2026;

•our ability to deliver cost efficiency across our business and to achieve targeted cash breakeven;

•our expectations regarding the size and durability of the respiratory vaccine market and future demand for and sales of our products;

•the potential and timing for future data readouts, regulatory filings, regulatory approvals and commercial launches;

•the timing of initiation, progress, completion, results (including interim data) and cost of our clinical trials, as well as those of our collaborators;

•our ability to successfully contract with third-party suppliers, distributors and manufacturers;

•our ability and the ability of third parties with whom we contract to successfully manufacture, supply and distribute our products, at scale, as well as drug substances, delivery vehicles and product candidates;

•the scope of protection we are able to establish and maintain for intellectual property rights covering our commercial products, product candidates and technology, including our ability to enter into license agreements, and our expectations regarding pending legal proceedings related to our intellectual property;

•participant enrollment in our clinical trials, including enrollment demographics and timing;

•potential advantages of mRNA as compared to traditional medicine;

•our ability to successfully commercialize our products, if approved, including in light of the size and growth potential of the markets for our products and the degree of market acceptance of our products;

•the pricing and reimbursement of our medicines, if approved;

•the buildout of our global manufacturing and commercial operations, and our ability to leverage our global manufacturing network;

•our financial performance and estimates of our future expenses, revenues and capital requirements;

•the potential benefits of strategic collaboration agreements and our ability to enter into strategic collaborations or other agreements with collaborators with development, regulatory and commercialization expertise;

•legal and regulatory developments in the United States and foreign countries;

•our ability to produce our products or product candidates with advantages in turnaround times and manufacturing cost;

•our ability to attract and retain key scientific, manufacturing, regulatory, commercial and management personnel; and

•developments relating to our competitors and our industry.

In some cases, forward-looking statements can be identified by terminology such as “may,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these identifying words. Forward-looking statements are based on our management’s belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by these forward-looking statements. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on forward-looking statements. Factors that may cause actual results or events to differ materially from current expectations include, among other things, those listed under the section entitled “Risk Factors” and elsewhere in this Annual Report on Form 10-K. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those expressed or implied by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date of this Annual Report on Form 10-K. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Annual Report on Form 10-K.

This Annual Report on Form 10-K includes statistical and other industry and market data that we obtained from industry publications and research, surveys, and studies conducted by third parties. Industry publications and third-party research, surveys, and studies generally indicate that their information has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. We have not independently verified the information contained in such sources.

NOTE REGARDING COMPANY REFERENCES

Unless the context otherwise requires, the terms “Moderna,” the “Company,” “we,” “us” and “our” in this Annual Report on Form 10-K refer to Moderna, Inc. and its consolidated subsidiaries.

TRADEMARKS

This Annual Report on Form 10-K contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to, including logos, artwork and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Table of Contents

PART I

Item 1. Business

Moderna is a pioneer and leader in the field of mRNA medicine. Through the advancement of our technology platform, we are reimagining how medicines are made to transform how we treat and prevent diseases. Since our founding, our mRNA platform has enabled the development of vaccine and therapeutic candidates across infectious disease, oncology, rare disease and more.

With a global team and a unique culture, driven by our values and mindsets, our mission is to deliver the greatest possible impact to people through mRNA medicines.

We currently have three commercial products—Spikevax and mNEXSPIKE (our COVID vaccines) and mRESVIA (our vaccine against respiratory syncytial virus (RSV)). mNEXSPIKE, which we launched commercially in the third quarter of 2025, is now our leading product in the U.S. retail channel. In 2025, we achieved total revenue of $1.9 billion, largely from sales of our COVID vaccines.

Beyond our commercial products, we continue to demonstrate the potential of our platform technology and are advancing a pipeline of development candidates across oncology, rare disease and infectious disease. In January 2026, we and Merck announced five-year data from the Phase 2b study of intismeran autogene (mRNA-4157), our mRNA-based individualized neoantigen therapy, in combination with Merck’s pembrolizumab (KEYTRUDA®), which demonstrated sustained improvement in recurrence-free survival in patients with high-risk melanoma (stage III/IV) following complete resection. We are advancing intismeran in collaboration with Merck, with eight Phase 2 and Phase 3 clinical trials underway across multiple tumor types. In oncology, we are also advancing mRNA-4359, a cancer antigen therapy designed to elicit T-cell immune responses against tumor and immunosuppressive cells.

In infectious disease, we have regulatory filings under review for our seasonal flu+COVID combination vaccine candidate (mRNA-1083) in Europe and Canada, and for our seasonal flu vaccine candidate (mRNA-1010) in the United States, Europe, Canada and Australia. For mRNA-1010, in response to a prior Refusal-to-File letter, we engaged with the U.S. Food and Drug Administration (FDA) in a Type A meeting and submitted an amended biologics license application (BLA) outlining a revised regulatory pathway based on age, seeking full approval for adults 50 to 64 years of age and accelerated approval for adults 65 and older, along with a post-marketing requirement to conduct an additional study in older adults. Following the meeting and submission of the amended application, the FDA accepted our BLA for review and assigned a Prescription Drug User Fee Act (PDUFA) goal date of August 5, 2026. In addition, we recently completed enrollment of a second Northern Hemisphere season (2025-2026) cohort in our ongoing Phase 3 study for our norovirus candidate (mRNA-1403).

In rare disease, our propionic acidemia therapeutic (mRNA-3927) has reached target enrollment in a registrational study. In January 2026, we entered into a strategic collaboration with Recordati, an international pharmaceutical group, to advance mRNA-3927 through the final stages of clinical development and, if approved, global commercialization. In addition, we expect the registrational study for our methylmalonic acidemia therapeutic (mRNA-3705) to begin in 2026.

Since 2022, we have streamlined our production sites into a global manufacturing network to support new product launches and deliver products for multi-year collaborations. In 2025, we announced new drug product capabilities in the U.S. and we have added three Moderna-built and managed facilities in the UK, Canada and Australia to enable local access to mRNA vaccines. Additionally, our Marlborough, Massachusetts facility was purpose-built for intismeran and began clinical batch supply in September 2025.

THE mRNA OPPORTUNITY

mRNA, the software of life

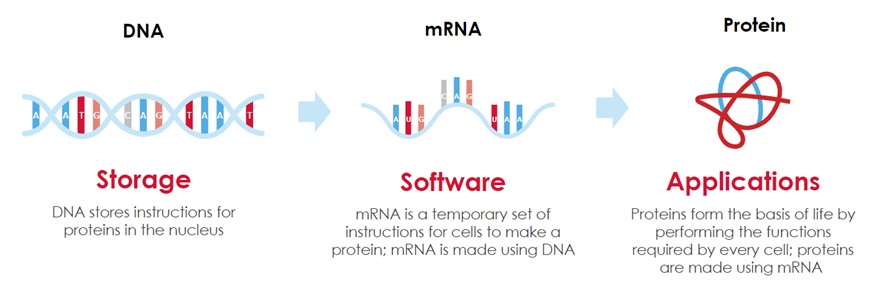

mRNA transfers the information stored in our genes to the cellular machinery that makes all the proteins required for life. Our genes are stored as sequences of DNA which contain the instructions to make specific proteins. DNA serves as a hard drive, safely storing these instructions in the cell’s nucleus until they are needed by the cell.

When a cell needs to produce a protein, the instructions to make that protein are copied from the DNA to mRNA, which serves as the template for protein production. Each mRNA molecule contains the instructions to produce a specific protein with a distinct function in the body. mRNA transmits those instructions to cellular machinery, called ribosomes, that make copies of the required protein.

We see mRNA functioning as the “software of life.” Every cell uses mRNA to provide real time instructions to make the proteins necessary to drive all aspects of biology, including in human health and disease. This was codified as the central dogma of molecular biology over 60 years ago, and is exemplified in the schematic below.

6

Table of Contents

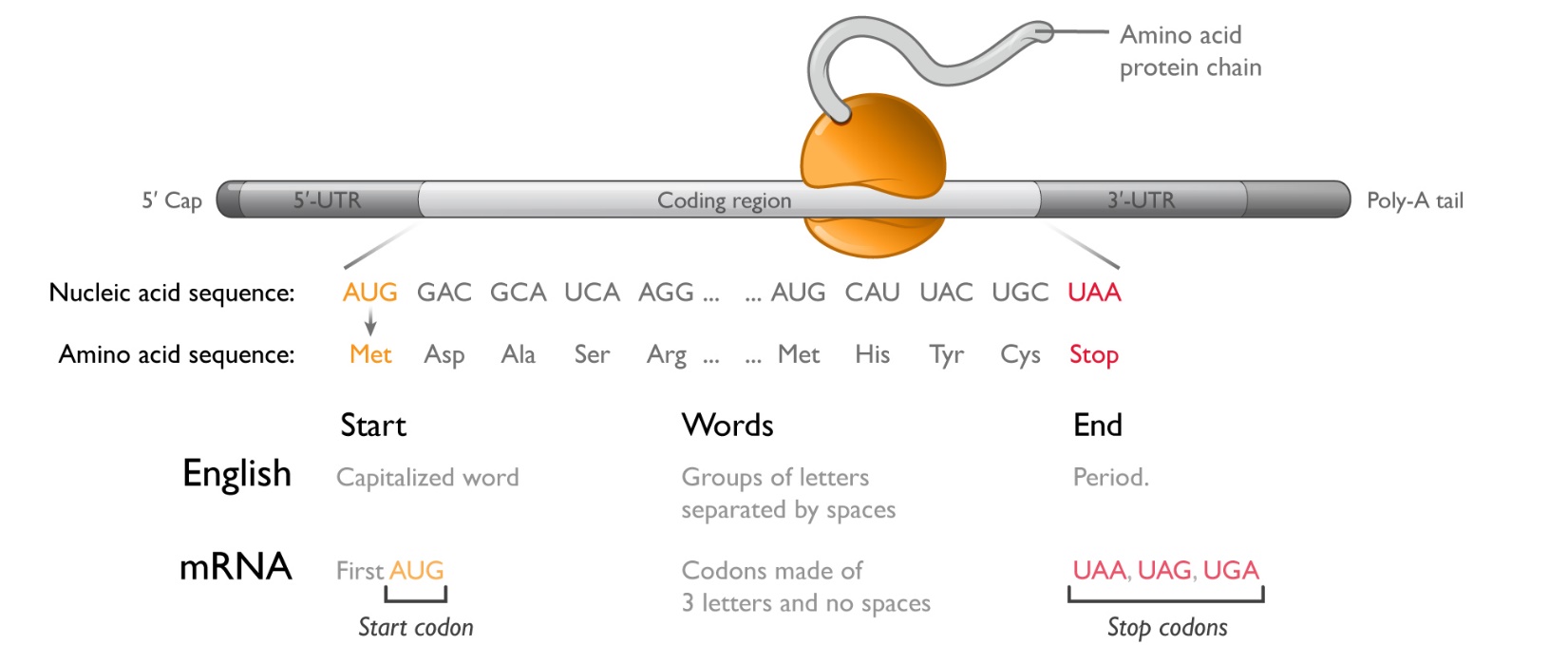

The structure of mRNA

mRNA is a linear polymer comprising four monomers called nucleotides: adenosine (A), guanosine (G), cytosine (C) and uridine (U). Within the region of the molecule that codes for a protein (the coding region), the sequence of these four nucleotides forms a language made up of three-letter words called codons. The first codon, or start codon (AUG), signals where the ribosome should start protein synthesis. To know what protein to make, the ribosome then progresses along the mRNA one codon at a time, appending the appropriate amino acid to the growing protein. To end protein synthesis, three different codons (UAA, UAG, and UGA) serve as stop signals, telling the ribosome where to terminate protein synthesis. In total, there are 64 potential codons, but only 20 amino acids that are used to build proteins; therefore, multiple codons can encode for the same amino acid.

The process of protein production is called translation because the ribosome is reading in one language (a sequence of codons) and outputting in another language (a sequence of amino acids). The coding region is analogous to a sentence in English. Much like a start codon, a capitalized word can indicate the start of a sentence. Codons within the coding region resemble groups of letters representing words. The end of the sentence is signaled by a period in English, or a stop codon for mRNA.

In every cell, hundreds of thousands of mRNAs make hundreds of millions of proteins every day. A typical protein contains 200-600 amino acids; therefore, a typical mRNA coding region ranges from 600-1,800 nucleotides. In addition to the coding region, mRNAs contain four other key features: (1) the 5’ untranslated region (5’-UTR); (2) the 3’ untranslated region (3’-UTR); (3) the 5’ cap; and (4) a 3’ polyadenosine (poly-A) tail. The sequence of nucleotides in the 5’-UTR influences how efficiently the ribosome initiates protein synthesis, whereas the sequence of nucleotides in the 3’-UTR contains information about which cell types should translate that mRNA and how long the mRNA should last. The 5’ cap and 3’ poly-A tail enhance ribosome engagement and protect the mRNA from attack by intracellular enzymes that digest mRNA from its ends.

7

Table of Contents

The intrinsic advantages of using mRNA as a medicine

mRNA possesses inherent characteristics that we believe position it to have a profound impact on human health:

•mRNA is used by every cell to produce all proteins: mRNA is used to make every type of protein, including secreted, membrane and intracellular proteins, in varying quantities over time, in different locations and in various combinations. Given the universal role of mRNA in protein production, we believe that mRNA medicines could have broad applicability across human disease.

•Making proteins inside one’s own cells mimics human biology: Tailored mRNA can be sent into cells to instruct them to produce specific protein therapeutics or vaccine antigens and provides certain advantages over traditional approaches to medicine, where a protein or chemical is introduced to the body.

•mRNA has a simple and flexible chemical structure: Each mRNA molecule comprises four chemically similar nucleotides to encode proteins made from up to 20 chemically different amino acids. To make the full diversity of possible proteins, only simple sequence changes are required in mRNA, instead of starting from scratch for each new vaccine or therapy.

•mRNA has classic pharmacologic features: mRNA possesses many of the attractive pharmacologic features of most modern medicines, including reproducible activity, predictable potency and well-behaved dose dependency; mRNA also provides the ability to adjust dosing based on an individual patient’s needs, including stopping or lowering the dose, to seek to promote safety and tolerability.

Our success in developing, manufacturing and commercializing mRNA medicines demonstrates the potential of our platform to help people and patients in far-reaching ways that could exceed the impact of traditional approaches to medicine.

We believe that the main advantages of mRNA as compared to traditional medicine are:

1.mRNA could create an unprecedented abundance and diversity of medicines. mRNA’s breadth of applicability has the potential to create an extraordinary number of new mRNA medicines that are currently beyond the reach of recombinant protein technology.

2.Advances in the development of our mRNA medicines reduce risks across our portfolio. mRNA medicines share fundamental features that can be leveraged across our portfolio. We believe that once safety and proof of protein production has been established in one program, the technology and biology risks of related programs that use similar mRNA technologies, delivery technologies and manufacturing processes will decrease significantly.

3.mRNA technology can accelerate discovery and development. The software-like features of mRNA enable rapid in silico design and the use of automated high-throughput synthesis processes that permit discovery to proceed in parallel rather than sequentially. We believe these mRNA features can also accelerate drug development by allowing the use of shared manufacturing processes and infrastructure.

4.The ability to leverage shared processes and infrastructure can drive significant capital efficiency over time. We believe the manufacturing requirements of different mRNA medicines are similar and that at commercial scale, a portfolio of mRNA medicines will benefit from shared capital expenditures.

OUR STRATEGY

We believe that the development of mRNA medicines represents a significant breakthrough for patients, our industry and human health globally. We are currently focused on four strategic priorities:

1.Deliver sales growth. Our commercial growth drivers include geographic expansion and new product launches. In 2026, we expect to drive revenue growth from the annualized impact of our long-term partnerships in the UK, Canada and Australia, as well as continued strong uptake of mNEXSPIKE in the U.S. In addition, we expect multiple growth opportunities in 2027 and 2028.

2.Deliver cost efficiency across the business. Throughout 2025, we maintained disciplined cost management, improving productivity across manufacturing, R&D and SG&A. We expect to further reduce costs in 2026 and 2027. We plan to leverage our global production network, artificial intelligence (AI) and digital tools to improve cost efficiency.

3.Execute on our prioritized pipeline. We anticipate pivotal trial data readouts in 2026 across our oncology, rare disease and infectious disease portfolios. We expect to launch several new infectious disease products over the next few years (flu, flu+COVID combination and Norovirus), which would expand our infectious disease vaccine franchise to as many as six approved products. We expect to invest the cash generated from these products into oncology and rare disease therapeutics.

8

Table of Contents

4.Continue to advance our early pipeline and platform technology. We continue to advance our early-stage pipeline. This includes our early-stage oncology programs, which expand our oncology portfolio across cancer antigen therapies, T-cell engagers and cell-therapy enhancers, as well as multiple early-stage vaccine programs.

OUR PLATFORM

Overview of our platform

Our mRNA “platform” refers to our accumulated knowledge and capabilities in basic and applied sciences. Our platform incorporates advances across three key components—mRNA, delivery and the manufacturing process— to advance our medicines. We integrate these components and combine different versions of mRNA delivery and process into each of our medicines.

Our platform: mRNA science advancements

We continue to invest in both basic and applied research, seeking to advance both the state of our technology and the state of the scientific community’s understanding of mRNA. Examples of advances in mRNA science that combine nucleotide chemistry, sequence engineering and targeting elements are described below.

mRNA chemistry: Modified nucleotides to mitigate immune system activation: The innate immune system has evolved to protect cells from foreign RNA, such as viral RNA, by inducing inflammation and suppressing mRNA translation once detected. Many cells surveil their environment through sensors called toll-like-receptors (TLRs). These include types that are activated by the presence of double-stranded RNA (TLR3) or uridine containing RNA fragments (TLR7, TLR8). Additionally, all cells have cytosolic double-stranded RNA, sensors, including retinoic acid inducible gene-I (RIG-I) that are sensitive to foreign RNA inside the cell.

The immune and cellular response to mRNA is complex, context specific, and often linked to the sensing of uridine. To minimize undesired immune responses to our potential mRNA medicines, our platform employs chemically-modified uridine nucleotides to minimize recognition by both immune cell sensors such as TLR3/7/8, and broadly-distributed cytosolic receptors such as RIG-I.

mRNA sequence engineering: Maximizing protein expression: mRNA exists transiently in the cytoplasm, during which time it can be translated into thousands of proteins before eventually being degraded. Our platform applies bioinformatic, biochemical, and biological screening capabilities, most of which have been invented internally that aim to optimize the amount of protein produced per mRNA. We have identified proprietary sequences for the 5’-UTR that have been observed to increase the likelihood that a ribosome bound to the 5’-end of the mRNA transcript will find the desired start codon and reliably initiate translation of the coding region. We additionally design the nucleotide sequence of the coding region to maximize its successful translation into protein.

Targeting elements: Enabling tissue-targeted translation: All nucleated cells in the body are capable of translating mRNA, resulting in pharmacologic activity in any cell in which mRNA is delivered and translated. To minimize or prevent potential off-target effects, our platform employs technologies that regulate mRNA translation in select cell types. Cells often contain short RNA sequences, called microRNAs or miRNAs, that bind to mRNA to regulate protein translation at the mRNA level. Different cell types have different concentrations of specific microRNAs, in effect giving cells a microRNA signature. microRNA binding directly to mRNA effectively silences or reduces mRNA translation and promotes mRNA degradation. We design microRNA binding sites into the 3’-UTR of our potential mRNA medicines so that if our mRNA is delivered to cells with such microRNAs, it will be minimally translated and rapidly degraded.

Our platform: Delivery science

Our mRNA can, in specific instances, be delivered by direct injection to a tissue in a simple saline formulation without lipid nanoparticles (LNPs) to locally produce small amounts of pharmacologically active protein. However, the blood and interstitial fluids in humans contain significant RNA degrading enzymes that rapidly degrade any extracellular mRNA and prevent broader distribution without LNPs. Additionally, cell membranes tend to act as a significant barrier to entry of large, negatively-charged molecules such as mRNA. We have therefore invested heavily in delivery science and have developed LNP technologies to enable delivery of larger quantities of mRNA to target tissues.

LNPs are generally composed of four components: an amino lipid, a phospholipid, cholesterol, and a pegylated-lipid (PEG-lipid). Each component, as well as the overall composition, or mix of components, contributes to the properties of each LNP system. LNPs containing mRNA injected into the body rapidly bind proteins that can drive uptake of LNPs into cells. Once internalized in endosomes within cells, the LNPs are designed to escape the endosome and release their mRNA cargo into the cell cytoplasm, where the mRNA can be translated to make a protein and have the desired therapeutic effect. Any mRNA and LNP components that do not escape the endosome are typically delivered to lysosomes where they are degraded by the natural process of cellular digestion.

9

Table of Contents

Examples of tools we developed by using our platform include proprietary LNP formulations that address the steps of mRNA delivery, including cell uptake, endosomal escape, and subsequent lipid metabolism, and for avoidance of counterproductive interactions with the immune system.

Chemistry: Novel lipid chemistry to potentially improve safety and tolerability: Our proprietary LNP systems are designed to be highly tolerated and minimize any LNP vehicle-related toxicities with repeat administration in vivo. To overcome limitations of previous LNP formulations, we have engineered amino lipids to avoid the immune system and to be rapidly biodegradable relative to prior lipids.

Composition: Proprietary LNPs enhance delivery efficiency: Our platform includes extensive in-house expertise in medicinal chemistry, which we have applied to design large libraries of novel lipids. Using these libraries in combination with our discovery biology capabilities, we have conducted high throughput screens for desired LNP properties and believe that we have made fundamental discoveries in preclinical studies about the relationships between structural motifs of lipids and LNP performance for protein expression.

Surface properties: Novel LNP design to avoid immune recognition: We have designed our proprietary LNP systems for sustained pharmacology upon repeat dosing by eliminating or altering features that activate the immune system. These are based on insights into the surface properties of LNPs. Upon repeated dosing, surface features on traditional LNPs such as amino lipids, phospholipids, and PEG-lipids, can be recognized by the immune system, leading to rapid clearance from the bloodstream, a decrease in potency upon repeat dosing, and an increase in inflammation. Based on our insights into these mechanisms, we have engineered our LNP systems to reduce or eliminate undesirable surface features. In clinical studies for our systemic therapeutic product candidates that use our novel LNP systems, we have been able to repeat dose with negligible or undetectable loss in potency, liver damage, and immune system activation.

Our platform: Manufacturing process science

We invest significantly in manufacturing process science to impart more potent features to our mRNA and LNPs, and to invent the technological capabilities necessary to manufacture our mRNA medicines at scales ranging from micrograms to kilograms, as well as achieve pharmaceutical properties such as solubility and shelf life. We view developing these goals of manufacturing and pharmaceutical properties as appropriate for each program, based on its stage of development.

mRNA manufacturing process: Improving pharmacology: Our platform creates mRNA using a cell-free approach called in vitro transcription in which an RNA polymerase enzyme binds to and transcribes a DNA template, adding the nucleotides encoded by the DNA to the growing RNA strand. Following transcription, we employ proprietary purification techniques to ensure that our mRNA is free from undesired synthesis components and impurities that could activate the immune system in an indiscriminate manner. Applying our understanding of the basic science underlying each step in the manufacturing process, we have designed proprietary manufacturing processes to impart desirable pharmacologic features, for example increasing potency in a vaccine.

LNP manufacturing process: Improving pharmacology: Our platform technology includes synthetic processes to produce LNPs. Traditionally LNPs are assembled by dissolving the four molecular components, amino lipid, phospholipid, cholesterol, and PEG-lipid, in ethanol and then mixing this with mRNA in an aqueous buffer. The resulting mixture is then purified to isolate LNPs from impurities. Such impurities include molecular components that have not been incorporated into particles, un-encapsulated mRNA that could activate the immune system, and particles outside of the desired size range. Going beyond optimization of traditional manufacturing processes, we have invested in understanding and measuring the various biochemical and physical interactions during LNP assembly and purification. We have additionally developed state-of-the-art analytical techniques necessary to characterize our LNPs and biological systems to analyze their in vitro and in vivo performance. With these insights, we have identified manufacturing process parameters that drive LNP performance, for example, the potency in a secreted therapeutic setting. These insights have allowed us to make significant improvements in the efficiency of our processing and the potency of our LNPs.

Harnessing the power of mRNA through modalities

Within our platform, we invest in science to invent novel ways to deliver mRNA into various cell types. Each novel delivery system is a new application, called a “modality.” While the programs within a modality may target diverse diseases, they share similar mRNA characteristics and manufacturing processes to achieve shared product features.

We believe that the high technological correlation within a modality allows us to rapidly accelerate the expansion of programs within that modality based on learnings from the earlier programs, while the lower technology correlation between modalities allows us to compartmentalize the technology risks. Additionally, because programs within a modality pursue diverse diseases, they often have uncorrelated biology risk. New modalities and product candidates can create a network effect by helping us gain additional insight into the other programs in our pipeline.

10

Table of Contents

Although developing a new modality is difficult, time-consuming and expensive, we believe our experience and technology provide us with unique advantages in the development of mRNA medicines. Over the last decade, we have developed a number of modalities, each with one or many product candidates in the clinic. We believe that our ongoing investments in our platform will lead to the identification of additional modalities and expand the utility of our existing modalities and the diversity of our pipeline.

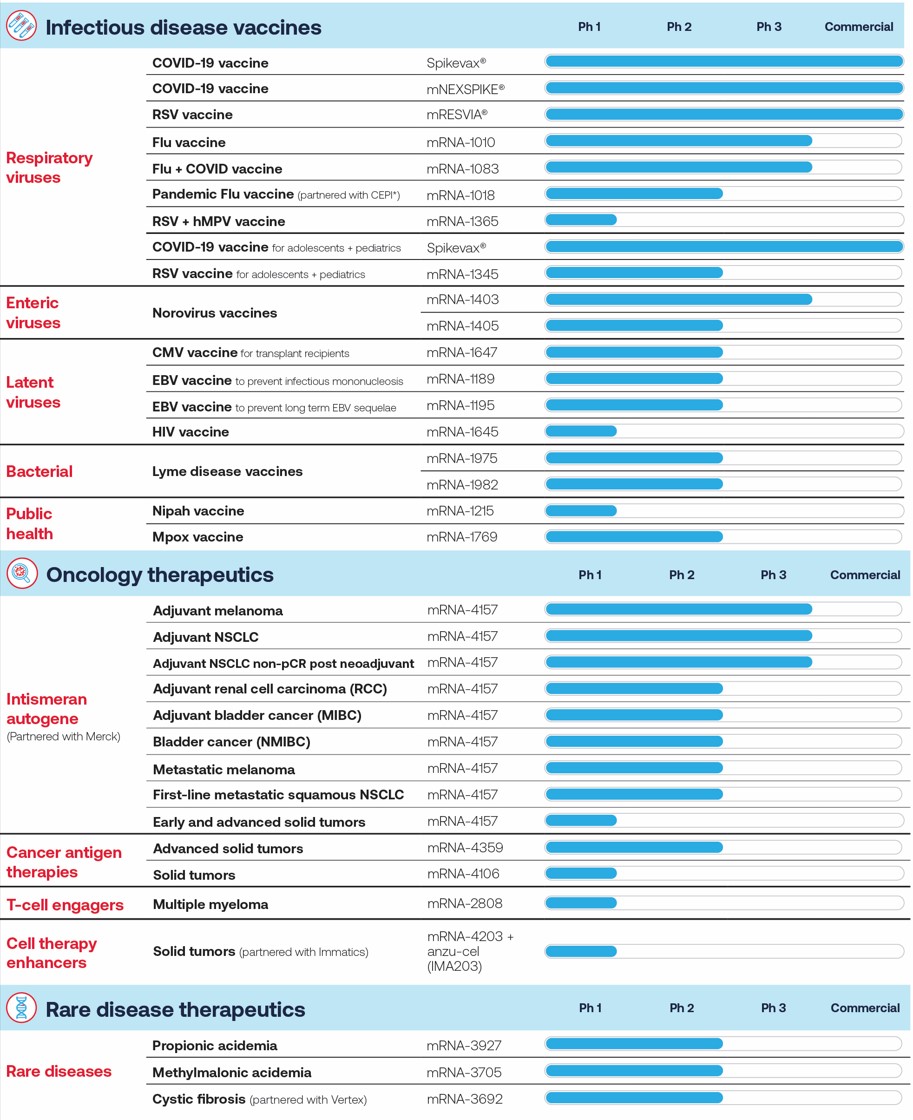

OUR PIPELINE

Over the last decade, we have advanced in parallel a diverse development pipeline that currently consists of 35 therapeutic and vaccine programs, 6 of which are in late-stage development. The scope of our pipeline reflects the breadth of biology addressable using mRNA technology, and spans three franchises: infectious disease vaccines, oncology therapeutics, and rare disease therapeutics.

Our selection process for advancing new product candidates reflects both program-specific and portfolio-wide considerations. Program-specific criteria include, among other relevant factors, the severity of the unmet medical need, the biology risk of our chosen target or disease, the feasibility of clinical development, the costs of development and the commercial opportunity. Portfolio-wide considerations include the ability to demonstrate technical success for our platform components within a modality, thereby increasing the probability of success and learnings for subsequent programs.

11

Table of Contents

Our full pipeline is shown in the figure below:

12

Table of Contents

INFECTIOUS DISEASE FRANCHISE

Respiratory Vaccines

We have three commercial respiratory vaccines—Spikevax and mNEXSPIKE (our COVID vaccines) and mRESVIA (our RSV vaccine for older adults and high-risk adults ages 18-59). Additionally, we have regulatory filings under review for our seasonal flu+COVID vaccine (mRNA-1083) in Europe and Canada and for our seasonal flu vaccine (mRNA-1010) in the United States, Europe, Canada and Australia. Our current respiratory programs are summarized below.

COVID vaccines (Spikevax/mRNA-1273, mNEXSPIKE/mRNA-1283)

COVID-19 is caused by the SARS-CoV-2 virus that was first identified in humans in 2019, driving a global pandemic resulting in millions of deaths. The risk of mortality increases with age, and the risk of severe disease and mortality is higher among individuals with certain pre-existing conditions, including cardiovascular disease, diabetes, chronic lung disease and obesity. As the SARS-CoV-2 virus continues to evolve, our COVID vaccines continue to be key tools in fighting COVID-19.

We currently have two approved COVID vaccines: Spikevax (our original COVID vaccine) and mNEXSPIKE. mNEXSPIKE was approved by the FDA in May 2025 for individuals 65 years of age and older, and individuals 12 through 64 years of age who are at high risk for severe COVID-19. mNEXSPIKE focuses immune responses to the domains of the SARS-CoV-2 spike protein that are critical for neutralizing antibody and T cell responses. mNEXSPIKE’s mRNA dose is one-fifth that of Spikevax. In April 2025, we shared Phase 3 data showing non-inferior vaccine efficacy relative to Spikevax, and a 13.5% relative vaccine efficacy (rVE) compared to Spikevax in participants 65 years of age and older.

As part of our strategy to continue to combat COVID-19, we develop and assess variant-specific versions of our COVID vaccines. We pursue updated vaccine compositions based on guidance from the FDA, and other regulatory bodies including European Medicines Agency (EMA) and the World Health Organization (WHO), with the goal of broadening vaccine-induced immunity and providing protection against circulating SARS-CoV-2 variants. Our 2025-2026 formulas for Spikevax and mNEXSPIKE target the LP.8.1 variant of SARS-CoV-2. The FDA has approved our 2025-2026 Spikevax formula for high-risk individuals aged six months through 64 years and all adults 65 years of age and older. We have received approval of our 2025-2026 Spikevax formula in 40 countries. The FDA has approved our 2025-2026 mNEXSPIKE formula for high-risk individuals 12 through 64 years of age and all adults 65 years of age and older. We have also received approvals of mNEXSPIKE in Europe, Canada and Australia.

RSV vaccine (mRESVIA/mRNA-1345)

RSV is one of the most common causes of lower respiratory disease in children under the age of five and in older adults. Populations that are especially vulnerable to developing severe RSV infections include infants, young children, children and adults with chronic medical conditions and older adults. Most children are infected at least once by age two. In the United States, it is estimated that up to 80,000 children are hospitalized due to RSV infection annually. RSV infection causes up to 160,000 hospitalizations and up to 10,000 deaths per year in adults aged 65 years or older in the United States. Adults 18 to 59 years of age with certain comorbidities also face a significant disease burden that is similar to that of older adults.

We have developed an RSV vaccine (mRNA-1345 or mRESVIA) for adults. mRESVIA encodes an engineered form of the RSV F protein stabilized in the prefusion conformation and is formulated in our proprietary LNP. In May 2024, we announced the FDA approved mRNA-1345, brand name mRESVIA, for the prevention of RSV-associated lower respiratory tract disease (RSV-LRTD) in adults 60 years or older. Subsequently, the Advisory Committee on Immunization Practices (ACIP) issued a recommendation for all unvaccinated people aged 75 years and older and unvaccinated people aged 60 to 74 who are at increased risk for RSV. In June 2025, we received FDA approval for use of mRESVIA in adults ages 18-59 who are at increased risk for RSV-LRTD. In April 2025, the ACIP expanded its RSV vaccination recommendation to include high-risk individuals ages 50-59. mRESVIA was approved in the EU in August 2024 and in Canada in November 2024. In Canada, mRESVIA is recommended for individuals 75 and over and high-risk individuals ages 50-74, while in Europe, the vaccine is recommended for individuals 60 and over as well as high-risk individuals ages 18-59. mRESVIA has been approved in 40 countries for all adults 60 years and older and also approved in 31 of those countries for high-risk adults aged 18-59.

We have completed additional Phase 3 studies in adults that have shown that mRNA-1345 restores immune response when revaccinated at 12 or 24 months, can be co-administered with a COVID mRNA vaccine, and is immunogenic in the solid organ transplant population.

13

Table of Contents

Seasonal influenza vaccine (mRNA-1010)

The WHO estimates that seasonal influenza viruses cause three to five million cases of severe illness and 290,000 to 650,000 deaths each year, resulting in a severe challenge to public health. Currently licensed seasonal influenza vaccines rarely exceed 60% overall effectiveness and can provide low effectiveness during years when the circulating viruses do not match the strains selected for the vaccine antigens.

Our seasonal influenza vaccine candidate (mRNA-1010) encodes for the hemagglutinin (HA) proteins of the strains recommended by the WHO. We aim to work with the WHO, regulators and public health authorities to enable strain selection closer to the influenza season to provide a better match to the circulating viruses.

In February 2023, we announced interim results from the P301 study of mRNA-1010. The results indicated that mRNA-1010 achieved higher seroconversion rates for A/H3N2 and A/H1N1, as well as superiority on geometric mean titer ratios for A/H3N2 and non-inferiority on geometric mean titer rations for A/H1N1. Non-inferiority was not met for either endpoints for the influenza B/Victoria- or B/Yamagata-lineage strains. mRNA-1010 showed an acceptable safety and tolerability profile. In April 2023, we announced the P302 study of mRNA-1010 did not accrue sufficient cases at the interim efficacy analysis to declare early success in the Phase 3 Northern Hemisphere efficacy trial. In September 2023, we announced the P303 immunogenicity and safety study of mRNA-1010 met all eight co-primary endpoints with an updated composition that was able to generate an improved immune response to influenza B strains. mRNA-1010 also elicited higher titers than the licensed comparator against all strains in this study. In September 2024, we shared results in an older adult extension study of P303, where mRNA-1010 met all primary immunogenicity endpoints, including superiority for all strains, compared to a licensed enhanced flu vaccine and showed an acceptable reactogenicity profile. Consequently, we announced that we were planning to start a confirmatory vaccine efficacy study, P304, funded by project financing through Blackstone Life Sciences, a collaboration we announced in 2024. In October 2025, we presented the results of this study showing a 26.6% relative vaccine efficacy versus the standard dose comparator in adults 50 year of age and older.

mRNA-1010 has been filed for approval in the United States, Europe, Canada and Australia. In February 2026, in response to a prior Refusal-to-File letter, we engaged with the FDA in a Type A meeting and submitted an amended BLA outlining a revised regulatory pathway based on age, seeking full approval for adults 50 to 64 years of age and accelerated approval for adults 65 and older, along with a post-marketing requirement to conduct an additional study in older adults. Following the meeting and submission of the amended application, the FDA accepted our BLA for review and assigned a PDUFA goal date of August 5, 2026.

We have paused development of mRNA-1011, mRNA-1012, mRNA-1020, and mRNA-1030, which were flu vaccines that included additional antigens relative to what is included in mRNA-1010.

Combination vaccines (mRNA-1083 and mRNA-1365)

We are developing combination vaccine candidates to simplify and facilitate protection against a range of respiratory diseases.

Our COVID and seasonal influenza combination vaccine (mRNA-1083), encodes the same antigens as our seasonal influenza vaccine (mRNA-1010) and mNEXSPIKE. In June 2024, we announced that our Phase 3 clinical trial of mRNA-1083 met its primary endpoints, eliciting higher immune responses against influenza virus and SARS-CoV-2 than licensed flu and COVID vaccines in adults 50 years and older, including an enhanced influenza vaccine in adults 65 years and older. We filed for FDA approval for mRNA-1083 in November 2024 and also submitted regulatory applications in other geographies, including the EU, Canada, Australia and the UK. Demonstration of vaccine efficacy in our ongoing Phase 3 mRNA-1010 flu study was required by regulatory authorities in certain jurisdictions to support approval of mRNA-1083. As a result, we withdrew our application for mRNA-1083 in certain geographies until the mRNA-1010 Phase 3 study was completed. In October 2025, we reported full results of our mRNA-1010 vaccine efficacy study. mRNA-1083 is under regulatory review in Europe and Canada, and we are awaiting further guidance from the FDA for re-filing in the U.S. In addition, we plan to pursue regulatory submissions for mRNA-1083 in selected additional international markets.

We continue to evaluate the clinical development strategy for mRNA-1083, including the appropriate age populations and indications for future studies.

In addition, safety follow-up continues in our Phase 1 study for mRNA-1365, our RSV and human metapneumovirus (hMPV) combination vaccine, in children five to 23 months of age. We are also evaluating an updated version of mRNA-1365 in older adults.

14

Table of Contents

Pandemic influenza vaccine (mRNA-1018)

An influenza pandemic is a global outbreak of a new influenza A virus that is very different from recently circulating human seasonal influenza A viruses. Historically, pandemic strains have arisen by antigenic shift, which is a major change in an influenza A virus caused by the exchange of genetic segments between a non-human influenza virus with another influenza virus; this can occur through a simultaneous infection of an animal (e.g., swine) or humans with multiple influenza viruses.

We are developing a pandemic influenza vaccine candidate that encodes for hemagglutinin (HA) glycoproteins. In 2023, we initiated a Phase 1/2 study to generate safety and immunogenicity data of our investigational pandemic influenza vaccine (mRNA-1018) in healthy adults 18 years of age and older. The study included vaccine candidates against H5 and H7 avian influenza viruses. In October 2025, we presented results of this study showing that mRNA-1018 demonstrated a rapid, potent and durable immune response. At Day 43, three weeks after the second vaccination, 97.8% of participants achieved hemagglutination inhibition (HAI) antibody titers ≥1:40, an HAI titer considered to correlate with protection.

In December 2025, we announced that the Coalition for Epidemic Preparedness Innovations (CEPI) will invest up to $54.3 million to support a pivotal Phase 3 clinical trial that aims to help advance our investigational mRNA-based H5 pandemic influenza vaccine candidate, mRNA-1018, to licensure. The Phase 3 trial is expected to begin in early 2026.

Latent and Other Vaccines

Our current latent and other vaccines programs are summarized below.

Vaccines against latent viruses

CMV vaccine (mRNA-1647)

Cytomegalovirus (CMV) is member of the herpes virus family and a common human pathogen that causes complications for people who are immunosuppressed or can be passed to babies during pregnancy and result in congenital malformation.

Our CMV vaccine candidate, mRNA-1647, combines six mRNAs in one vaccine. These six mRNAs encode proteins located on the surface of CMV: five mRNAs encode the subunits that form the membrane-bound pentamer complex and one mRNA encodes the full-length membrane-bound glycoprotein B (gB). Both pentamer and gB are essential for CMV to infect barrier epithelial surfaces and gain access to the body, which is the first step in CMV infection. mRNA-1647 is designed to produce an immune response against both pentamer and gB for the prevention of CMV infection.

Congenital CMV (cCMV) results when infected mothers transmit the virus to their unborn child and it is the leading infectious cause of birth defects in the United States. We conducted a cCMV Phase 3 study of mRNA-1647 in women of childbearing age and announced in October 2025 that the study failed to reach its primary clinical endpoint. The program in women of childbearing age was discontinued.

In addition to the health burden of cCMV infection, CMV is a major health risk in the transplant population. There are approximately 47,000 solid organ transplants and 23,000 hematopoietic stem cell transplants in the U.S. annually. Each recipient faces a significant risk of CMV infection post-transplant, and this could result in graft rejection or end-organ CMV disease. mRNA-1647 has the potential to prevent CMV viral replication and/or disease in transplant populations. A Phase 2 proof-of-concept study for mRNA-1647 in allogeneic hematopoietic cell transplant (HCT) patients is ongoing. In interim data from our Phase 2 study, we reported robust CMV-specific T-Cell responses, and we expect to present full Phase 2 data after the study’s conclusion.

15

Table of Contents

EBV vaccines (mRNA-1189 and mRNA-1195)

Epstein-Barr virus (EBV) is a member of the herpesvirus family that infects approximately 90% of people in the U.S. by adulthood, with primary infection typically occurring during childhood or late adolescence (approximately 50% and 89% seropositivity, respectively). EBV is the major cause of infectious mononucleosis, accounting for over 90% of the cases in the U.S. each year. Infectious mononucleosis can debilitate patients for weeks to months and, in some cases, can lead to hospitalization due to complications such as splenic rupture. EBV infection is also associated with the development and progression of certain lymphoproliferative disorders, cancers and autoimmune diseases. In particular, EBV infection and infectious mononucleosis are associated with increased risk of developing multiple sclerosis (MS), an autoimmune disease of the central nervous system. MS is the most common neurodegenerative disorder of the central nervous system, affecting approximately 2.8 million individuals worldwide of which approximately 1 million live in the U.S. MS leads to progressive disability, with profound socioeconomic impact on the patients, caregivers and the healthcare system.

We are developing two mRNA candidates against EBV —a prophylactic vaccine to prevent infectious mononucleosis (mRNA-1189) and a therapeutic to treat multiple sclerosis (mRNA-1195). We believe that an effective EBV vaccine must generate an immune response against antigens that are required for viral entry and reactivation in susceptible cell types. mRNA-1189 is designed to elicit an immune response to EBV envelope glycoproteins, which are required for infection of both epithelial and B cells. mRNA-1195 encodes for entry glycoproteins and latent antigens aimed at inducing an antibody and T cell response, and will be investigated in the context of multiple sclerosis and post-transplant lymphoproliferative disorder.

We are currently conducting Phase 2, randomized, observer-blind, placebo-controlled studies of mRNA-1189 and mRNA-1195. The primary purpose of these studies is to assess the safety, tolerability and immunogenicity of these candidates, and to enable dose selection for further clinical development. In March 2024, we shared Phase 1 data for mRNA-1189, where the randomized, observer-blind, placebo-controlled study showed mRNA-1189 was immunogenic and generally well tolerated across all dose levels. We have since fully enrolled a dose finding Phase 2 study for mRNA-1189. Our Phase 1 study for mRNA-1195 is fully enrolled, and in November 2025 we shared data that showed mRNA-1195 was immunogenic and generally well tolerated across all dose levels. Our mRNA-1195 Phase 2 proof of concept trial in MS is ongoing, with an initial sentinel cohort fully enrolled as of December 2025.

HIV vaccine (mRNA-1645)

Human immunodeficiency virus (HIV) is responsible for acquired immunodeficiency syndrome (AIDS), a lifelong, progressive illness with no effective cure. Approximately 38 million people worldwide are currently living with HIV, with 1.2 million in the U.S. Approximately 1.5 million new infections of HIV are acquired worldwide every year and approximately 680,000 people die annually due to complications from HIV/AIDS. The primary routes of transmission are sexual intercourse and IV drug use, putting young adults at the highest risk of infection. From 2000 to 2015, a total of $562.6 billion globally was spent on care, treatment and prevention of HIV, representing a significant economic burden.

Our HIV vaccine candidate (mRNA-1645) is being studied in Phase 1 clinical trials, sponsored by IAVI, to determine the optimal design to induce broadly neutralizing antibodies capable of addressing the genetic diversity of HIV that is necessary in future proof of concept studies. In collaboration with the Gates Foundation, International AIDS Vaccine Initiative (IAVI), The Scripps Research Institute and the National Institutes of Health (NIH), Phase 1 studies of previous versions of our HIV vaccine have been completed.

Vaccines against enteric viruses

Norovirus vaccines (mRNA-1403 and mRNA-1405)

Norovirus is a leading cause of acute gastroenteritis (AGE), responsible for approximately 18% of all AGE cases worldwide and imposing a substantial global health care burden. Annually, norovirus causes an estimated 685 million illnesses and 200,000 deaths, including more than 50,000 deaths in children under the age of five. While the incidence of norovirus AGE is highest among children under five years of age, disease severity is most pronounced in infants, older adults, and individuals with underlying medical conditions. In high-income countries such as the United States, approximately 90% of norovirus-associated deaths occur among older adults.

Norovirus is highly infectious and difficult to control due to its environmental stability and persistence on contaminated surfaces, frequently leading to large, disruptive, and costly outbreaks in closed or semi-closed settings such as daycare centers, schools, cruise ships, long term care facilities and healthcare institutions. Globally, the economic impact of norovirus is estimated at $60 billion per year. In the United States alone, norovirus causes an estimated 20 million infections, 100,000 hospitalizations and 900 deaths each year, with associated costs of approximately $2 billion. As populations age and reliance on institutionalized care increases, the burden of norovirus disease among older adults is expected to rise further.

16

Table of Contents

Norovirus exhibits broad genetic diversity, with 10 genogroups and 49 genotypes identified to date, 30 of which infect humans. Vaccine development has been challenging to date for many reasons, including the lack of a robust cell culture system, no reliable immune markers of norovirus protection and the broad and shifting diversity of genotypes. A multivalent vaccine with broad genotype coverage is needed to maximize protection against the genotypes most frequently associated with AGE in older adults and young children.

We are currently developing pentavalent (mRNA-1405) and trivalent (mRNA-1403) vaccine candidates for norovirus. Both candidates were reviewed in a Phase 1 study to evaluate safety, reactogenicity and immunogenicity in healthy adult participants 18 to 49 years of age and 60 to 80 years of age. In March 2024, we presented data demonstrating that a single dose of trivalent vaccine candidate mRNA-1403 was well-tolerated across all dose levels evaluated and elicited robust antibody responses against vaccine-matched norovirus genogroup I & II selected genotypes, including functional histo-blood group antigen (HBGA) blocking antibodies. In September 2024, we presented additional data that mRNA-1403 elicited robust HBGA blocking antibody titers against a second GII genotype in older and younger adults.

In September 2024, we began dosing participants in a Phase 3 study of mRNA-1403. This Phase 3 trial is a randomized, observer-blind, placebo-controlled trial evaluating the efficacy, safety and immunogenicity of mRNA-1403. The trial has enrolled approximately 38,000 participants 18 years of age and older globally, across countries in the Northern Hemisphere (U.S., Canada, UK and Japan), and Panama and Australia. Approximately 33,000 participants 60 years of age and older and approximately 5,000 participants between 18 and 59 years of age have been enrolled to assess the ability of mRNA-1403 to protect against vaccine genotype-matched moderate to severe norovirus AGE, with a focus on the older adult age group that is at greatest risk of severe outcomes including hospitalization and death.

The Phase 3 study of mRNA-1403 completed its first seasons in the Northern and Southern Hemispheres. A second Northern Hemisphere season cohort is fully enrolled and the study is ongoing.

Bacterial vaccines

Lyme vaccines (mRNA-1975 and mRNA-1982)

Lyme disease is an illness caused by Borrelia bacteria transmitted by the bite of infected ticks. Lyme disease affects approximately 675,000 people annually in the U.S. and Europe, with incidence increasing due to expanding tick territories driven by rising temperatures. The disease burden follows a bimodal age distribution, predominantly impacting children under 15 and older adults. Symptoms include rash, fever, headaches, fatigue, joint pain, swelling, stiffness, and headaches. While no vaccines are currently approved, prior Phase 3 trials of outer surface protein A (OspA) antigen-based vaccines achieved efficacy up to 92%, with protection linked to high levels of antigen-specific antibodies.

We are conducting a randomized, observer-blind, placebo-controlled, dose-ranging Phase 1/2 trial in healthy participants aged 18 to 70. This trial evaluates the safety and immunogenicity of a heptavalent (mRNA-1975) and monovalent (mRNA-1982) approach in parallel. mRNA-1982 targets Borrelia burgdorferi, responsible for nearly all Lyme cases in North America, while mRNA-1975 targets the four major Borrelia species causing disease in North America and Europe.

No safety concerns have been identified across the evaluated dose levels for three injections of mRNA-1975/1982. Furthermore, three injections of mRNA-1975/1982 elicit robust anti-OspA IgG antibody responses, with titers up to ~1,300 times above baseline for OspA serotype 1 of Borrelia burgdorferi. The program will progress to a Phase 2 dose ranging study of mRNA-1982.

Public health vaccines

Nipah vaccine (mRNA-1215)

Nipah virus (NiV) is a zoonotic virus transmitted to humans from animals, contaminated food or through direct human-to-human transmission and causes a range of illnesses including fatal encephalitis. Severe respiratory and neurologic complications from NiV have no treatment other than intensive supportive care. The case fatality rate among those infected is estimated at 40-75%. NiV outbreaks cause significant economic burden to impacted regions due to loss of human life and interventions to prevent further spread, such as the slaughter of infected animals. NiV has been identified as the cause of isolated outbreaks in India,

Bangladesh, Malaysia and Singapore since 2000 and is included on the WHO R&D Blueprint list of epidemic threats needing urgent research and development action.

17

Table of Contents

In collaboration with the NIH-Vaccine Research Center (VRC), we conducted a Phase 1 clinical trial of mRNA-1215, our vaccine candidate against NiV, and testing was focused on pandemic preparedness. This Phase 1 dose-escalation, open-label clinical trial was the first study of mRNA-1215 in healthy adults to evaluate the safety, tolerability and immunogenicity of a NiV mRNA vaccine candidate. The trial was sponsored and funded by the National Institute of Allergy and Infectious Diseases (NIAID).

Mpox vaccine (mRNA-1769)

Mpox (formerly known as monkeypox) is an infectious disease caused by the mpox virus, a member of the Orthopoxvirus genus, which also includes Variola virus, the virus that caused smallpox. Although smallpox was eradicated in 1980, continued protection from smallpox is of great importance given the lethality of the infection and potential for use as an agent of bioterrorism. Other viruses associated with the Orthopoxvirus genus include cowpox, rabbitpox and camelpox.

There are two main types of the mpox virus, Clade I and Clade II, each with subtypes (a and b). Prior to 2022, mpox outbreaks were primarily sporadic, driven by zoonotic spillover in endemic regions. Mpox can infect humans and other animals and is spread mainly through close physical contact with an infected person or contaminated materials, as well as through contact with infected animals. Respiratory transmission via face-to-face interaction is also possible.

Clade II (subclade IIb) was responsible for the 2022 global mpox outbreak which led the WHO to declare a Public Health Emergency of International Concern (PHEIC). Transmission during the outbreak occurred primarily through sexual contact. In 2024, a second PHEIC was declared due to Clade I outbreak expansion in the Democratic Republic of the Congo and neighboring countries. Current epidemiology reports indicate that both Clade I and Clade II viruses continue to circulate globally, with recent expansions of Clade Ib transmission in some regions outside Africa, sometimes without direct travel links to endemic areas.

The incubation period for mpox typically ranges from 3 to 17 days. Initial symptoms include fever, headache, muscle aches, fatigue, and swollen lymph nodes, followed by a characteristic rash or skin lesions that may last 2-4 weeks. Most individuals recover fully, although severe disease can occur, particularly in people with weakened immune systems.

The current standard of care for mpox prevention is JYNNEOS, which is approved by the FDA for prevention of mpox and smallpox.

Our mpox vaccine candidate, mRNA-1769, is designed to express four antigens from the mpox virus. In preclinical studies using a stringent non-human primate model, vaccination with mRNA-1769 resulted in fewer lesions, reduced viral replication, and stronger neutralizing and functional antibody responses compared with existing treatments. The immune responses induced by mRNA-1769 also showed broad activity against several orthopoxviruses. These results were published in 2024.

We conducted a randomized, placebo-controlled, dose-ranging Phase 1/2 study to evaluate the safety, tolerability, and immune response of three dose levels of mRNA-1769 in healthy adult participants. Interim analysis showed that mRNA-1769 demonstrated a favorable safety profile and strong immunogenicity. These interim results were presented as an oral presentation at the 2025 ESCMID Global conference. The full study results are currently expected in 2026.

ONCOLOGY THERAPEUTICS FRANCHISE

Within our oncology therapeutics franchise, we are developing intismeran autogene (mRNA-4157) in collaboration with Merck. We and Merck are targeting a variety of tumor types, with eight Phase 2 and Phase 3 trials ongoing.

Separate from the collaboration with Merck, our Phase 1/2 study of mRNA-4359, an investigational wholly-owned cancer antigen therapy, is ongoing. We have also expanded our oncology portfolio with early-stage programs, including mRNA-4106 (a cancer antigen therapy), mRNA-2808 (a T-cell engager), and mRNA-4203 (a cell-therapy enhancer). mRNA-4203 is being developed in collaboration with Immatics.

18

Table of Contents

Intismeran autogene (mRNA-4157)

As tumors grow, they acquire mutations which may lead to the creation of new protein segments (neoantigens) that can be presented on human leukocyte antigen (HLA) molecules in the tumor and recognized as non-self by T cells. While some neoantigens are shared across tumors, the majority are completely unique to an individual patient’s tumor and their presentation is dependent on a patient’s specific HLA type.

Intismeran autogene, mRNA-4157, uses next generation sequencing and a machine-learning based algorithm to design an mRNA that encodes up to 34 neoantigens against each individual patient’s tumor mutations with specificity to their HLA type, and is predicted to elicit both class I (CD8+ T cells) and class II (CD4+ T cells) responses. The neoantigens are encoded in a single mRNA sequence and formulated in our proprietary LNPs designed for intramuscular injection. Intismeran autogene is manufactured using an automated workflow to enable a rapid turnaround time.

We are developing mRNA-4157 in collaboration with Merck. In September 2022, Merck exercised its option for personalized cancer vaccines (PCVs), including mRNA-4157, pursuant to the terms of our existing PCV Collaboration and License Agreement with Merck, which was amended and restated in 2018 (PCV Agreement, also referred to as the INT Agreement). Pursuant to the PCV Agreement, we and Merck will collaborate on further development and commercialization of mRNA-4157, and we will share costs and any profits and losses worldwide related to mRNA-4157 equally.

In December 2022, we announced that the randomized Phase 2 trial of mRNA-4157 had met its primary endpoint. The open-label Phase 2 study is investigating a 1 mg dose of mRNA-4157 in combination with Merck’s KEYTRUDA, compared to pembrolizumab alone, for the adjuvant treatment of high-risk resected melanoma. The study showed that mRNA-4157 in combination with KEYTRUDA reduced the risk of recurrence or death by 44% (HR=0.56 [95% CI, 0.31-1.02]; one-sided p value=0.0266) compared with KEYTRUDA alone. The results were the first demonstration of efficacy for an investigational mRNA cancer treatment in a randomized clinical trial in melanoma. Adverse events observed were consistent with those previously reported in a Phase 1 clinical trial, which showed mRNA-4157 to be well-tolerated at all dose levels.

In February 2023, mRNA-4157 received a Breakthrough Therapy Designation from the FDA, and in April 2023, mRNA-4157 received PRIME Scheme Designation from the EMA.

In December 2023, we announced that at a planned median follow-up of approximately three years, mRNA-4157 in combination with KEYTRUDA showed sustained benefit, reducing the risk of recurrence or death by 49% (HR=0.510 [95% CI, 0.288-0.906]; one-sided nominal p=0.0095) and the risk of distant metastasis or death by 62% (HR=0.384 [95% CI, 0.172-0.858]; one-sided nominal p= 0.0077) compared to KEYTRUDA alone in stage III/IV melanoma patients with high risk of recurrence following complete resection. These data were presented at the American Society of Clinical Oncology (ASCO) in June 2024, as well as translational biomarker data that suggests mRNA-4157 may benefit a broad patient population, irrespective of the status of PD-L1, TMB, ctDNA, and HLA heterozygosity. Three-year exploratory endpoint data also showed an encouraging trend in overall survival (OS) with the combination versus pembrolizumab monotherapy.

In January 2026, we announced that at a planned median follow-up of approximately five years, mRNA-4157 in combination with KEYTRUDA showed continued sustained benefit, reducing the risk of recurrence or death by 49% (HR=0.510 [95% CI, 0.294-0.887]; one-sided nominal p=0.0075) compared to KEYTRUDA alone in stage III/IV melanoma patients with high risk of recurrence following complete resection.

We and Merck have expanded the intismeran autogene program, initiating Phase 3 studies in adjuvant melanoma, adjuvant non-small cell lung cancer (NSCLC), and adjuvant NSCLC post neoadjuvant treatment. We also have Phase 2 trials ongoing in adjuvant renal cell carcinoma (RCC), muscle-invasive bladder cancer (MIBC), non-muscle-invasive bladder cancer (NMIBC), metastatic melanoma, and first-line metastatic squamous NSCLC. In addition, we have an ongoing Phase 1 study in early and advanced solid tumors. Enrollment of the Phase 3 adjuvant melanoma study was completed in 2024 and enrollment of the Phase 2 RCC study was completed in 2025.

Cancer antigen therapy (mRNA-4359)

We are developing a cancer antigen therapy (mRNA-4359) that encodes Indoleamine 2,3-dioxygenase (IDO) and programmed death-ligand 1 (PD-L1) antigens. We designed mRNA-4359 with the goal of stimulating effector T cells that target and kill suppressive immune and tumor cells that express the target antigens. Our initial indications for mRNA-4359 are advanced or metastatic cutaneous melanoma and NSCLC.

19

Table of Contents

We presented data from the Phase 1a study of mRNA-4359 at the European Society for Medical Oncology (ESMO) Congress in 2024, where in a population of patients with heavily pre-treated, advanced stage cancers, eight of 16 response-evaluable patients achieved a best overall response (BOR) of stable disease. Translational data showed antigen-specific T-cell responses were elicited by mRNA-4359 treatment; a proportion of activated, cytotoxic, and memory T cells were elevated and a proportion of regulatory T cells and myeloid-derived suppressor cells (MDSCs) were diminished on treatment. mRNA-4359 monotherapy was tolerable at all dose levels tested with most adverse events of low grade (grade 1–2) and manageable.

We presented data from the Phase 1b study at ESMO in 2025, where in a population of 29 checkpoint inhibitor resistant/refractory melanoma patients, across all evaluable patients, mRNA-4359 in combination with pembrolizumab, the objective response rate (ORR) was 24%, and the disease control rate, or the combination of patients achieving tumor response and stable disease, was 60%. mRNA also demonstrated a consistently manageable safety profile. Responses were enriched in patients with PD-L1 ≥1% tumor proportion score (TPS), with an ORR of 67%, indicating encouraging activity in this difficult to treat patient population. Translational analyses demonstrated biological activity of mRNA-4359, including induction of PD-L1– and IDO1-specific T-cell responses and novel clonal T-cell expansion in the periphery, consistent with the proposed mechanism of action.

Additional translational analyses presented at the Society for Immunotherapy of Cancer (SITC) 2025 Annual Meeting further demonstrated that the magnitude of immune activation, including T-cell clonal expansion, correlated with clinical outcomes and was accompanied by early and substantial reductions in circulating tumor DNA. Tumor-based analyses showed that responders had higher baseline gene expression of PD-L1 and IDO1 and exhibited on-treatment increases in immune-inflamed gene expression signatures.

The Phase 1/2 study of mRNA-4349 is ongoing. The Phase 2 portion of the study includes cohorts in first-line metastatic melanoma, second-line+ metastatic melanoma and first-line metastatic NSCLC

Cancer antigen therapy (mRNA-4106)

mRNA-4106 is a cancer antigen therapy offering broad coverage across tumor types. It encodes for multiple tumor targets and is designed to broaden coverage across and within patients. Our Phase 1 study commenced in 2025.

T-cell engager (mRNA-2808)