Exhibit 1.01

CONFLICT MINERALS REPORT

Overview of Apple’s Commitment to Responsible Sourcing

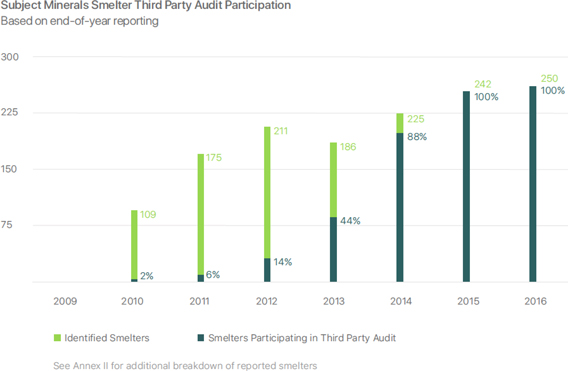

Apple is committed to responsible sourcing and seeks to ensure that the minerals in its products do not directly or indirectly finance armed conflict or benefit armed groups. As of December 31, 2016—and for the second year in a row—all identified smelters and refiners* in Apple’s supply chain for all current products had participated in an independent third-party conflict minerals audit program for gold, columbite-tantalite (coltan), cassiterite, wolframite, tantalum, tin, and tungsten (collectively, the “Subject Minerals”). Throughout its supply chain, Apple aims to drive industry-leading practices for responsible sourcing, including from high-risk areas such as the Democratic Republic of the Congo and adjoining countries.

Apple urged smelters and refiners to complete the audit process and simultaneously removed those unwilling to participate in an independent third-party conflict minerals audit. Apple goes far beyond legal requirements and has developed a holistic risk assessment tool and made it available industry-wide. Of the 250 identified smelters and refiners of Subject Minerals, 75% have completed this additional risk assessment on issues beyond the scope of current third-party conflict minerals audits. Going forward, Apple plans to continue to encourage smelters and refiners to follow strict guidelines, offering assistance on due diligence requirements, and removing smelters and refiners not willing to comply.

While reaching 100% participation is significant, Apple knows further due diligence measures are needed to improve conditions for people on the ground. To this end, Apple has supported various civil society initiatives in the Democratic Republic of the Congo. Apple also believes that tracking incident reporting is key to supply chain due diligence efforts. In 2016, Apple worked to ensure the review of over 1,300 smelter, refiner, and mine-level reports including human rights and security concerns. Reviewing reports helps suppliers identify and address risks to protect miners and the communities in the supply chain.

As the African Great Lakes Region faces ongoing challenges to secure lasting change, Apple believes that all stakeholders—governments, non-governmental organizations, industries, and local communities—will need to heighten their efforts to implement comprehensive due diligence programs.

| * | 250 in total as of December 31, 2016. |

1

Details of Apple’s Approach to Responsible Sourcing

Apple Foundational Due Diligence

Apple has driven a steady increase in smelters and refiners (hereinafter, collectively, “smelters”) participating in an independent third-party conflict minerals audit (a “Third Party Audit”). In 2015, Apple reached its goal of 100% participation, and again achieved 100% in 2016. As of December 31, 2016, 96% of smelters in Apple’s supply chain had completed their audit and 4% were in the process of completing one. Apple is closely tracking their progress.

Apple continues to believe Third Party Audits play a significant role in providing assurances that smelters have due diligence systems in place to ensure that their operations and sourcing do not support conflict in the Democratic Republic of the Congo (“DRC”) and adjoining countries. In order to meet the target of 100% participation, Apple continuously works hard to persuade new smelters to join Third Party Audit programs, including assisting many of them in understanding conflict minerals due diligence expectations (see Annex I for further details).

In 2016, 18 new smelters joined a Third Party Audit program and were approved and reported to be in Apple’s supply chain. Apple believes that, among other things, continued pressure on smelters removed from Apple’s supply chain in previous years for not participating in a Third Party Audit led to some smelters joining such programs for the first time in 2016. As a result, those smelters have been reapproved to enter Apple’s supply chain. At the same time, in 2016 Apple directed the removal of 22 smelters not willing to participate in, or complete, a Third Party Audit by Apple’s deadline.

2

Apple regularly receives conflict minerals related data from its suppliers and works to improve the quality of that data. Apple conducts in-person spot audits to verify the accuracy of reported data and to ensure corrective actions are taken where gaps may exist. Based on the findings from these spot audits and other supplier outreach, Apple has developed training for over 500 suppliers and internal teams, which are now in various stages of implementing such training.

In 2016, Apple provided online and/or in-person training to suppliers on due diligence expectations and practices and related reporting in line with the Organisation for Economic Co-operation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Due Diligence Guidance”). Apple has also spent significant time educating suppliers on how embargoing materials from the DRC and adjoining countries can stymie progress in protecting human rights. In addition, suppliers found to have gaps in management systems, in data management, or in reporting smelters not meeting Apple’s requirements have received tailored support to address their shortfalls.

As part of its reasonable due diligence, in 2016 Apple sought to improve risk identification efforts by smelters. Based on its 2016 review of public smelter reporting, Apple found in certain instances that smelters did not report on all identified risks or provide specific risk responses in all cases. Apple works to go above and beyond what’s required by law to help smelters report, assess, and mitigate risk in their business practices. Accordingly, Apple developed a new tool—the Risk Readiness Assessment (the “RRA”)—to assess comprehensive risks faced by particular smelters. The RRA includes 24 key metrics necessary in appraising holistic risk in the supply chain.

Apple received RRA responses from 75% of the Subject Minerals smelters in its supply chain in 2016. This work indicated that smelters were more aware of their conflict minerals risks than other areas of risk (see Annex I for further details). Apple has used the results from these RRAs to make sure that smelter risk identification, management, and reporting are further in line with the OECD Due Diligence Guidance.

Apple has leveraged its work on conflict minerals and holistic risk assessment into industry-wide tools. As an active member of the Conflict-Free Sourcing Initiative (the “CFSI”), Apple collaborated with the CFSI to incorporate its supplier audit methodology into an industry-wide, downstream audit program. In addition, Apple donated its supplier training content in-kind to the CFSI, and Apple is also donating its RRA methodology and tool through the Electronic Industry Citizenship Coalition. Apple’s aim is to make these resources available for use across a wider base of suppliers.

3

Further Due Diligence

Maintaining supply chain accountability is an ongoing challenge when sourcing from conflict regions such as the DRC and adjoining countries. Apple has addressed this challenge by not relying solely on existing sources of information, but instead seeking out new sources within the DRC and adjoining countries. Apple actively seeks to ensure review of mine-level and smelter incident reports potentially related to its supply chain and reported through monitoring systems, non-governmental organizations (“NGOs”), media, and private reports. By looking to both existing and new sources of information, Apple is better able to identify risks as they develop, which Apple believes complements the work of Third Party Audit programs.

Tracking and Addressing Identified Risks

In 2015, Apple began monitoring and reviewing reports generated through the ITRI’s Tin Supply Chain Initiative (“iTSCi”) reporting system, relating to incidents potentially associated with mine sites supplying smelters in the electronics and international supply chain. As reported in Apple’s Conflict Minerals Report for 2015, three of these incidents connected to material linked to smelters reported in Apple’s supply chain involved individuals identified as members or potential members of armed groups. Apple has received assurances that these three incidents ultimately resulted in corrective actions, including sanctions for alleged perpetrators or redress by local authorities.

In 2016, Apple reviewed over 1,300 incidents from iTSCi, local NGOs, and other reports. Through follow-up information provided by iTSCi, NGOs, and the London Bullion Market Association (“LBMA”) to date, Apple has received confirmation that 15 incidents potentially linked to smelters reported in Apple’s supply chain have occurred in which individuals, identified as members or potential members of organizations within the meaning of “armed groups,” as defined in Item 1.01(d)(2) of Form SD, in particular the police in the DRC, the DRC national army, and a Mai Mai group, were alleged to be involved. As of the filing date of this report, not all 2016 incidents have been publicly reported, fully traced to minerals associated with smelters, resolved, or remediated. Through its ongoing incident review process, Apple continues to review these and other incidents and follow up accordingly.

Notwithstanding limitations on its ability to trace minerals and categorically resolve and remediate incidents, Apple has sought to confirm that each of the 15 incidents was followed up on, including, where appropriate, by applicable local authorities. Each of the incidents appears to have involved a variety of different illicit activities, from theft, robbery, illegal taxation, and bribery, to corruption, fraud, and other criminal activity, potentially for personal gain, based on information received to date. In five of these cases, the alleged perpetrators have been sanctioned or the specific incident has otherwise received some level of official redress by the local authorities. In two cases, security and due diligence were improved near mine sites to prevent future risks, and no further security or diligence concerns appear to have been reported. Of the remaining eight cases, five occurred near the end of 2016, and investigations and corrective actions are still in process with respect to these cases. In one case involving illegal taxation, no corrective actions were specifically taken due to a lack of local stakeholder engagement to resolve the issue, and further actions appear to be needed at the DRC national level to mitigate the risk in the future. Finally, in the two other cases, each involving gold, review by the LBMA is still ongoing with relevant supply chain actors to clarify incident details, supply chain linkage, and appropriate or required corrective actions.

4

More generally, Apple continues to be actively engaged with relevant stakeholders to better understand the incident reports and how they are addressed, including, where appropriate, by applicable local authorities. However, with respect to the 15 incidents identified, Apple has not, to date, been able to determine whether specific minerals were included in Apple’s products. The challenges with tracking specific mineral quantities through the supply chain currently continue to prevent the traceability of any specific mineral shipment through the entire manufacturing process.

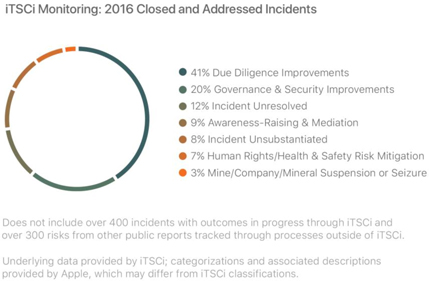

Of the 2016 incidents that were monitored and closed by iTSCi, 20% were addressed through improvements in governance and security, which included arrests and prosecution of perpetrators as well as other actions taken by local authorities, such as steps to reduce corruption. With respect to other 2016 incidents that were monitored and closed, 7% were addressed through human rights or health and safety risk mitigation, including repayment to miners or families for damages. In 3% of closed incidents, mines, companies, or minerals were actually suspended or seized, which demonstrates the extent to which responsible sourcing requirements impact businesses. Moreover, due diligence improvements, covering everything from administrative corrections to changes in company sourcing practices, represented 41% of all 2016 monitored and closed incidents, and such steps demonstrate the continuous improvement occurring along the supply chain.

5

In some cases, there may be incidents that are not fully addressed despite ongoing monitoring and resolution efforts. Apple understands that unresolved incidents may be due to a variety of factors, such as the lack of engagement by local authorities, stakeholders, or supply chain actors, or in some cases due to lack of international agreement on the disposal of seized minerals. In the cases where supply chain actors that are linked to issues have not taken recommended actions to reasonably and systematically address identified risks, Apple has been informed that these supply chain actors are warned by relevant stakeholders and ultimately may be suspended by the DRC government or iTSCi program. Apple continues to engage with both iTSCi and local authorities to ensure all risks are addressed. However, follow-up efforts require broader and more systematic engagement by other stakeholders in the supply chain to be fully effective.

Action Toward Risk Prevention and Mitigation

In 2016, Apple further developed a process to identify, categorize, and follow up on alleged incidents potentially connected to smelters in Apple’s supply chain. Apple worked directly with the Responsible Jewellery Council (“RJC”), LBMA, and CFSI to test new and existing OECD-aligned processes for investigating and resolving these alleged incidents. Apple continues to work with third-party grievance channels to clarify processes for following up on these incidents and ensuring, where necessary, responsible corrective actions are taken (see Annex I for further details). Apple intends to work with smelters and third parties to continue developing the necessary practices for resolving any credible incidents in a timely manner. Apple expects these practices to include public reporting on proactive risk identification and reactive risk resolutions.

Apple’s further due diligence also includes supporting various civil society initiatives on the ground. In 2016, Apple supported programs to expand whistleblowing and monitoring networks in several new provinces of the DRC that empower the general public to report conflict or serious human rights issues. Additionally, Apple supported the Public Private Alliance for Responsible Minerals Trade, which has selected International Peace Information Service to test oversight of two major gold trading hubs.

In 2016, Apple continued its commitment to responsible sourcing of artisanal gold. Apple participated in the Responsible Artisanal Gold Solutions Forum (“RAGS”). Through the Partnership Africa Canada’s Just Gold project, and in collaboration with RAGS, Apple is supporting efforts to overcome challenges in exporting responsible artisanal gold from the DRC to a major gold refiner. Separately, Apple has continued to engage gold industry stakeholders, including banking and jewelry industry groups, to encourage strong leadership on responsible sourcing from these key gold users.

Risk Mitigation and Future Due Diligence Measures

Apple will continue to seek responsible sourcing of conflict minerals throughout its supply chain. Without constant improvements to due diligence practices, any strides forward in human rights and better working conditions can evaporate relatively quickly. Apple is committed to not letting that happen. Going forward, in order to improve due diligence and mitigate and address systemic risks in conflict minerals sourcing, Apple intends to:

| • | Continue to seek qualitative improvements in supplier and smelter due diligence of conflict minerals. |

6

| • | Broaden participation rates and depth of smelter risk identification and risk reporting. |

| • | Continue collaborating with various stakeholders for improvement in tracking and addressing incidents and greater accountability in the conflict minerals sector. |

| • | Support smelters and third-party organizations to advance addressing and resolving relevant incidents. |

Determination

Based on the information provided by Apple’s suppliers and its own due diligence efforts through December 31, 2016 (see Annex I), Apple believes that the facilities that may have been used to process the Subject Minerals in Apple’s products include the smelters listed in Annex II. Through the smelter identification and validation process, Apple has identified a total of 311 smelters as potential sources of Subject Minerals that, initially, were believed to have been in its supply chain at some point during 2016 (see Annex II). Of the 311 smelters:

| • | 250 smelters were determined to be in Apple’s Subject Minerals supply chain as of December 31, 2016; |

| • | 15 smelters were subsequently found to be inoperative during 2016; and |

| • | 46 smelters were removed and no longer reported in Apple’s supply chain as of December 31, 2016. |

Of the 46 removed smelters:

| • | 24 had been reported and confirmed removed from Apple’s supply chain in previous Apple Conflict Minerals Reports and, following initial supplier reporting of these smelters again in 2016, were re-removed during the year; and |

| • | 22 were newly removed in 2016 at Apple’s request. |

Of these 22 newly removed smelters:

| • | 8 had been previously participating and previously reported but subsequently stopped participating in a Third Party Audit program; and |

| • | 14 were newly identified and reported to Apple in 2016. |

Apple’s reasonable country of origin inquiry is based on Third Party Audit information and, to the extent that country of origin information has not been audited, additional information collected by it and others. To the extent reasonably possible, Apple has documented the country of origin of identified smelters based on information received through the CFSI’s Third Party Audit program—the Conflict-Free Smelter Program (the “CFSP”), the LBMA, surveys of smelters, and/or third-party reviews of publicly available information. However, some country of origin information has not been audited by a third-party because, among other reasons, applicable smelters have gone out of operation before completing a Third Party Audit, smelters have not gone through a Third Party Audit, or the particular Third Party Audit program has not yet required reporting of country of origin information from all smelters. Therefore, Apple does not have sufficient information to conclusively determine the countries of origin of the Subject Minerals in all of its products; however, based on the information provided by Apple’s suppliers and smelters, as well as from the CFSP, LBMA, and other sources, Apple believes that the Subject Minerals contained in its products originate from the countries listed in Annex III, as well as from recycled and scrap sources.

7

Of all of the smelters of Subject Minerals identified for 2016, Apple found no reasonable basis for concluding that any such smelter sourced Subject Minerals that directly or indirectly finance or benefit armed groups. Of the 35 smelters known to be sourcing from the DRC or an adjoining country, all participated in a Third Party Audit. The foregoing does not include smelters indirectly sourcing from the DRC or adjoining countries by acquiring Subject Minerals from these 35 smelters. Of the 35 smelters:

| • | 33 smelters have undergone a Third Party Audit involving the review of the smelter’s traceability of Subject Minerals, in addition to a validation of its due diligence systems and country of origin information; |

| • | One smelter was audited with respect to its due diligence systems and Apple has requested that the Third Party Audit program have country of origin information audited by next calendar year; and |

| • | One smelter did not finish its Third Party Audit, due to intermittent operations throughout the year preventing it from meeting requirements for validation of corrective actions and the completion of the audit process. As a result, Apple required the removal of this smelter from its supply chain until such time as the auditor is able to complete the Third Party Audit. |

About This Report

The report has been prepared pursuant to Rule 13p-1 under the Securities Exchange Act of 1934, as amended, for the reporting period from January 1 to December 31, 2016.

This report relates to the process undertaken for Apple products that were manufactured, or contracted to be manufactured, during 2016 and that contain Subject Minerals.

These products are Apple’s iPhone®, iPad®, Mac®, iPod®, Apple TV®, Apple Watch®, AirPods™, Beats® products, displays, and Apple accessories. Third-party products that Apple retails but that it does not manufacture or contract to manufacture are outside of the scope of this report. The smelters identified in this report include smelters producing service or spare parts contract manufactured in 2016 for use in connection with the subsequent service of previously sold products, including products serviced in subsequent years using those parts. This report does not include smelters of tantalum, tin, tungsten, and gold included in end-of-life service parts for products that Apple no longer manufactures or contracts to manufacture.

8

This report’s use of the term “smelters” refers to the facilities (i.e., a smelter or refiner) processing primary Subject Minerals to retail purity. Apple suppliers have in some cases reported smelters that Apple believes are not operational or may have been misidentified as smelters. As a result, Apple continues to conduct independent research on smelters and to work with suppliers throughout its supply chain to re-validate, improve, and refine their reported information, taking into account supply chain fluctuations and other changes in status or scope and relationships over time. “Identified” smelters are those that (i) have been reported in supplier surveys, (ii) Apple believes are currently operational, were operational at some point during the applicable year or, while inoperative, were capable of re-engagement with minimal delay or effort, and (iii) otherwise meet the definition of a smelter. As part of its reasonable country of origin inquiry, Apple concluded that several processing facilities are using only recycled material. Facilities that process only secondary materials (i.e., scrap or recycled material) are excluded from the scope of this report, except where the entity has undergone a Third Party Audit and is otherwise identified in Annex II.

Participating smelters are those that have agreed to participate in, or have been found compliant with, the CFSP or cross-recognized independent third-party conflict minerals audit programs confirming their conflict minerals sourcing practices. Such programs may also include audits of traceability requirements, conformity with OECD Due Diligence Guidance, management systems, and/or risk assessments. Cross-recognized independent third-party conflict minerals audit programs include the LBMA’s Responsible Gold Program and the RJC’s Chain-of-Custody Certification. Throughout this report, the audits by these programs are included in references to “Third Party Audit” programs.

This report includes forward-looking statements, within the meaning of the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Forward-looking statements provide current expectations of future events based on certain assumptions and include any statement that does not directly relate to any historical or current fact. Forward-looking statements can also be identified by words such as “expects,” “plans,” “intends,” “will,” “may,” and similar terms. Forward-looking statements are not guarantees of future performance. Apple assumes no obligation to revise or update any forward-looking statements for any reason, except as required by law. Subsequent events may affect Apple’s future determinations under Rule 13p-1.

9

ANNEX I†

Design of Due Diligence

Apple designed its due diligence measures to conform to the OECD Due Diligence Guidance.

2016 Due Diligence Measures Performed:

| 1. | Apple required relevant suppliers to source from smelters that have participated in an independent Third Party Audit program. As such, Apple identified smelters that did not meet this requirement and informed relevant suppliers of these smelters. Apple conducted outreach to smelters not yet participating in a Third Party Audit program, and participating smelters appearing to delay the completion of their Third Party Audits, to request their timely participation and completion of an audit in order to meet this requirement. |

| 2. | Apple encouraged improved monitoring and transparent tracking of incidents, in order to determine whether reported smelters, identified as potentially sourcing Subject Minerals from the DRC or adjoining countries, may be associated with armed groups. |

| a) | Apple compared information provided by the CFSP against other publicly available information. This publicly available information included investigation reports from NGOs and international organizations that have conducted investigations on individuals and companies associated with armed groups. |

| b) | Apple provided a methodology from its 2015 iTSCi incident review process and supported the development of a joint incident review process between CFSI and iTSCi in 2016. Apple analyzed CFSI’s review of 2016 iTSCi incidents to identify which reports related to potential armed group interference in applicable mineral supply chains, whether these incidents had been followed up and addressed, and whether the incidents could be linked to smelters in Apple’s tin, tantalum, or tungsten supply chains. |

| c) | Apple identified and tracked available local NGO reports from the DRC related to mine site incidents to supplement the iTSCi incident collection process and verify coverage of the iTSCi monitoring system. The review identified only six incidents that had not been monitored by iTSCi, and Apple accordingly took steps to make sure that incidents relevant to the iTSCi system were in fact included and followed up by the iTSCi’s incident monitoring process. |

| † | Certain terms used in this Annex are defined in the report. |

10

| 3. | Apple encouraged and made suggestions to Third Party Audit programs to improve their programs and to test and develop new and existing grievance channels. |

| a) | In 2015, Apple commissioned a third-party consultant to identify whether reported gold refiners may have been associated with armed groups. In 2016, Apple conducted due diligence to further assess the accuracy of allegations presented and, as applicable, to review relevant documentation supportive of specific allegations. Apple has shared and will continue to share results of its investigation with Third Party Audit programs that are certifying the due diligence of such gold refiners to ensure follow-up and resolution through appropriate third-party grievance channels. |

| b) | In connection with item 2(c) above, Apple followed up on identified incidents from local NGO reports in the gold supply chain through the LBMA to determine what, if any, corrective actions had occurred. LBMA’s investigation into these incidents is still ongoing. |

| c) | In addition to testing grievance channels, Apple contributed to the OECD process to better align the systems, processes, and protocols of Third Party Audit programs. |

| 4. | Apple conducted a secondary review of OECD Due Diligence Guidance “Step 5” reporting (namely, with respect to reporting annually on supply chain due diligence), on a test basis, by certain smelters in its supply chain to assess the quality of how smelters are reporting and addressing risks. Apple also requested additional smelter reporting on a broader set of risks from all reported smelters through Apple’s own Risk Readiness Assessment. |

11

ANNEX II†

Smelter List

List 1: Smelters reported in Apple’s Supply Chain as of December 31, 2016.

| # | Subject Mineral |

Facility Name of Smelter | Country Location of Smelter | |||

|

1 |

Gold | Advanced Chemical Co.* | United States | |||

|

2 |

Gold | Aida Chemical Industries Co., Ltd. | Japan | |||

|

3 |

Gold | Allgemeine Gold-und Silberscheideanstalt AG | Germany | |||

|

4 |

Gold | Almalyk Mining and Metallurgical Complex | Uzbekistan | |||

|

5 |

Gold | AngloGold Ashanti Córrego do Sítio Mineraçäo | Brazil | |||

|

6 |

Gold | Argor-Heraeus S.A. | Switzerland | |||

|

7 |

Gold | Asahi Pretec Corp.* | Japan | |||

|

8 |

Gold | Asahi Refining Canada Ltd. | Canada | |||

|

9 |

Gold | Asahi Refining USA Inc. | United States | |||

|

10 |

Gold | Asaka Riken Co., Ltd.* | Japan | |||

|

11 |

Gold | AU Traders and Refiners | South Africa | |||

|

12 |

Gold | Aurubis AG | Germany | |||

|

13 |

Gold | Bangalore Refinery | India | |||

|

14 |

Gold | Bangko Sentral ng Pilipinas (Central Bank of the Philippines) | Philippines | |||

|

15 |

Gold | Boliden AB | Sweden | |||

|

16 |

Gold | C. Hafner GmbH + Co. KG | Germany | |||

|

17 |

Gold | CCR Refinery – Glencore Canada Corp. | Canada | |||

|

18 |

Gold | Cendres + Métaux S.A. | Switzerland | |||

|

19 |

Gold | Chimet S.p.A. | Italy | |||

|

20 |

Gold | Daejin Indus Co., Ltd.** | Republic of Korea | |||

| † | Certain terms used in this Annex are defined in the report. |

12

|

21 |

Gold |

Daye Non-Ferrous Metals Mining Ltd. |

China | |||

|

22 |

Gold |

Doduco GmbH* |

Germany | |||

|

23 |

Gold |

Dowa* |

Japan | |||

|

24 |

Gold |

DSC (Do Sung Corp.) |

Republic of Korea | |||

|

25 |

Gold |

Eco-System Recycling Co., Ltd.* |

Japan | |||

|

26 |

Gold |

Elemetal Refining LLC** |

United States | |||

|

27 |

Gold |

Emirates Gold DMCC |

United Arab Emirates | |||

|

28 |

Gold |

Geib Refining Corp. |

United States | |||

|

29 |

Gold |

Great Wall Precious Metals Co., Ltd. of CBPM |

China | |||

|

30 |

Gold |

Heimerle + Meule GmbH |

Germany | |||

|

31 |

Gold |

Heraeus Ltd. Hong Kong |

China | |||

|

32 |

Gold |

Heraeus Precious Metals GmbH & Co. KG |

Germany | |||

|

33 |

Gold |

Inner Mongolia Qiankun Gold and Silver Refinery Share Co., Ltd. |

China | |||

|

34 |

Gold |

Ishifuku Metal Industry Co., Ltd. |

Japan | |||

|

35 |

Gold |

Istanbul Gold Refinery |

Turkey | |||

|

36 |

Gold |

Japan Mint |

Japan | |||

|

37 |

Gold |

Jiangxi Copper Co., Ltd. |

China | |||

|

38 |

Gold |

JSC Ekaterinburg Non-Ferrous Metal Processing Plant |

Russia | |||

|

39 |

Gold |

JSC UralElectromed |

Russia | |||

|

40 |

Gold |

JX Nippon Mining & Metals Co., Ltd. |

Japan | |||

|

41 |

Gold |

Kazzinc |

Kazakhstan | |||

|

42 |

Gold |

Kennecott Utah Copper LLC |

United States | |||

|

43 |

Gold |

KGHM Polska Miedź Spółka Akcyjna |

Poland | |||

|

44 |

Gold |

Kojima Chemicals Co., Ltd.* |

Japan | |||

|

45 |

Gold |

Kyrgyzaltyn JSC |

Kyrgyzstan | |||

|

46 |

Gold |

LS-NIKKO Copper Inc. |

Republic of Korea | |||

|

47 |

Gold |

Materion* |

United States | |||

13

| 48 |

Gold |

Matsuda Sangyo Co., Ltd. |

Japan | |||

| 49 |

Gold |

Metalor Technologies (Hong Kong) Ltd. |

China | |||

| 50 |

Gold |

Metalor Technologies (Singapore) Pte., Ltd. |

Singapore | |||

| 51 |

Gold |

Metalor Technologies (Suzhou) Ltd. |

China | |||

| 52 |

Gold |

Metalor Technologies S.A. |

Switzerland | |||

| 53 |

Gold |

Metalor USA Refining Corp. |

United States | |||

| 54 |

Gold |

Metalúrgica Met-Mex Peñoles S.A. de C.V. |

Mexico | |||

| 55 |

Gold |

Mitsubishi Materials Corp. |

Japan | |||

| 56 |

Gold |

Mitsui Mining and Smelting Co., Ltd. |

Japan | |||

| 57 |

Gold |

MMTC-PAMP India Pvt., Ltd. |

India | |||

| 58 |

Gold |

Moscow Special Alloys Processing Plant |

Russia | |||

| 59 |

Gold |

Nadir Metal Rafineri San. Ve Tic A.Ş. |

Turkey | |||

| 60 |

Gold |

Navoi Mining and Metallurgical Combinat |

Uzbekistan | |||

| 61 |

Gold |

Nihon Material Co., Ltd. |

Japan | |||

| 62 |

Gold |

Ögussa Österreichische Gold- und Silber-Scheideanstalt GmbH |

Austria | |||

| 63 |

Gold |

Ohura Precious Metal Industry Co., Ltd.* |

Japan | |||

| 64 |

Gold |

OJSC “The Gulidov Krasnoyarsk Non-Ferrous Metals Plan” (OJSC Krastsvetmet) | Russia | |||

| 65 |

Gold |

OJSC Novosibirsk Refinery |

Russia | |||

| 66 |

Gold |

PAMP S.A. |

Switzerland | |||

| 67 |

Gold |

Prioksky Plant of Non-Ferrous Metals |

Russia | |||

| 68 |

Gold |

PT Aneka Tambang (Persero) Tbk |

Indonesia | |||

| 69 |

Gold |

PX Précinox S.A. |

Switzerland | |||

| 70 |

Gold |

Rand Refinery (Pty) Ltd. |

South Africa | |||

| 71 |

Gold |

Republic Metals Corp. |

United States | |||

| 72 |

Gold |

Royal Canadian Mint |

Canada | |||

| 73 |

Gold |

Samduck Precious Metals* |

Republic of Korea | |||

| 74 |

Gold |

SAXONIA Edelmetalle GmbH* |

Germany | |||

| 75 |

Gold |

Schone Edelmetaal B.V. |

Netherlands | |||

14

|

76 |

Gold | SEMPSA Joyería Platería S.A. | Spain | |||

|

77 |

Gold | Shandong Zhaojin Gold & Silver Refinery Co., Ltd. | China | |||

|

78 |

Gold | Sichuan Tianze Precious Metals Co., Ltd. | China | |||

|

79 |

Gold | Singway Technology Co., Ltd.* | Taiwan | |||

|

80 |

Gold | SOE Shyolkovsky Factory of Secondary Precious Metals | Russia | |||

|

81 |

Gold | Solar Applied Materials Technology Corp. | Taiwan | |||

|

82 |

Gold | Sumitomo Metal Mining Co., Ltd. | Japan | |||

|

83 |

Gold | T.C.A. S.p.A. | Italy | |||

|

84 |

Gold | Tanaka Kikinzoku Kogyo K.K. | Japan | |||

|

85 |

Gold | The Refinery of Shandong Gold Mining Co., Ltd. | China | |||

|

86 |

Gold | Tokuriki Honten Co., Ltd. | Japan | |||

|

87 |

Gold | Torecom* | Republic of Korea | |||

|

88 |

Gold | Umicore Brasil Ltda. | Brazil | |||

|

89 |

Gold | Umicore Precious Metals Thailand | Thailand | |||

|

90 |

Gold | Umicore S.A. Business Unit Precious Metals Refining | Belgium | |||

|

91 |

Gold | United Precious Metal Refining Inc.* | United States | |||

|

92 |

Gold | Valcambi S.A. | Switzerland | |||

|

93 |

Gold | Western Australian Mint trading as The Perth Mint | Australia | |||

|

94 |

Gold | Wieland Edelmetalle GmbH* | Germany | |||

|

95 |

Gold | Yamamoto Precious Metal Co., Ltd.* | Japan | |||

|

96 |

Gold | Yokohama Metal Co., Ltd.* | Japan | |||

|

97 |

Gold | Zhongyuan Gold Smelter of Zhongjin Gold Corp. | China | |||

|

98 |

Gold | Zijin Mining Group Co., Ltd. Gold Refinery | China | |||

|

99 |

Tantalum | Changsha South Tantalum Niobium Co., Ltd. | China | |||

|

100 |

Tantalum | Conghua Tantalum and Niobium Smeltry | China | |||

|

101 |

Tantalum | D Block Metals LLC | United States | |||

|

102 |

Tantalum | Duoluoshan | China | |||

|

103 |

Tantalum | Exotech Inc. | United States | |||

|

104 |

Tantalum | F&X Electro-Materials Ltd. | China | |||

15

|

105 |

Tantalum |

FIR Metals & Resource Ltd. |

China | |||

|

106 |

Tantalum |

Global Advanced Metals Aizu |

Japan | |||

|

107 |

Tantalum |

Global Advanced Metals Boyertown |

United States | |||

|

108 |

Tantalum |

Guangdong Zhiyuan New Material Co., Ltd. |

China | |||

|

109 |

Tantalum |

H.C. Starck Co., Ltd. |

Thailand | |||

|

110 |

Tantalum |

H.C. Starck Hermsdorf GmbH |

Germany | |||

|

111 |

Tantalum |

H.C. Starck Inc. |

United States | |||

|

112 |

Tantalum |

H.C. Starck Ltd. |

Japan | |||

|

113 |

Tantalum |

H.C. Starck Smelting GmbH & Co. KG |

Germany | |||

|

114 |

Tantalum |

H.C. Starck Tantalum and Niobium GmbH, Goslar |

Germany | |||

|

115 |

Tantalum |

Hengyang King Xing Lifeng New Materials Co., Ltd. |

China | |||

|

116 |

Tantalum |

Jiangxi Dinghai Tantalum & Niobium Co., Ltd. |

China | |||

|

117 |

Tantalum |

Jiangxi Tuohong New Raw Material |

China | |||

|

118 |

Tantalum |

JiuJiang JinXin Nonferrous Metals Co., Ltd. |

China | |||

|

119 |

Tantalum |

Jiujiang Nonferrous Metals Smelting Corp., Ltd. |

China | |||

|

120 |

Tantalum |

Jiujiang Zhongao Tantalum & Niobium Co., Ltd. |

China | |||

|

121 |

Tantalum |

Kemet Blue Metals |

Mexico | |||

|

122 |

Tantalum |

Kemet Blue Powder |

United States | |||

|

123 |

Tantalum |

King-Tan Tantalum Industry Ltd. |

China | |||

|

124 |

Tantalum |

LSM Brasil S.A. |

Brazil | |||

|

125 |

Tantalum |

Metallurgical Products India Pvt., Ltd. |

India | |||

|

126 |

Tantalum |

Mineração Taboca S.A. |

Brazil | |||

|

127 |

Tantalum |

Mitsui Mining & Smelting |

Japan | |||

|

128 |

Tantalum |

Molycorp Silmet A.S. |

Estonia | |||

|

129 |

Tantalum |

Ningxia Orient Tantalum Industry Co., Ltd. |

China | |||

|

130 |

Tantalum |

Plansee SE Liezen** |

Austria | |||

|

131 |

Tantalum |

Plansee SE Reutte** |

Austria | |||

|

132 |

Tantalum |

Power Resources Ltd. |

Malta | |||

|

133 |

Tantalum |

QuantumClean* |

United States | |||

16

|

134 |

Tantalum |

Resind Indústria e Comércio Ltda. |

Brazil | |||

|

135 |

Tantalum |

RFH Tantalum Smeltry Co., Ltd. |

China | |||

|

136 |

Tantalum |

Solikamsk Magnesium Works OAO |

Russia | |||

|

137 |

Tantalum |

Taki Chemicals |

Japan | |||

|

138 |

Tantalum |

Telex Metals |

United States | |||

|

139 |

Tantalum |

Tranzact Inc.* |

United States | |||

|

140 |

Tantalum |

Ulba Metallurgical Plant JSC |

Kazakhstan | |||

|

141 |

Tantalum |

XinXing Haorong Electronic Material Co., Ltd. |

China | |||

|

142 |

Tantalum |

Yichun Jin Yang Rare Metal Co., Ltd. |

China | |||

|

143 |

Tantalum |

Zhuzhou Cemented Carbide Group Corp., Ltd. |

China | |||

|

144 |

Tin |

Alpha |

United States | |||

|

145 |

Tin |

An Vinh Joint Stock Mineral Processing Co. |

Vietnam | |||

|

146 |

Tin |

Chenzhou Yunxiang Mining and Metallurgy Co., Ltd. |

China | |||

|

147 |

Tin |

China Tin Group Co., Ltd. |

China | |||

|

148 |

Tin |

Cooperativa Metalurgica de Rondônia Ltda. |

Brazil | |||

|

149 |

Tin |

CV Ayi Jaya |

Indonesia | |||

|

150 |

Tin |

CV Dua Sekawan |

Indonesia | |||

|

151 |

Tin |

CV Gita Pesona |

Indonesia | |||

|

152 |

Tin |

CV Serumpun Sebalai |

Indonesia | |||

|

153 |

Tin |

CV Tiga Sekawan |

Indonesia | |||

|

154 |

Tin |

CV United Smelting |

Indonesia | |||

|

155 |

Tin |

CV Venus Inti Perkasa |

Indonesia | |||

|

156 |

Tin |

Dowa |

Japan | |||

|

157 |

Tin |

Electro-Mechanical Facility of the Cao Bang Minerals & Metallurgy Joint Stock Co. |

Vietnam | |||

|

158 |

Tin |

Elmet S.L.U. (Metallo Group) |

Spain | |||

|

159 |

Tin |

EM Vinto |

Bolivia | |||

|

160 |

Tin |

Fenix Metals |

Poland | |||

|

161 |

Tin |

Gejiu Kai Meng Industry and Trade LLC |

China | |||

17

|

162 |

Tin |

Gejiu Non-Ferrous Metal Processing Co., Ltd. |

China | |||

|

163 |

Tin |

Gejiu Yunxin Nonferrous Electrolysis Co., Ltd. |

China | |||

|

164 |

Tin |

Guanyang Guida Nonferrous Metal Smelting Plant |

China | |||

|

165 |

Tin |

HuiChang Hill Tin Industry Co., Ltd. |

China | |||

|

166 |

Tin |

Jiangxi Ketai Advanced Material Co., Ltd. |

China | |||

|

167 |

Tin |

Magnu’s Minerais Metais e Ligas Ltda. |

Brazil | |||

|

168 |

Tin |

Malaysia Smelting Corp. (MSC) |

Malaysia | |||

|

169 |

Tin |

Melt Metais e Ligas S.A. |

Brazil | |||

|

170 |

Tin |

Metallic Resources Inc.* |

United States | |||

|

171 |

Tin |

Metallo-Chimique N.V. |

Belgium | |||

|

172 |

Tin |

Mineração Taboca S.A. |

Brazil | |||

|

173 |

Tin |

Minsur |

Peru | |||

|

174 |

Tin |

Mitsubishi Materials Corp.* |

Japan | |||

|

175 |

Tin |

O.M. Manufacturing (Thailand) Co., Ltd.* |

Thailand | |||

|

176 |

Tin |

O.M. Manufacturing Philippines Inc. |

Philippines | |||

|

177 |

Tin |

Operaciones Metalurgical S.A. |

Bolivia | |||

|

178 |

Tin |

PT Aries Kencana Sejahtera |

Indonesia | |||

|

179 |

Tin |

PT Artha Cipta Langgeng |

Indonesia | |||

|

180 |

Tin |

PT ATD Makmur Mandiri Jaya |

Indonesia | |||

|

181 |

Tin |

PT Babel Inti Perkasa |

Indonesia | |||

|

182 |

Tin |

PT Bangka Prima Tin |

Indonesia | |||

|

183 |

Tin |

PT Bangka Tin Industry |

Indonesia | |||

|

184 |

Tin |

PT Belitung Industri Sejahtera |

Indonesia | |||

|

185 |

Tin |

PT Bukit Timah |

Indonesia | |||

|

186 |

Tin |

PT Cipta Persada Mulia |

Indonesia | |||

|

187 |

Tin |

PT DS Jaya Abadi |

Indonesia | |||

|

188 |

Tin |

PT Eunindo Usaha Mandiri |

Indonesia | |||

|

189 |

Tin |

PT Inti Stania Prima |

Indonesia | |||

|

190 |

Tin |

PT Kijang Jaya Mandiri |

Indonesia | |||

18

|

191 |

Tin |

PT Mitra Stania Prima |

Indonesia | |||

|

192 |

Tin |

PT Panca Mega Persada |

Indonesia | |||

|

193 |

Tin |

PT Prima Timah Utama |

Indonesia | |||

|

194 |

Tin |

PT Refined Bangka Tin |

Indonesia | |||

|

195 |

Tin |

PT Sariwiguna Binasentosa |

Indonesia | |||

|

196 |

Tin |

PT Stanindo Inti Perkasa |

Indonesia | |||

|

197 |

Tin |

PT Sukses Inti Makmur |

Indonesia | |||

|

198 |

Tin |

PT Sumber Jaya Indah |

Indonesia | |||

|

199 |

Tin |

PT Timah (Persero) Tbk Kundur |

Indonesia | |||

|

200 |

Tin |

PT Timah (Persero) Tbk Mentok |

Indonesia | |||

|

201 |

Tin |

PT Tinindo Inter Nusa |

Indonesia | |||

|

202 |

Tin |

PT Tommy Utama |

Indonesia | |||

|

203 |

Tin |

Resind Indústria e Comércio Ltda. |

Brazil | |||

|

204 |

Tin |

Rui Da Hung |

Taiwan | |||

|

205 |

Tin |

Soft Metais Ltda. |

Brazil | |||

|

206 |

Tin |

Thaisarco |

Thailand | |||

|

207 |

Tin |

VQB Mineral and Trading Group JSC |

Vietnam | |||

|

208 |

Tin |

White Solder Metalurgia e Mineração Ltda. |

Brazil | |||

|

209 |

Tin |

Yunnan Chengfeng Non-ferrous Metals Co., Ltd. |

China | |||

|

210 |

Tin |

Yunnan Tin Co., Ltd. |

China | |||

|

211 |

Tungsten |

A.L.M.T. Tungsten Corp. |

Japan | |||

|

212 |

Tungsten |

Asia Tungsten Products Vietnam Ltd. |

Vietnam | |||

|

213 |

Tungsten |

Chenzhou Diamond Tungsten Products Co., Ltd. |

China | |||

|

214 |

Tungsten |

Chongyi Zhangyuan Tungsten Co., Ltd. |

China | |||

|

215 |

Tungsten |

FuJian JinXin Tungsten Co., Ltd. |

China | |||

|

216 |

Tungsten |

Ganzhou Huaxing Tungsten Products Co., Ltd. |

China | |||

|

217 |

Tungsten |

Ganzhou Jiangwu Ferrotungsten Co., Ltd. |

China | |||

|

218 |

Tungsten |

Ganzhou Seadragon W & Mo Co., Ltd. |

China | |||

|

219 |

Tungsten |

Global Tungsten & Powders Corp. |

United States | |||

19

|

220 |

Tungsten |

Guangdong Xianglu Tungsten Co., Ltd. |

China | |||

|

221 |

Tungsten |

H.C. Starck Smelting GmbH |

Germany | |||

|

222 |

Tungsten |

H.C. Starck Smelting GmbH & Co. KG* |

Germany | |||

|

223 |

Tungsten |

Hunan Chenzhou Mining Co., Ltd. |

China | |||

|

224 |

Tungsten |

Hunan Chuangda Vanadium Tungsten Co., Ltd. Wuji |

China | |||

|

225 |

Tungsten |

Hunan Chunchang Nonferrous Metals Co., Ltd. |

China | |||

|

226 |

Tungsten |

Hydrometallurg JSC |

Russia | |||

|

227 |

Tungsten |

Japan New Metals Co., Ltd. |

Japan | |||

|

228 |

Tungsten |

Jiangwu H.C. Starck Tungsten Products Co., Ltd. |

China | |||

|

229 |

Tungsten |

Jiangxi Gan Bei Tungsten Co., Ltd. |

China | |||

|

230 |

Tungsten |

Jiangxi Tonggu Non-ferrous Metallurgical & Chemical Co., Ltd. |

China | |||

|

231 |

Tungsten |

Jiangxi Xinsheng Tungsten Industry Co., Ltd. |

China | |||

|

232 |

Tungsten |

Jiangxi Xiushui Xianggan Nonferrous Metals Co., Ltd. |

China | |||

|

233 |

Tungsten |

Jiangxi Yaosheng Tungsten Co., Ltd. |

China | |||

|

234 |

Tungsten |

Kennametal Fallon |

United States | |||

|

235 |

Tungsten |

Kennametal Huntsville |

United States | |||

|

236 |

Tungsten |

Malipo Haiyu Tungsten Co., Ltd. |

China | |||

|

237 |

Tungsten |

Moliren Ltd. |

Russia | |||

|

238 |

Tungsten |

Niagara Refining LLC |

United States | |||

|

239 |

Tungsten |

Nui Phao H.C. Starck Tungsten Chemicals Manufacturing LLC |

Vietnam | |||

|

240 |

Tungsten |

Philippine Chuangxin Industrial Co., Inc.* |

Philippines | |||

|

241 |

Tungsten |

South-East Nonferrous Metal Co., Ltd. of Hengyang City |

China | |||

|

242 |

Tungsten |

Tejing (Vietnam) Tungsten Co., Ltd. |

Vietnam | |||

|

243 |

Tungsten |

Unecha Refractory Metals Plant |

Russia | |||

|

244 |

Tungsten |

Vietnam Youngsun Tungsten Industry Co., Ltd. |

Vietnam | |||

|

245 |

Tungsten |

Wolfram Bergbau und Hütten AG |

Austria | |||

|

246 |

Tungsten |

Woltech Korea Co., Ltd. |

Republic of Korea | |||

|

247 |

Tungsten |

Xiamen Tungsten (H.C.) Co., Ltd. |

China | |||

20

|

248 |

Tungsten |

Xiamen Tungsten Co., Ltd. |

China | |||||

|

249 |

Tungsten |

Xinfeng Huarui Tungsten & Molybdenum New Material Co., Ltd. |

China | |||||

|

250 |

Tungsten |

Xinhai Rendan Shaoguan Tungsten Co., Ltd. |

China | |||||

21

List 2: Smelters identified in Apple’s Supply Chain during 2016, but subsequently determined to be inoperative or removed prior to December 31, 2016.

| # | Subject Mineral |

Facility Name of Smelter | Country Location of Smelter | |||

|

1 |

Gold | Al Etihad Gold Refinery DMCC | United Arab Emirates | |||

|

2 |

Gold | Atasay Kuyumculuk Sanayi Ve Ticaret A.S. | Turkey | |||

|

3 |

Gold | Caridad | Mexico | |||

|

4 |

Gold | Gansu Seemine Material High-Tech Co., Ltd. | China | |||

|

5 |

Gold | Guangdong Jinding Gold Ltd. | China | |||

|

6 |

Gold | Gujarat Gold Centre | India | |||

|

7 |

Gold | Hangzhou Fuchunjiang Smelting Co., Ltd. | China | |||

|

8 |

Gold | Hunan Chenzhou Mining Group Co., Ltd. | China | |||

|

9 |

Gold | Hwasung CJ Co., Ltd. | Republic of Korea | |||

|

10 |

Gold | Kazakhmys Smelting LLC | Kazakhstan | |||

|

11 |

Gold | Korea Zinc Co., Ltd. | Republic of Korea | |||

|

12 |

Gold | L’azurde Co. For Jewelry | Saudi Arabia | |||

|

13 |

Gold | Lingbao Gold Co., Ltd. | China | |||

|

14 |

Gold | Lingbao Jinyuan Tonghui Refinery Co., Ltd. | China | |||

|

15 |

Gold | Luoyang Zijin Yinhui Metal Smelting Co., Ltd. | China | |||

|

16 |

Gold | Modeltech Sdn Bhd | Malaysia | |||

|

17 |

Gold | Morris and Watson | New Zealand | |||

|

18 |

Gold | OJSC Kolyma Refinery | Russia | |||

|

19 |

Gold | Penglai Penggang Gold Industry Co., Ltd. | China | |||

|

20 |

Gold | Remondis Argentia B.V. | Netherlands | |||

|

21 |

Gold | SAAMP | France | |||

|

22 |

Gold | Sabin Metal Corp. | United States | |||

|

23 |

Gold | SAFINA A.S. | Czech Republic | |||

22

|

24 |

Gold | Sai Refinery | India | |||

|

25 |

Gold | Samwon Metals Corp. | Republic of Korea | |||

|

26 |

Gold | Shandong Tiancheng Biological Gold Industrial Co., Ltd. | China | |||

|

27 |

Gold | Tongling Nonferrous Metals Group Holdings Co., Ltd. | China | |||

|

28 |

Gold | TOO Tau-Ken-Altyn | Kazakhstan | |||

|

29 |

Gold | Yantai Guoda Safina High-Advanced Refining Co., Ltd. | China | |||

|

30 |

Gold | Yunnan Copper Industry Co., Ltd. | China | |||

|

31 |

Tantalum | Hi-Temp Specialty Metals Inc. | United States | |||

|

32 |

Tin | An Thai Minerals Co., Ltd. | Vietnam | |||

|

33 |

Tin | CNMC (Guangxi) PGMA Co., Ltd. | China | |||

|

34 |

Tin | Estanho de Rondônia S.A. | Brazil | |||

|

35 |

Tin | Gejiu Fengming Metallurgy Chemical Plant** | China | |||

|

36 |

Tin | Gejiu Jinye Mineral Co., Ltd.** | China | |||

|

37 |

Tin | Gejiu Zi-Li | China | |||

|

38 |

Tin | Huichang Jinshunda Tin Co., Ltd. | China | |||

|

39 |

Tin | Modeltech Sdn Bhd | Malaysia | |||

|

40 |

Tin | Nankang Nanshan Tin Manufactory Co., Ltd. | China | |||

|

41 |

Tin | Nghe Tinh Non-Ferrous Metals Joint Stock Co. | Vietnam | |||

|

42 |

Tin | Phoenix Metal Ltd.** | Rwanda | |||

|

43 |

Tin | PT Bangka Timah Utama Sejahtera | Indonesia | |||

|

44 |

Tin | PT BilliTin Makmur Lestari | Indonesia | |||

|

45 |

Tin | PT Justindo | Indonesia | |||

|

46 |

Tin | PT Karimun Mining | Indonesia | |||

|

47 |

Tin | PT O.M. Indonesia** | Indonesia | |||

|

48 |

Tin | PT Seirama Tin Investment | Indonesia | |||

|

49 |

Tin | PT Timah Nusantara | Indonesia | |||

|

50 |

Tin | PT Tirus Putra Mandiri | Indonesia | |||

|

51 |

Tin | PT Wahana Parkit Jaya | Indonesia | |||

23

|

52 |

Tin | Tuyen Quang Non-Ferrous Metals Joint Stock Co. | Vietnam | |||

|

53 |

Tungsten | ACL Metais Eireli | Brazil | |||

|

54 |

Tungsten | Dayu Jincheng Tungsten Industry Co., Ltd. | China | |||

|

55 |

Tungsten | Dayu Weiliang Tungsten Co., Ltd. | China | |||

|

56 |

Tungsten | Ganzhou Non-ferrous Metals Smelting Co., Ltd. | China | |||

|

57 |

Tungsten | Ganzhou Yatai Tungsten Co., Ltd. | China | |||

|

58 |

Tungsten | Jiangxi Dayu Longxintai Tungsten Co., Ltd. | China | |||

|

59 |

Tungsten | Jiangxi Minmetals Gao’ an Non-ferrous Metals Co., Ltd. | China | |||

|

60 |

Tungsten | Pobedit JSC | Russia | |||

|

61 |

Tungsten | Sanher Tungsten Vietnam Co., Ltd. | Vietnam | |||

Note: Smelter facility names originate from information provided by the LBMA and/or the CFSP. Some smelters that are no longer reported in Apple’s supply chain may currently be participating in a Third Party Audit. Smelters that completed a Third Party Audit will be approved for Apple’s supply chain; otherwise, such smelters will be removed from Apple’s supply chain.

* The smelter is believed to process Subject Minerals solely from recycled or scrap sources. It is listed alongside smelters in this Annex to highlight its efforts to complete a Third Party Audit. Other smelters determined to be processing Subject Minerals solely from recycled or scrap sources reported to be in Apple’s supply chain, which have not undergone a Third Party Audit or which are not seeking to participate in a Third Party Audit, are not listed.

** The smelter has changed its compliance or operational status since December 31, 2016, which change in status may result in approval for Apple’s supply chain (in the case of completion of a Third Party Audit) or in a determination to remove such smelter from Apple’s supply chain (in the case of the inability or unwillingness to participate or complete a Third Party Audit).

24

ANNEX III

25