Exhibit 1.01

MICROSOFT CORPORATION

CONFLICT MINERALS REPORT

FOR 2024 REPORTING YEAR

Contents

| I. Introduction |

2 | |||

| II. Due Diligence Framework |

3 | |||

| OECD Step #1: Establish Strong Company Management Systems |

3 | |||

| 1. Company Policies |

3 | |||

| 2. Internal Management Team and Corporate Approval |

4 | |||

| 3. System of Supply Chain Controls, Data Disclosure, and Due Diligence Assurance |

4 | |||

| 4. Leveraging Industry Partnerships for Greater Impact |

5 | |||

| 5. Supplier Engagement to Ensure Conformance |

6 | |||

| 6. Grievance Mechanism |

7 | |||

| OECD Step #2: Identify and Assess Risk in the Supply Chain |

7 | |||

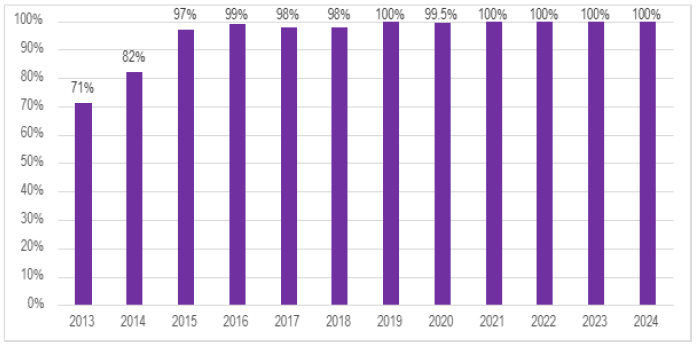

| Figure 1. CMRT Response Rate (2013-2024 Reporting Years) |

8 | |||

| OECD Step #3: Design and Implement a Strategy to Respond to Risks |

8 | |||

| 7. Microsoft Supplier Specifications - H00594, H00642, and H02050 |

8 | |||

| 8. Implementation of OECD Guidance |

8 | |||

| OECD Step #4: Independent Third-Party Audits of Supply Chain Due Diligence |

9 | |||

| OECD Step #5: Report on Supply Chain Due Diligence |

9 | |||

| III. Conflict Mineral Disclosure |

9 | |||

| Reasonable Countries of Origin of 3TGs |

9 | |||

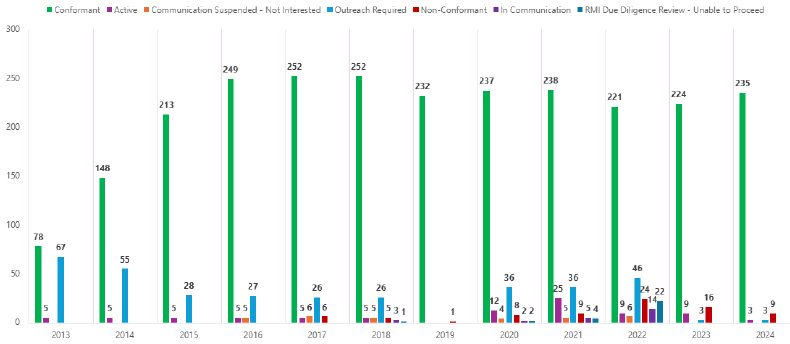

| Figure 2. Identified SORs by Audit Status (2013- 2024 Reporting Years) |

11 | |||

| 3TG Countries of Origin |

11 | |||

| IV. Microsoft Commitment |

14 | |||

| Appendix A: Eligible Smelters and Refiners for 2024 Reporting Year | A-1 | |||

1

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| I. | Introduction |

This Conflict Minerals Report (“CMR”) for MICROSOFT CORPORATION (“Microsoft”) is filed with the United States Securities and Exchange Commission (SEC) as an exhibit to Microsoft’s Form SD pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, (the “Rule”) for the 2024 Reporting Year (“RY”) (January 1, 2024-December 31, 2024).1 The CMR covers all Microsoft majority-owned subsidiaries and variable interest entities that are subject to the Rule.2 During the 2024 Reporting Year, covered devices included the Surface line of computers, tablets, and accessories; Xbox gaming consoles, accessories, and select merchandise manufactured or contracted to manufacture by Microsoft; the HoloLens mixed reality device; and Nuance dictation devices.

Our commitment to the responsible sourcing of raw materials is established by Microsoft’s Responsible Sourcing of Raw Materials (“RSRM”) Policy, which guides our work to ensure that all raw materials used in our devices, unbounded by specific materials or locations, are sourced from responsible suppliers. We commit to the responsible sourcing of tin, tantalum, tungsten, and gold (“3TGs”) from Conflict Affected and High-Risk Areas (“CAHRAs”), including the Democratic Republic of the Congo (“DRC”) or DRC-adjoining countries (each a “Covered Country” under the Rule), rather than restricting or avoiding sourcing from such regions. We do this in recognition of the harmful societal and economic impacts that curtailing 3TG mineral sourcing from such regions might cause.

Based on our supply chain due diligence, we determined that 3TGs that were necessary to the functionality or production of devices we manufactured or contracted to manufacture during the 2024 Reporting Year may have originated in a Covered Country. Microsoft found no reasonable basis for concluding that any 3TG Smelter or Refiner (“SOR”) that was identified in the Microsoft Devices supply chain for the 2024 Reporting Year sourced 3TGs in a manner that directly or indirectly financed or benefitted armed groups in a Covered Country.

| 1 | This CMR contains links to internal and external websites for informational purposes only. References to such websites and information available through such websites are not incorporated into this CMR. Additionally, this CMR includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions regarding the future implementation of our responsible sourcing program and are subject to change. Statements in this CMR are based on due diligence activities that were performed in good faith and to the best of our ability at the time of this filing. Factors that could affect the accuracy of such statements include, but are not limited to, incomplete or incorrect data submitted by suppliers, amendments to the Rule or SEC guidance. |

| 2 | Throughout this CMR, we use “Microsoft,” “Microsoft Devices,” “we,” “our,” “us” and similar terms to refer to Microsoft Corporation and its subsidiaries and various interest entities subject to the Rule (collectively, “Microsoft”), unless otherwise indicated. |

2

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| II. | Due Diligence Framework |

This CMR is based on Microsoft Devices’ Due Diligence Framework (“Due Diligence Framework”), which conforms to the Organisation for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas and its related Supplements (“OECD Guidance”).

Our Microsoft Devices supply chain contains many layers of upstream suppliers positioned between Microsoft and 3TG raw material mines and SORs. We use contractual provisions to require our direct suppliers to disclose 3TG sourcing information through the industry standard Conflict Minerals Reporting Template (CMRT) and meet audit requirements regarding the sources and chains of custody of 3TGs necessary for the functionality or production of our covered devices. We also require our direct suppliers to cascade down Microsoft requirements regarding 3TG sources and chains of custody to their own suppliers. In this manner, we work to promote responsible sourcing across our direct and indirect supply chains.

Our due diligence actions go beyond the Rule and OECD Guidance by including several quality assurance steps. We review all supplier responses to identify and address any inaccuracies or inconsistencies in the 3TG sourcing data that is reported to us. We engage a third party to review all 3TG sourcing data reported to us and to conduct enhanced research and due diligence on identified SORs. If a non-conformant SOR is reported by a supplier, we work with the supplier to engage with the SOR to bring them into conformance. If the SOR is not interested or not able to become conformant, we instruct suppliers to remove the SOR from their supply chain and source from conformant alternatives or face business termination with Microsoft.

We also survey our supply chain for minerals beyond 3TGs and beyond the Covered Countries consistent with our RSRM Policy, which is unbounded by specific materials or location. In addition to the CMRT survey, which is focused on 3TGs, we request our in-scope suppliers to report on their use of cobalt and other priority minerals, including aluminum, copper, gallium, lithium, nickel, silicon, germanium, graphite, and rare earth elements.

OECD Step #1:

Establish Strong Company Management Systems

| 1. | Company Policies |

Microsoft’s commitment to corporate responsibility and integrity guides everything we do as a company. We have established high ethical standards to govern the way we conduct our business, which also apply to our suppliers and business partners. Microsoft policies include the Microsoft Global Human Rights Statement, Microsoft Supply Chain Human Rights Policy Statement, Trust Code, and our Supplier Code of Conduct. These policies establish Microsoft expectations for our suppliers concerning legal and regulatory compliance; business practices and ethics; human rights and fair labor practices; health and safety; environmental protection; and data and privacy protection.

As previously described, our RSRM Policy describes our commitment to responsibly sourcing raw materials. This pledge extends to the harvesting, extraction, and transportation of raw materials, unbounded by specific material or location, and supports implementation of programs that advance the use of responsibly sourced minerals in our manufactured devices.

3

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Our policies are based on internationally recognized standards, including the following declaration and covenants: Universal Declaration of Human Rights, International Covenant on Civil and Political Rights, and International Covenant on Economic, Social and Cultural Rights. Our business operations are informed by human rights guidelines described in the following documents: International Labor Organization’s (“ILO”) Declaration on Fundamental Principles and Rights at Work, OECD Guidelines for Multinational Enterprises, and the United Nations Global Compact. As a global Information and Communications Technology company operating in more than 100 countries, we respect all human rights—civil, political, economic, social, and cultural; and our supplier requirements expect the same level of commitment.

| 2. | Internal Management Team and Corporate Approval |

A cross-functional internal team supports CMR development. Microsoft’s Director of Devices Governance and Ethics sponsors the team, which consists of representatives from Microsoft Devices Operations; Responsible Sourcing; Corporate, External and Legal Affairs; and Finance. The team assesses program progress, identifies steps needed to meet our compliance obligations, and identifies areas for continuous improvement. The team annually develops, reviews, and submits the final CMR to Microsoft’s President for approval and signature before being filed as an Exhibit to Microsoft’s Form SD and posted on the Microsoft website pursuant to the Rule.

| 3. | System of Supply Chain Controls, Data Disclosure, and Due Diligence Assurance |

Our Due Diligence Framework is based on a system of supply chain controls, data disclosure, and due diligence assurance. Our contracts require our suppliers to meet Microsoft specifications. Our environmental compliance specifications - H00594, Restricted Substances for Hardware Products; and H00642, Microsoft Restricted Substances Control System for Hardware Products (both available at this link) - require the disclosure of every substance contained in the materials, components, and products supplied to us, including 3TGs, by weight.

We require suppliers to annually submit a CMRT that provides source and chain of custody information for 3TGs that are contained in the products and components they supply to us. Our contracts also require suppliers to obtain the same information from their upstream suppliers. We collect these supply chain disclosures, conduct controls to ensure data integrity, and assess 3TG sourcing risk.

Microsoft supply chain mineral disclosure requirements go beyond 3TGs and cover additional prioritized minerals. Since 2019, we have required suppliers to report on their use of cobalt, using the Responsible Minerals Initiative’s Extended Minerals Reporting Template (“EMRT”). For the 2024 calendar year , we utilized the RMI’s Additional Minerals Reporting Template (“AMRT”), formerly known as the Pilot Reporting Template (“PRT”), for all other prioritized minerals, including: aluminum, copper, gallium, lithium, nickel, silicon, germanium, graphite, and rare earth elements. These additional materials are prioritized through an extensive internal review and risk analysis of the materials present in our products. This regular prioritization exercise ensures that the materials on which we focus are representative of identified need, and thus this list is dynamic over time.

4

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Microsoft Devices’ Supplier Social and Environmental Accountability Manual (“H02050”) provides an operational framework for Microsoft to achieve supplier conformance with Microsoft’s Supplier Code of Conduct and other responsible sourcing requirements. H02050 establishes a minimum set of requirements that suppliers must meet, including compliance with all applicable laws and regulations with respect to labor, ethics, occupational health and safety, and protection of the environment. Suppliers are encouraged to go beyond legal compliance by meeting relevant international standards (e.g., ILO and relevant United Nations Conventions) and committing to a process of continuous improvement.

H02050 requires all in-scope suppliers to:

| • | Adopt a company policy for raw material sourcing, including a commitment to source raw materials from responsible sources and clearly communicate such policy to their suppliers and the public; |

| • | Exercise due diligence on the source and chain of custody of high-risk raw materials, including 3TGs, contained in materials, products, or parts supplied to Microsoft; |

| • | Require SORs to participate in the Responsible Mining Assurance Process (“RMAP”) or an equivalent independent, third-party audit program for 3TGs; |

| • | Timely communicate potential sourcing risks to Microsoft and propose a contingency plan and mitigation strategy to achieve conformance; and |

| • | Establish a system to gather, examine, and verify sourcing information for raw materials, including 3TGs, contained in products supplied to Microsoft and request their upstream suppliers to do the same. This supply chain transfer of audit data, source and chain of custody information, and risk assessment enables and facilitates raw material due diligence, mapping, and transparency. |

Microsoft works with its suppliers to use SORs that are conformant to RMAP or another equivalent independent, third-party audit program for 3TGs. If we find that a supplier has introduced responsible sourcing risk to the Microsoft supply chain, such as use of an upstream SOR that is not conformant, Microsoft engages such supplier to address the non-conformance. Risks are mitigated by supplier engagement, corrective actions, audits, training, and business termination when appropriate. These controls and related documentation are detailed in H02050 and Microsoft internal operating procedures.

| 4. | Leveraging Industry Partnerships for Greater Impact |

We leverage partnerships with industry peers and partners to scale our responsible sourcing impact. Microsoft is a long-standing member of the Responsible Business Alliance (“RBA”) and the RMI. The RMI is one of the most utilized and respected resources for supply chain minerals due diligence and is aligned to the OECD Guidance. The RMI operates and manages the RMAP, which uses independent, third-party audits to assess, monitor, and validate whether SORs process 3TGs from sources that directly or indirectly finance, or benefit armed groups in a CAHRA, including Covered Countries.

5

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

In 2024, Microsoft provided direct financial support to the RMI upstream smelter due diligence fund to further the reach and success of the RMAP and participated in Working Groups to support the RMI and to improve and expand the scope of responsible mineral sourcing activities.

We also work outside of our supply chain to promote responsible mining practices in CAHRAs, including Covered Countries, by partnering with organizations, including the RMI, the Initiative for Responsible Mining Assurance (“IRMA”), the Public-Private Alliance for Responsible Minerals Trade (“PPA”), and others. In this manner, we go beyond the minimum due diligence established by the OECD Guidance to assess and reduce our supply chain sourcing risk and improve working conditions in raw material supply chains.

| 5. | Supplier Engagement to Ensure Conformance |

We apply several supplier-focused strategies to promote responsible mining and sourcing, including the supplier engagement tools set forth below.

| • | Supplier Requirements: We require our suppliers to meet our material disclosure requirements and related responsible sourcing policies through contractual provisions and product specifications. We communicate, monitor, and track supplier adherence to these requirements, ensuring conformance through the Microsoft Compliance Map System. |

| • | Training: We train suppliers on our responsible sourcing requirements through classes, educational forums, and direct communications. Existing suppliers and newly onboarded suppliers are required to complete training modules to understand and implement Microsoft Social and Environmental Accountability (“SEA”) requirements. We leverage the online component of our “SEA Academy” to educate factory management, workers, and third-party auditors as well as internal Microsoft teams with the goal of promoting responsible sourcing across our supply chain. |

| • | Capability Building and Partnerships: We work closely with in-scope suppliers and third-party auditors to build suppliers’ raw material due diligence capabilities and advance conformance to the RMAP or equivalent independent, third-party audit program for 3TGs. We invest in industry programs to increase suppliers’ abilities and provide platforms for sharing best practices. |

| • | Supplier Audits and Conformance Assurance: Microsoft requires audits of its directly contracted suppliers to assess their conformance to these requirements. Newly contracted suppliers undergo an Initial Capability Assessment prior to onboarding and Sustaining Maintenance Audits after onboarding to verify their initial conformance and to confirm their sustained conformance to our requirements. |

Microsoft selects and retains business partners that are committed to meeting these requirements. A failure by a supplier or their upstream suppliers to conform to these requirements may constitute a breach of the supplier’s contractual agreement with Microsoft, resulting in possible business termination.

6

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| 6. | Grievance Mechanism |

Microsoft provides an anonymous grievance reporting mechanism for employees and other stakeholders who may be impacted by our operations. Microsoft’s Integrity Portal allows employees and others to anonymously ask compliance questions or report concerns regarding Microsoft’s business operations, including our responsible sourcing policies or those of our suppliers. Additionally, Microsoft continues to scale its Worker Voice Hotline Program3 across our supplier factories. This program provides workers with a reliable and anonymous reporting channel for raising workplace concerns. The Hotline is operated by a neutral third-party provider. We investigate and, where appropriate, take remedial action to address reported issues. We also participate in the development of industry grievance mechanisms that seek to address responsible sourcing of raw materials-related issues.

OECD Step #2:

Identify and Assess Risk in the Supply Chain

In order to make a Reasonable Country of Origin Inquiry (“RCOI”) determination, Microsoft took the following steps, which are consistent with OECD Guidance and Microsoft procedure, to identify and assess 3TG sourcing risk in our supply chain during the 2024 RY:

| • | We generated a list of in-scope suppliers by surveying 144 Microsoft Devices direct suppliers to determine whether they used any 3TGs in the products or parts supplied to Microsoft by utilizing the CMRT and the services of a third-party solution provider. All in-scope suppliers responded to our survey request – a 100% response rate. |

| • | We excluded suppliers who did not report the use of 3TG minerals. |

| • | For the 2024 RY, we identified 119 in-scope suppliers that reported the use of 3TG minerals in the products or parts supplied to Microsoft. For these suppliers, we reviewed their CMRT responses to validate completion and to identify any contradictions or inconsistencies. |

| • | Based on the CMRTs, 250 SORs were found to be eligible for the RMAP or an equivalent, independent, third-party audit program for 3TG minerals such as cross-recognized programs overseen by the London Bullion Market Association (“LBMA”) or Responsible Jewelry Council (“RJC”). |

| 3 | Please our Supply Chain Integrity Statement for more details regarding our Workers’ Voice Hotline Program. |

7

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Figure 1. CMRT Response Rate (2013-2024 Reporting Years)

OECD Step #3:

Design and Implement a Strategy to Respond to Risks

We determined that 3TGs that were necessary to the functionality or production of covered devices may have originated in one or more Covered Countries. Accordingly, we performed due diligence on the source and chain-of-custody of those 3TGs to assess our conflict minerals sourcing risk.

| 7. | Microsoft Supplier Specifications—H00594, H00642, and H02050 |

For the 2024 RY, Microsoft required its in-scope suppliers to conduct due diligence to address the potential sourcing of 3TGs from CAHRAs, including Covered Countries, through contract requirements (H00594, H00642, and H02050), incorporating Microsoft’s supplier specifications and responsible sourcing requirements, as detailed above.

| 8. | Implementation of OECD Guidance |

Microsoft screened its in-scope supplier CMRT data for the 2024 RY against the OECD Guidance “red flag” triggers4 to assess the in-scope suppliers that required due diligence per the OECD Guidance.

| 4 | See p. 33 of the OECD Guidance. |

8

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

OECD Step #4:

Independent Third-Party Audits of Supply Chain Due Diligence

Our due diligence program leveraged independent SOR audits to provide assurance that the 250 Eligible 3TG SORs that were identified in our supply chain for the 2024 Reporting Year conducted an appropriate level of conflict minerals due diligence. Microsoft obtained SOR data from the RMAP Conformant Smelter List5 using Reasonable Country of Origin Inquiry Data for member MSFT and used the SOR data to assess the conflict mineral audit status of our in-scope suppliers and to support our due diligence findings.

Recognizing the importance of broad and consistent participation in the RMAP, Microsoft proactively engages directly with certain SORs where it is believed that a SOR may be at risk of becoming non-conformant. Microsoft also asks its suppliers to engage directly with potentially non-conformant SORs to prevent potential non-conformance and to develop Corrective Action Plans (“CAPs”) to identify sourcing alternatives in case a SOR becomes non-conformant.

Although Microsoft’s Responsible Sourcing program operates an escalation and engagement process should non-conformant SORs be detected, taking a proactive approach to potentially non-conformant SORs helps prevent potential non-conformances from occurring. During the 2024 RY, we did not identify a SOR nonconformance that supported business termination with any in-scope supplier.

OECD Step #5:

Report on Supply Chain Due Diligence

We have filed our CMR with the SEC and posted it on our Microsoft Supply Chain Integrity website. The website provides additional information about Microsoft’s RSRM Program. Each year, Microsoft Devices publishes a list of its Top 100 Production Suppliers. These disclosures meet the fifth step of the OECD Guidance.

| III. | Conflict Mineral Disclosure |

| A. | Reasonable Countries of Origin of 3TGs |

Microsoft obtained Reasonable Country of Origin data through our membership in the RMAP using the Reasonable Country of Origin Inquiry Data for member MSFT. We used this data to determine the 3TG country of origin for the 250 Eligible SORs identified in Microsoft Devices’ supply chain for the 2024 RY.

| 5 | The RMAP Conformant Smelter list identifies the SORs that have undergone conformance audits through the RMAP or equivalent independent, third-party audit programs for 3TGs. |

9

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

The RMAP classifies SOR audit status in the manner described in the table below. The breakdown of the identified 250 Eligible 3TG SORs (for which minerals sourcing information was available from RMAP or an equivalent, independent, third-party audit program for 3TGs) by their RMI Status was as follows:

| Audit Status |

Audit Status Description |

SOR Count | Percentage | |||||

| Conformant |

SOR has been audited and found to conform with a relevant, third-party audit protocol, including RMAP, LBMA, or RJC | 235 | 94 | % | ||||

| Active |

SOR has been engaged but is not yet conformant | 3 | 1.2 | % | ||||

| Non-Conformant |

SOR was audited but found not to conform to a relevant, third-party audit protocol or failed to renew its assessment | 9 | 3.6 | % | ||||

| Outreach Required |

SOR is not yet active, and outreach is needed by RMAP member companies to encourage SOR participation in RMAP | 3 | 1.2 | % | ||||

For the identified 250 Eligible 3TG SORs:

| • | 40 SORs sourced from Covered Countries, of which 40 (100%) were Conformant. |

| • | Out of 250 Eligible SORs, 224 (95.2%) were participating in a third-party audit program (either Conformant or Active); and |

| • | All were either Conformant, Active, or are reasonably believed to have sourced 3TGs from outside the Covered Countries. |

Microsoft found no reasonable basis for concluding that any SOR sourced 3TGs in a manner that directly or indirectly financed or benefitted armed groups in a Covered Country. Figure 2 depicts the 257 SORs by 3TG audit status and Reporting Year.

10

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Figure 2. Identified SORs by Audit Status (2013- 2024 Reporting Years)

Appendix A provides the list of 250 Eligible SORs identified in Microsoft Devices’ supply chain which processed 3TGs during the 2024 Reporting Year. Appendix A lists each SOR by mineral, official name, and country of operation.

3TG Countries of Origin

The table below lists the countries of origin for the 250 Eligible SORs identified in the Microsoft Devices’ supply chain and which processed 3TG minerals during the 2024 RY.

Argentina

Australia

Austria

Azerbaijan

Belgium

Benin

Bolivia

Bosnia and Herzegovina

Botswana

Brazil

Bulgaria

11

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Burkina Faso

Burundi

Cambodia

Canada

Chile

China

Colombia

Congo, Democratic Republic of the

Côte d’Ivoire

Dominican Republic

Ecuador

Egypt

Eswatini

Ethiopia

Fiji

Finland

France

French Guiana

Georgia

Germany

Ghana

Greece

Guinea

Guyana

Nigeria

Panama

Papua New Guinea

Peru

Philippines

Portugal

Russia

Rwanda

Saudi Arabia

Senegal

Sierra Leone

Slomon Islands

Slovakia

South Africa

Spain

Sudan

Suriname

Sweden

Tajikistan

Tanzania

12

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

Thailand

Turkey

Uganda

United Kingdom

United States of America

Uzbekistan

Vietnam

Zambia

Zimbabwe

Nigeria

Panama

Papua New Guinea

Peru

Philippines

Portugal

Russia

Rwanda

Saudi Arabia

Senegal

Sierra Leone

Slomon Islands

Slovakia

South Africa

Spain

Sudan

Suriname

Sweden

Tajikistan

Tanzania

Thailand

Turkey

Uganda

United Kingdom

United States of America

Uzbekistan

Vietnam

Zambia

Zimbabwe

13

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| IV. | Microsoft Commitment |

Microsoft is committed to the responsible sourcing of raw materials in support of human rights; labor, health and safety; and environmental protection. We continue to advance implementation of our RSRM policy in our Microsoft Devices supply chain to promote supply chain identification, traceability, risk assessment, and due diligence.

Our 2024 RY achievements included the following:

| • | We supported supplier efforts to increase their responsible sourcing capabilities through supplier forums, training, webinars, and by providing technical resources; |

| • | We continued our engagements with external responsible sourcing organizations, including but not limited to the RMI, that are committed to advancing responsible sourcing on a global basis; |

| • | We achieved a 100% supplier CMRT response rate through extensive supplier outreach, including a supplementary campaign to directly contact suppliers and encourage reporting; |

| • | We conducted a data validation and verification program to randomly audit CMRT information submitted to us by suppliers to validate and confirm that supplier data was accurate and complete; |

Going forward, Microsoft will remain focused on internal and external efforts to promote the responsible sourcing of minerals, including:

| • | Expanding our knowledge about 3TGs, cobalt, and other critical raw materials to effectively implement our RSRM strategy to promote the responsible sourcing of raw materials across our hardware supply chains; |

| • | Requiring our in-scope suppliers to meet our requirements for responsibly sourcing raw materials and finding alternative upstream suppliers if they are found to be sourcing from non-conformant SORs; |

| • | Engaging with in-scope suppliers so that they utilize supplier best practices and tools for responsibly sourcing raw materials from CAHRAs, including Covered Countries; |

| • | Furthering engagement with industry organizations and external stakeholders to improve mineral traceability, establish global responsible sourcing standards, and support due diligence programs in the mineral supply chain; and |

| • | Leveraging Full Material Disclosure and other supplier data to fine-tune supplier data requests and verify and confirm reported critical raw material information. |

14

Appendix A

Eligible SORs for 2024 Reporting Year

This Appendix lists the 250 eligible SORs which processed 3TG minerals during the 2024 RY. Please note that Eligible SORs are listed for each 3TG they processed. Therefore, certain Eligible SORs may be represented more than once.

Gold

| Smelter Name |

Country | |

| Advanced Chemical Company | United States of America | |

| Aida Chemical Industries Co., Ltd. | Japan | |

| Agosi AG | Germany | |

| Almalyk Mining and Metallurgical Complex (AMMC) | Uzbekistan | |

| AngloGold Ashanti Corrego do Sitio Mineracao | Brazil | |

| Argor-Heraeus S.A. | Switzerland | |

| Asahi Pretec Corp. | Japan | |

| Asaka Riken Co., Ltd. | Japan | |

| Aurubis AG | Germany | |

| Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Philippines | |

| Boliden AB | Sweden | |

| C. Hafner GmbH + Co. KG | Germany | |

| CCR Refinery—Glencore Canada Corporation | Canada | |

| Chimet S.p.A. | Italy | |

| Chugai Mining | Japan | |

| Daye Non-Ferrous Metals Mining Ltd. | China | |

| DSC (Do Sung Corporation) | Korea, Republic of | |

| Dowa | Japan | |

| Eco-System Recycling Co., Ltd. East Plant | Japan | |

| LT Metal Ltd. | Korea, Republic of | |

| Heimerle + Meule GmbH | Germany | |

| Heraeus Metals Hong Kong Ltd. | China | |

| Heraeus Germany GmbH Co. KG | Germany | |

| Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. | China | |

| Ishifuku Metal Industry Co., Ltd. | Japan | |

| Istanbul Gold Refinery | Turkey | |

| Japan Mint | Japan | |

| Jiangxi Copper Co., Ltd. | Japan | |

| Asahi Refining USA Inc. | United States of America | |

| Asahi Refining Canada Ltd. | Canada | |

| JX Nippon Mining & Metals Co., Ltd. | Japan |

A-1

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| Kazzinc | Kazakhstan | |

| Kennecott Utah Copper LLC | United States of America | |

| Kojima Chemicals Co., Ltd. | Japan | |

| LS-NIKKO Copper Inc. | Korea, Republic of | |

| Materion | United States of America | |

| Matsuda Sangyo Co., Ltd. | Japan | |

| Metalor Technologies (Suzhou) Ltd. | China | |

| Metalor Technologies (Hong Kong) Ltd. | China | |

| Metalor Technologies (Singapore) Pte., Ltd. | Singapore | |

| Metalor Technologies S.A. | Switzerland | |

| Metalor USA Refining Corporation | United States of America | |

| Metalurgica Met-Mex Penoles S.A. De C.V. | Mexico | |

| Mitsubishi Materials Corporation | Japan | |

| Mitsui Mining and Smelting Co., Ltd. | Japan | |

| Nadir Metal Rafineri San. Ve Tic. A.S. | Turkey | |

| Navoi Mining and Metallurgical Combinat | Uzbekistan | |

| Nihon Material Co., Ltd. | Japan | |

| Ohura Precious Metal Industry Co., Ltd. | Japan | |

| PAMP S.A. | Switzerland | |

| PT Aneka Tambang (Persero) Tbk | Indonesia | |

| PX Precinox S.A. | Switzerland | |

| Rand Refinery (Pty) Ltd. | South Africa | |

| Royal Canadian Mint | Canada | |

| SEMPSA Joyeria Plateria S.A. | Spain | |

| Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China | |

| Sichuan Tianze Precious Metals Co., Ltd. | China | |

| Solar Applied Materials Technology Corp. | Taiwan | |

| Sumitomo Metal Mining Co., Ltd. | Japan | |

| Tanaka Kikinzoku Kogyo K.K. | Japan | |

| Great Wall Precious Metals Co., Ltd. of CBPM | China | |

| Shandong Gold Smelting Co., Ltd. | China | |

| Tokuriki Honten Co., Ltd. | Japan | |

| Torecom | Korea, Republic of | |

| Umicore S.A. Business Unit Precious Metals Refining | Belgium | |

| United Precious Metal Refining, Inc. | United States of America | |

| Valcambi S.A. | Switzerland | |

| Western Australian Mint (T/a The Perth Mint) | Australia | |

| Yamakin Co., Ltd. | Japan | |

| Yokohama Metal Co., Ltd. | Japan | |

| Zhongyuan Gold Smelter of Zhongjin Gold Corporation | China | |

| Gold Refinery of Zijin Mining Group Co., Ltd. | China | |

| SAFINA A.S. | Czech Republic | |

| Guangdong Jinding Gold Limited | China |

A-2

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| MMTC-PAMP India Pvt., Ltd. | India | |

| KGHM Polska Miedz Spolka Akcyjna | Poland | |

| Al Etihad Gold Refinery DMCC | United Arab Emirates | |

| T.C.A S.p.A | Italy | |

| REMONDIS PMR B.V. | Netherlands | |

| Korea Zinc Co., Ltd. | Korea, Republic of | |

| TOO Tau-Ken-Altyn | Kazakhstan | |

| Abington Reldan Metals, LLC | United States of America | |

| L’Orfebre S.A. | Andorra | |

| Italpreziosi | Italy | |

| WIELAND Edelmetalle GmbH | Germany | |

| Ogussa Osterreichische Gold- und Silber-Scheideanstalt GmbH | Austria | |

| Bangalore Refinery | India | |

| SungEel HiMetal Co., Ltd. | Korea, Republic of | |

| Planta Recuperadora de Metales SpA | Chile | |

| NH Recytech Company | Korea, Republic of | |

| Eco-System Recycling Co., Ltd. North Plant | Japan | |

| Eco-System Recycling Co., Ltd. West Plant | Japan | |

| Metal Concentrators SA (Pty) Ltd. | South Africa | |

| WEEEREFINING | France | |

| Gold by Gold Colombia | Colombia | |

| Coimpa Industrial LTDA | Brazil | |

| GG Refinery Ltd. | Tanzania | |

| Impala Rustenburg | South Africa | |

| Impala Refineries – Platinum Metals Refinery (PMR) | South Africa | |

| Elite Industech Co., Ltd. | Taiwan | |

| Tantalum | ||

| Smelter Name |

Country | |

| Changsha South Tantalum Niobium Co., Ltd. | China | |

| Guangdong Rising Rare Metals-EO Materials Ltd. | China | |

| F&X Electro-Materials Ltd. | China | |

| XIMEI RESOURCES (GUANGDONG) LIMITED | China | |

| JiuJiang JinXin Nonferrous Metals Co., Ltd. | China | |

| Jiujiang Tanbre Co., Ltd. | China | |

| AMG Brasil | Brazil | |

| Metallurgical Products India Pvt., Ltd. | India | |

| Mineracao Taboca S.A. | Brazil | |

| Mitsui Mining and Smelting Co., Ltd. | Japan | |

| NPM Silmet AS | Estonia | |

| Ningxia Orient Tantalum Industry Co., Ltd. | China | |

| QuantumClean | United States of America | |

| Yanling Jincheng Tantalum & Niobium Co., Ltd. | China | |

A-3

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| Taki Chemical Co., Ltd. | Japan | |

| Telex Metals | United States of America | |

| Ulba Metallurgical Plant JSC | Kazakhstan | |

| Hengyang King Xing Lifeng New Materials Co., Ltd. | China | |

| D Block Metals, LLC | United States of America | |

| FIR Metals & Resource Ltd. | China | |

| Jiujiang Zhongao Tantalum & Niobium Co., Ltd. | China | |

| XinXing HaoRong Electronic Material Co., Ltd. | China | |

| Jiangxi Dinghai Tantalum & Niobium Co., Ltd. | China | |

| KEMET de Mexico | Mexico | |

| TANIOBIS Co., Ltd. | Thailand | |

| TANIOBIS GmbH | Germany | |

| H.C. Starck Hermsdorf GmbH | Germany | |

| H.C. Starck Inc. | United States of America | |

| TANIOBIS Japan Co., Ltd. | Japan | |

| TANIOBIS Smelting GmbH & Co. KG | Germany | |

| Global Advanced Metals Boyertown | United States of America | |

| Global Advanced Metals Aizu | Japan | |

| Resind Industria e Comercio Ltda. | Brazil | |

| Jiangxi Tuohong New Raw Material | China | |

| RFH Yancheng Jinye New Material Technology Co., Ltd. | China | |

| PowerX Ltd. | Rwanda | |

| Tin | ||

| Smelter Name |

Country | |

| Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. | China | |

| Alpha | United States of America | |

| PT Aries Kencana Sejahtera | Indonesia | |

| PT Premium Tin Indonesia | Indonesia | |

| Dowa | Japan | |

| EM Vinto | Bolivia | |

| Estanho de Rondonia S.A. | Brazil | |

| Fenix Metals | Poland | |

| Gejiu Non-Ferrous Metal Processing Co., Ltd. | China | |

| Gejiu Zili Mining And Metallurgy Co., Ltd. | China | |

| China Tin Group Co., Ltd. | China | |

| Malaysia Smelting Corporation (MSC) | Malaysia | |

| Metallic Resources, Inc. | United States of America | |

| Mineracao Taboca S.A. | Brazil | |

| Minsur | Perú | |

| Mitsubishi Materials Corporation | Japan | |

| Jiangxi New Nanshan Technology Ltd. | China | |

| O.M. Manufacturing (Thailand) Co., Ltd. | Thailand | |

A-4

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| Operaciones Metalurgicas S.A. | Bolivia | |

| PT Artha Cipta Langgeng | Indonesia | |

| PT Babel Inti Perkasa | Indonesia | |

| PT Babel Surya Alam Lestari | Indonesia | |

| PT Bangka Tin Industry | Indonesia | |

| PT Belitung Industri Sejahtera | Indonesia | |

| PT Bukit Timah | Indonesia | |

| PT Mitra Stania Prima | Indonesia | |

| PT Prima Timah Utama | Indonesia | |

| PT Refined Bangka Tin | Indonesia | |

| PT Sariwiguna Binasentosa | Indonesia | |

| PT Stanindo Inti Perkasa | Indonesia | |

| PT Timah Tbk Kundur | Indonesia | |

| PT Timah Tbk Mentok | Indonesia | |

| PT Timah Nusantara | Indonesia | |

| PT Tinindo Inter Nusa | Indonesia | |

| PT Tommy Utama | Indonesia | |

| Rui Da Hung | Taiwan | |

| Soft Metais Ltda. | Brazil | |

| Thaisarco | Thailand | |

| Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. | China | |

| White Solder Metalurgia e Mineracao Ltda. | Brazil | |

| Yunnan Chengfeng Non-ferrous Metals Co., Ltd. | China | |

| Tin Smelting Branch of Yunnan Tin Co., Ltd. | China | |

| CV Venus Inti Perkasa | Indonesia | |

| Magnu’s Minerais Metais e Ligas Ltda. | Brazil | |

| PT ATD Makmur Mandiri Jaya | Indonesia | |

| O.M. Manufacturing Philippines, Inc. | Philippines | |

| CV Ayi Jaya | Indonesia | |

| PT Rajehan Ariq | Indonesia | |

| PT Cipta Persada Mulia | Indonesia | |

| Resind Industria e Comercio Ltda. | Brazil | |

| Super Ligas | Brazil | |

| Metallo Belgium N.V. | Belgium | |

| Metallo Spain S.L.U. | Spain | |

| PT Bangka Prima Tin | Indonesia | |

| PT Sukses Inti Makmur | Indonesia | |

| PT Menara Cipta Mulia | Indonesia | |

| HuiChang Hill Tin Industry Co., Ltd. | China | |

| Guangdong Hanhe Non-Ferrous Metal Co., Ltd. | China | |

| Chifeng Dajingzi Tin Industry Co., Ltd. | China | |

| PT Bangka Serumpun | Indonesia | |

| Tin Technology & Refining | United States of America |

A-5

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| PT Rajawali Rimba Perkasa | Indonesia | |

| Luna Smelter, Ltd. | Rwanda | |

| Yunnan Yunfan Non-ferrous Metals Co., Ltd. | China | |

| Precious Minerals and Smelting Limited | India | |

| PT Mitra Sukses Globalindo | Indonesia | |

| CRM Fundicao De Metais E Comercio De Equipamentos Eletronicos Do | Brazil | |

| Brasil Ltda | ||

| CRM Synergies | Spain | |

| Fabrica Auricchio Industria e Comercio Ltda. | Brazil | |

| DS Myanmar | Myanmar | |

| PT Putera Sarana Shakti (PT PSS) | Indonesia | |

| Takehara PVD Materials Plant / PVD Materials Division of MITSUI | Japan | |

| MINING & SMELTING CO., LTD. | ||

| Malaysia Smelting Corporation Berhad (Port Klang) | Malaysia | |

| Woodcross Smelting Company Limited | Uganda | |

| Global Advanced Metals Greenbushes Pty Ltd. | Australia | |

| Mining Minerals Resources SARL | Congo, Democratic Republic of the | |

| Tungsten | ||

| Smelter Name |

Country | |

| A.L.M.T. Corp. | Japan | |

| Kennametal Huntsville | United States of America | |

| Guangdong Xianglu Tungsten Co., Ltd. | China | |

| Chongyi Zhangyuan Tungsten Co., Ltd. | China | |

| Global Tungsten & Powders Corp. | United States of America | |

| Hunan Chenzhou Mining Co., Ltd. | China | |

| Hunan Chunchang Nonferrous Metals Co., Ltd. | China | |

| Japan New Metals Co., Ltd. | Japan | |

| Kennametal Fallon | United States of America | |

| Wolfram Bergbau und Hutten AG | Austria | |

| Xiamen Tungsten Co., Ltd. | China | |

| Ganzhou Jiangwu Ferrotungsten Co., Ltd. | China | |

| Jiangxi Yaosheng Tungsten Co., Ltd. | China | |

| Jiangxi Xinsheng Tungsten Industry Co., Ltd. | China | |

| Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. | China | |

| Malipo Haiyu Tungsten Co., Ltd. | China | |

| Xiamen Tungsten (H.C.) Co., Ltd. | China | |

| Jiangxi Gan Bei Tungsten Co., Ltd. | China | |

| Ganzhou Seadragon W & Mo Co., Ltd. | China | |

| Asia Tungsten Products Vietnam Ltd. | Vietnam | |

| Chenzhou Diamond Tungsten Products Co., Ltd. | China | |

| H.C. Starck Tungsten GmbH | Germany | |

| TANIOBIS Smelting GmbH & Co. KG | Germany | |

A-6

EXHIBIT 1.01 – MICROSOFT CORPORATION CONFLICT MINERALS REPORT FOR 2024 REPORTING YEAR

| Masan High-Tech Materials | Vietnam | |

| Jiangwu H.C. Starck Tungsten Products Co., Ltd. | China | |

| Niagara Refining LLC | United States of America | |

| China Molybdenum Tungsten Co., Ltd. | China | |

| Philippine Chuangxin Industrial Co., Inc. | Philippines | |

| Lianyou Metals Co., Ltd. | Taiwan | |

| Jingmen Dewei GEM Tungsten Resources Recycling Co., Ltd. | China | |

| Cronimet Brasil Ltda | Brazil | |

| Fujian Xinlu Tungsten | China | |

| Lianyou Resources Co., Ltd. | Taiwan | |

| Shinwon Tungsten (Fujian Shanghang) Co., Ltd. | China | |

| Philippine Carreytech Metal Corp. | Philippines | |

| Kenee Mining Corporation Vietnam | Vietnam | |

| Philippine Bonway Manufacturing Industrial Corporation | Philippines | |

| Tungsten Vietnam Joint Stock Company | Vietnam |

A-7