SECURITIES AND EXCHANGE COMMISSION

THE SECURITIES EXCHANGE ACT OF 1934

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 0-5108

Massachusetts (State or other jurisdiction of incorporation) One Lincoln Street Boston, Massachusetts (Address of principal executive office) |

04-2456637 (I.R.S. Employer Identification No.) 02111 (Zip Code) |

||

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| (Title of Each Class) |

(Name of each exchange on which registered) |

|||||

|---|---|---|---|---|---|---|

Common Stock, $1

par value Preferred share purchase rights |

Boston Stock

Exchange New York Stock Exchange Archipelago Stock Exchange |

|||||

None

| Large accelerated filer |X| | Accelerated Filer |_| | Non- Accelerated filer |_| | |||

(1) |

The registrant’s definitive Proxy Statement for the 2006 Annual Meeting to be filed pursuant to Regulation 14A on or before April 30, 2006 (Part III). |

Table of Contents

| Description |

Page Number |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

PART

I |

||||||||||

Item

1 |

Business |

1 | ||||||||

Item

1A |

Risk Factors |

5 | ||||||||

Item

1B |

Unresolved Staff Comments |

10 | ||||||||

Item

2 |

Properties |

10 | ||||||||

Item

3 |

Legal Proceedings |

10 | ||||||||

Item

4 |

Submission of Matters to a Vote of Security Holders |

10 | ||||||||

Item

4A |

Executive Officers of the Registrant |

11 | ||||||||

PART

II |

||||||||||

Item

5 |

Market for Registrant’s Common Equity and Related Stockholder Matters |

12 | ||||||||

Item

6 |

Selected Financial Data |

14 | ||||||||

Item

7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

15 |

||||||||

Item

7A |

Quantitative and Qualitative Disclosures About Market Risk |

58 | ||||||||

Item

8 |

Financial Statements and Supplementary Data |

59 | ||||||||

Item

9 |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

107 |

||||||||

Item

9A |

Controls and Procedures |

107 | ||||||||

Item

9B |

Other Information |

110 | ||||||||

PART

III |

||||||||||

Item

10 |

Directors and Executive Officers of the Registrant |

110 | ||||||||

Item

11 |

Executive Compensation |

110 | ||||||||

Item

12 |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

110 |

||||||||

Item

13 |

Certain Relationships and Related Transactions |

111 | ||||||||

Item

14 |

Principal Accountant Fees and Services |

111 | ||||||||

PART

IV |

||||||||||

Item

15 |

Exhibits and Financial Statement Schedules |

112 | ||||||||

Signatures |

118 | |||||||||

Exhibits |

||||||||||

and trusteeship of collective trust funds and separate accounts offered to employee benefit plans subject to ERISA is subject to regulation by the U.S. Department of Labor.

investments in mutual funds, other collective investment funds, and defined contribution plans, our revenue may be adversely affected.

transactions, which could have an adverse impact on our results of operations. Additionally, the Financial Accounting Standards Board has been considering making changes to the accounting guidance related to uncertain tax positions and leveraged leases. While such changes may not have an economic impact on our business, these changes could affect the attainment of our current financial goals.

special purpose entities we administer could experience deterioration in asset performance. This could result in higher levels of credit-related losses, which could adversely affect our earnings.

| Name | Age | Position | Year Elected (1) | |||

|---|---|---|---|---|---|---|

Ronald

E. Logue |

60 |

Chairman and Chief Executive Officer |

2004 | |||

Joseph

C. Antonellis |

51 | Executive Vice President and Chief Information Officer |

1999/2002 | |||

Jeffrey

N. Carp |

49 | Executive Vice President and Chief Legal Officer |

2006 | |||

Joseph

W. Chow |

53 | Executive Vice President |

1996 | |||

Charles

C. Cutrell, III |

51 | Executive Vice President, General Counsel and Secretary |

2004 | |||

Pamela

D. Gormley |

57 | Executive Vice President and Corporate Controller |

2004 | |||

Joseph

L. Hooley |

48 | Executive Vice President |

2000 | |||

William

W. Hunt |

43 | Executive Vice President; President and Chief Executive Officer, State

Street Global Advisors |

2001/2005 | |||

Edward

J. O’Brien |

51 | Executive Vice President and Treasurer |

2001/2005 | |||

David

C. O’Leary |

59 | Executive Vice President |

2005 | |||

James

S. Phalen |

55 | Executive Vice President |

1992 | |||

Edward

J. Resch |

53 | Executive Vice President and Chief Financial Officer |

2002 | |||

Stanley

W. Shelton |

51 | Executive Vice President |

1995 |

(1) |

For officers where two years are listed, the first year indicates the year they were elected as executive vice president, and the second year indicates the year they received the additional title as it appears in the table. |

ITEM 5. |

MARKET FOR REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS |

| Number

of Shares Purchased |

Average

Price Per Share |

Number

of Shares Purchased Under Publicly Announced Program |

Maximum Number of Shares Yet to Be Purchased Under Publicly Announced Program |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| (Shares

in thousands) |

|||||||||||

October

1 – October 31, 2005 |

938 | $54.29 | 927 | 8,797 | |||||||

November

1 – November 30, 2005 |

2,089 | 57.03 | 2,089 | 6,708 | |||||||

December 1 – December 31, 2005 |

1,905 | 58.52 | 1,905 | 4,803 | |||||||

Total |

4,932 | 4,921 | |||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars in millions, except per share data or where otherwise indicated) | |||||||||||||||||||||

| FOR

THE YEAR ENDED DECEMBER 31: |

|||||||||||||||||||||

| Total

fee revenue |

$ | 4,551 | $ | 4,048 | $ | 3,556 | $ | 2,850 | $ | 2,769 | |||||||||||

| Net

interest revenue |

907 | 859 | 810 | 979 | 1,025 | ||||||||||||||||

| Provision

for loan losses |

– | (18 | ) | – | 4 | 10 | |||||||||||||||

| (Losses)

gains on sales of available-for-sale investment securities, net |

(1 | ) | 26 | 23 | 76 | 43 | |||||||||||||||

| Gain

on sale of Private Asset Management business, net of exit and other associated

costs |

16 | – | 285 | – | – | ||||||||||||||||

| Gain

on sale of Corporate Trust business, net of exit and other associated costs |

– | – | 60 | 495 | – | ||||||||||||||||

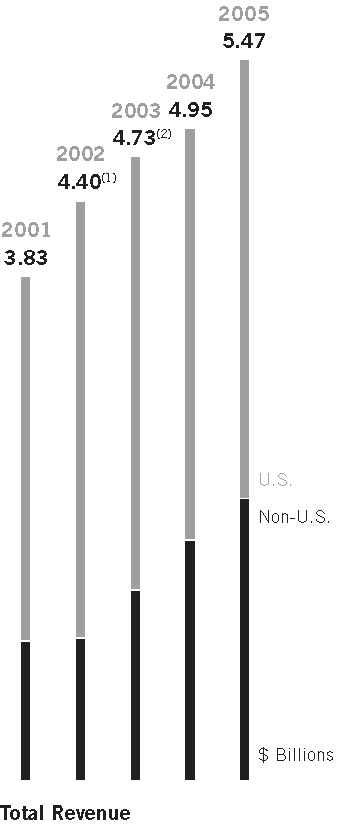

| Total

revenue |

5,473 | 4,951 | 4,734 | 4,396 | 3,827 | ||||||||||||||||

| Total

operating expenses |

4,041 | 3,759 | 3,622 | 2,841 | 2,897 | ||||||||||||||||

| Income

from continuing operations before income tax expense |

1,432 | 1,192 | 1,112 | 1,555 | 930 | ||||||||||||||||

| Income

tax expense from continuing operations |

487 | 394 | 390 | 540 | 302 | ||||||||||||||||

| Income

from continuing operations |

945 | 798 | 722 | 1,015 | 628 | ||||||||||||||||

| Net

loss from discontinued operations |

(107 | ) | – | – | – | – | |||||||||||||||

| Net

income |

$ | 838 | $ | 798 | $ | 722 | $ | 1,015 | $ | 628 | |||||||||||

| PER

COMMON SHARE: |

|||||||||||||||||||||

| Basic

earnings: |

|||||||||||||||||||||

| Continuing

operations |

$ | 2.86 | $ | 2.38 | $ | 2.18 | $ | 3.14 | $ | 1.94 | |||||||||||

| Net

income |

2.53 | 2.38 | 2.18 | 3.14 | 1.94 | ||||||||||||||||

| Diluted

earnings: |

|||||||||||||||||||||

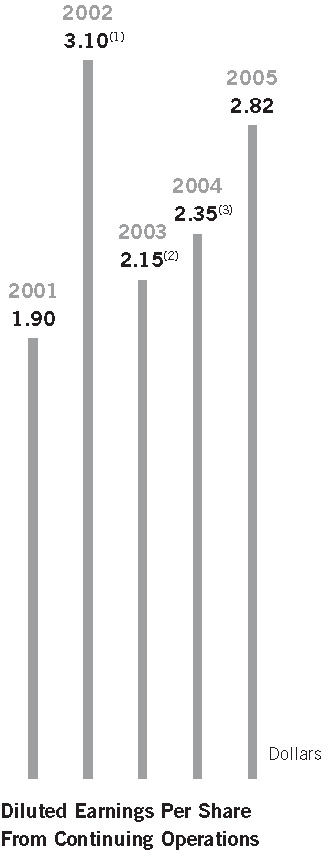

| Continuing

operations |

2.82 | 2.35 | 2.15 | 3.10 | 1.90 | ||||||||||||||||

| Net

income |

2.50 | 2.35 | 2.15 | 3.10 | 1.90 | ||||||||||||||||

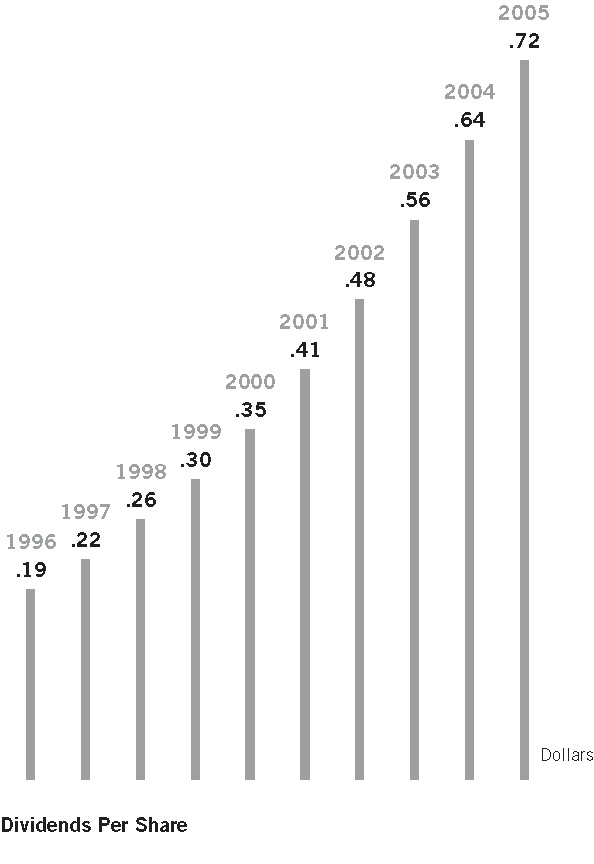

| Cash

dividends declared |

.72 | .64 | .56 | .48 | .41 | ||||||||||||||||

| Closing

price of common stock |

55.44 | 49.12 | 52.08 | 39.00 | 52.25 | ||||||||||||||||

| AT

YEAR-END: |

|||||||||||||||||||||

| Investment

securities |

$ | 59,870 | $ | 37,571 | $ | 38,215 | $ | 28,071 | $ | 20,781 | |||||||||||

| Total

assets |

97,968 | 94,040 | 87,534 | 85,794 | 69,850 | ||||||||||||||||

| Deposits |

59,646 | 55,129 | 47,516 | 45,468 | 38,559 | ||||||||||||||||

| Long-term

debt |

2,659 | 2,458 | 2,222 | 1,270 | 1,217 | ||||||||||||||||

| Shareholders’ equity |

6,367 | 6,159 | 5,747 | 4,787 | 3,845 | ||||||||||||||||

| Assets

under custody (in billions) |

$ | 10,121 | $ | 9,497 | $ | 9,370 | $ | 6,171 | $ | 6,203 | |||||||||||

| Assets

under management (in billions) |

1,441 | 1,354 | 1,106 | 763 | 775 | ||||||||||||||||

| Number

of employees |

20,965 | 19,668 | 19,850 | 19,501 | 19,753 | ||||||||||||||||

| RATIOS: |

|||||||||||||||||||||

| Continuing

operations: |

|||||||||||||||||||||

| Return

on shareholders’ equity |

15.3 | % | 13.3 | % | 13.9 | % | 24.1 | % | 17.3 | % | |||||||||||

| Return

on average assets |

.95 | .84 | .87 | 1.28 | .88 | ||||||||||||||||

| Dividend

payout |

25.3 | 26.9 | 25.9 | 15.4 | 21.0 | ||||||||||||||||

| Net

income: |

|||||||||||||||||||||

| Return

on shareholders’ equity |

13.6 | 13.3 | 13.9 | 24.1 | 17.3 | ||||||||||||||||

| Return

on average assets |

.84 | .84 | .87 | 1.28 | .88 | ||||||||||||||||

| Dividend

payout |

28.5 | 26.9 | 25.9 | 15.4 | 21.0 | ||||||||||||||||

| Average

shareholders’ equity to average assets |

6.2 | 6.3 | 6.3 | 5.3 | 5.1 | ||||||||||||||||

| Tier

1 risk-based capital |

11.7 | 13.3 | 14.0 | 17.1 | 13.6 | ||||||||||||||||

| Total

risk-based capital |

14.0 | 14.7 | 15.8 | 18.0 | 14.5 | ||||||||||||||||

| Tier

1 leverage ratio |

5.6 | 5.5 | 5.6 | 5.6 | 5.4 | ||||||||||||||||

| Tangible

common equity to adjusted total assets |

4.8 | 4.5 | 4.5 | 4.9 | 4.7 | ||||||||||||||||

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

||

| (1) | 2002

earnings per share included the gain on the sale of the divested Corporate

Trust business of $.90 per share. |

|

| (2) | 2003

earnings per share included the combined gains on sales of the divested

Corporate Trust and Private Asset Management businesses of $.68 per share,

and combined charges for divestiture costs, GSS acquisition merger and

integration costs, restructuring expenses, settlement of a state tax matter

and a loss on real estate sold equal to $.86 per share. |

|

| (3) | 2004

earnings per share included GSS merger and integration costs of $.12 per

share. |

|

|

||

(1) |

2002 total

revenue included the gain on the sale of the divested Corporate Trust

business of $495 million. |

|

(2) |

2003

total revenue included the combined gains on sales of the divested Corporate

Trust and Private Asset Management businesses of $345 million and a

loss on real estate sold of $13 million. |

|

|

|

|

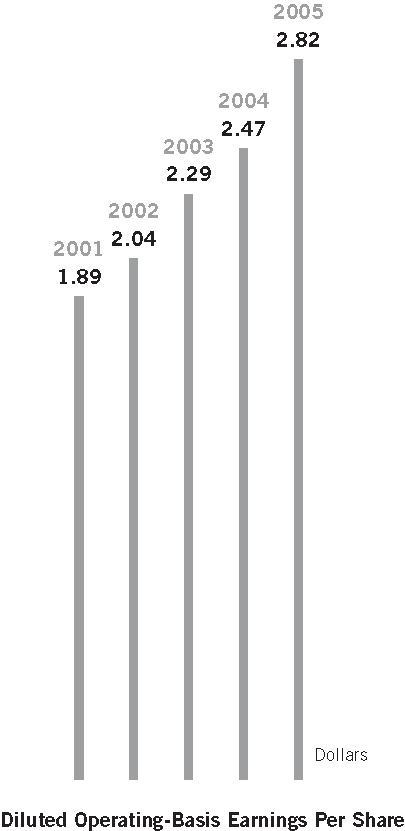

Significant

reconciling items between GAAP and operating-basis diluted earnings per

share are described in the footnotes to the chart on page 16. |

|

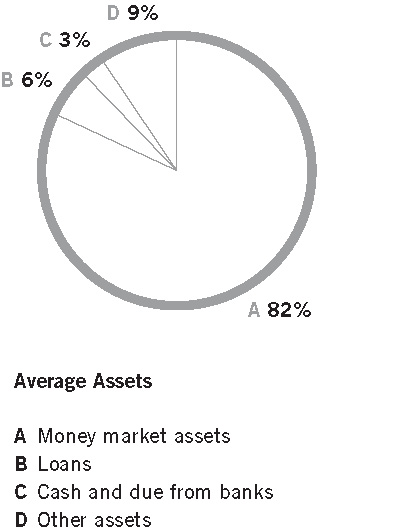

and commercial paper, to meet customers’ needs for high-grade liquid investments, and invest these sources of funds and additional borrowings in assets yielding a higher rate, generating net interest revenue.

| INDEX | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Daily

Averages of Indices |

Average

of Month-End Indices |

Year-End

Indices |

|||||||||||||||||||

| 2005 |

2004 |

Change |

2005 |

2004 |

Change |

2005 |

2004 |

Change |

|||||||||||||

| S&P

500® |

1207.2 | 1130.6 | 7 | % | 1207.8 | 1134.0 | 7 | % | 1248.3 | 1211.9 | 3 | % | |||||||||

| NASDAQ® |

2099.3 | 1986.5 | 6 | 2100.6 | 1992.9 | 5 | 2205.3 | 2175.4 | 1 | ||||||||||||

MSCI®

EAFE |

1536.2 | 1337.5 | 15 | 1540.0 | 1344.2 | 15 | 1680.1 | 1515.5 | 11 | ||||||||||||

| FEE REVENUE | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 |

Change 2004–2005 | |||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||

| Years

ended December 31, |

||||||||||||||||||

| Servicing

fees |

$ | 2,474 | $ | 2,263 | $ | 1,950 | 9 | % | ||||||||||

| Management

fees |

751 | 623 | 533 | 21 | ||||||||||||||

| Trading

services |

694 | 595 | 529 | 17 | ||||||||||||||

| Securities

finance |

330 | 259 | 245 | 27 | ||||||||||||||

| Processing

fees and other |

302 | 308 | 299 | (2 | ) | |||||||||||||

| Total

fee revenue |

$ | 4,551 | $ | 4,048 | $ | 3,556 | 12 | |||||||||||

| ASSETS UNDER CUSTODY | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 | 2002 |

2001 | 2004–2005 AGR |

2000–2005 CAGR |

||||||||||||||||||||||||

| (Dollars

in billions) | ||||||||||||||||||||||||||||||

| As

of December 31, |

||||||||||||||||||||||||||||||

| Customers

in the U.S.: |

||||||||||||||||||||||||||||||

| Mutual

funds |

$ | 3,891 | $ | 3,385 | $ | 3,105 | $ | 2,719 | $ | 2,794 | 15 | % | 8 | % | ||||||||||||||||

| Pensions,

insurance and other investment pools |

4,136 | 4,093 | 3,198 | 2,734 | 2,737 | 1 | 8 | |||||||||||||||||||||||

| Customers

outside the U.S. |

2,094 | 2,019 | 988 | 718 | 672 | 4 | 26 | |||||||||||||||||||||||

| Acquired

with GSS(1) |

– | – | 2,079 | – | – | |||||||||||||||||||||||||

| Total |

$ | 10,121 | $ | 9,497 | $ | 9,370 | $ | 6,171 | $ | 6,203 | 7 | 11 | ||||||||||||||||||

| Non-U.S.

securities as a percentage of total |

23 | % | 22 | % | 12 | % | 14 | % | 13 | % | ||||||||||||||||||||

(1) |

Assets relating to GSS customers, the majority of which had not yet converted to our systems, at December 31, 2003. For 2005 and 2004, assets related to GSS customers were included in the other categories of assets. |

| MIX OF ASSETS UNDER CUSTODY | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 | |||||||||

| (Dollars

in billions) |

|||||||||||

| As

of December 31, |

|||||||||||

| Financial

Instrument Mix: |

|||||||||||

| Equities |

$ | 4,814 | $ | 4,688 | $ | 3,479 | |||||

| Fixed

income |

3,797 | 3,286 | 2,636 | ||||||||

| Short-term

and other investments |

1,510 | 1,523 | 1,176 | ||||||||

| Acquired

with GSS(1) |

– | – | 2,079 | ||||||||

| Total |

$ | 10,121 | $ | 9,497 | $ | 9,370 | |||||

(1) |

Assets relating to GSS customers, the majority of which had not yet converted to our systems, at December 31, 2003. For 2005 and 2004, assets related to GSS customers were included in the other categories of assets. |

| GEOGRAPHIC MIX OF ASSETS UNDER CUSTODY | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 | |||||||||

| (Dollars

in billions) |

|||||||||||

| As

of December 31, |

|||||||||||

| United

States |

$ | 7,951 | $ | 7,410 | $ | 7,506 | |||||

| Other

Americas |

330 | 324 | 255 | ||||||||

| Europe/Middle

East/Africa |

1,454 | 1,403 | 1,251 | ||||||||

| Asia/Pacific |

386 | 360 | 358 | ||||||||

| Total |

$ | 10,121 | $ | 9,497 | $ | 9,370 | |||||

methods for both U.S. and global equities and fixed income securities. SSgA also renewed its focus on exchange traded funds, or ETFs, launching new offerings such as the SPDR® Dividend ETFs, and saw growth in some of its innovative approaches such as the streetTRACKS® Gold Shares.

| ASSETS UNDER MANAGEMENT | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 |

2002 |

2001 |

2004–2005 AGR |

2000–2005 CAGR |

||||||||||||||||||||||||

| (Dollars

in billions) |

||||||||||||||||||||||||||||||

| As

of December 31, |

||||||||||||||||||||||||||||||

| Equities: |

||||||||||||||||||||||||||||||

| Passive |

$ | 602 | $ | 596 | $ | 522 | $ | 361 | $ | 398 | 1 | % | 11 | % | ||||||||||||||||

| Active |

172 | 131 | 78 | 44 | 39 | 31 | 31 | |||||||||||||||||||||||

| Employer

securities |

76 | 77 | 76 | 56 | 76 | (1 | ) | – | ||||||||||||||||||||||

| Fixed

income |

155 | 139 | 98 | 74 | 54 | 12 | 29 | |||||||||||||||||||||||

| Money

market |

436 | 411 | 332 | 228 | 208 | 6 | 19 | |||||||||||||||||||||||

| Total |

$ | 1,441 | $ | 1,354 | $ | 1,106 | $ | 763 | $ | 775 | 6 | 15 | ||||||||||||||||||

GEOGRAPHIC MIX OF ASSETS UNDER MANAGEMENT |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in billions) |

2005 |

2004 |

2003 |

|||||||||||

| As

of December 31, |

||||||||||||||

| United

States |

$ | 1,023 | $ | 1,009 | $ | 891 | ||||||||

| Other

Americas |

24 | 23 | 15 | |||||||||||

| Europe/Middle

East/ Africa |

275 | 221 | 128 | |||||||||||

| Asia/Pacific |

119 | 101 | 72 | |||||||||||

| Total |

$ | 1,441 | $ | 1,354 | $ | 1,106 | ||||||||

ASSETS UNDER MANAGEMENT |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in billions) |

2005 |

2004 |

2003 |

|||||||||||

|

Years

Ended December 31, |

||||||||||||||

|

Balance

at beginning of year |

$ | 1,354 | $ | 1,106 | $ | 763 | ||||||||

|

Net

new business |

36 | 145 | 179 | |||||||||||

|

Market

appreciation |

51 | 103 | 164 | |||||||||||

|

Balance

at end of year |

$ | 1,441 | $ | 1,354 | $ | 1,106 | ||||||||

| NET INTEREST REVENUE | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 |

Change 2004–2005 |

|||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||

|

Years

ended December 31, |

||||||||||||||||||

|

Interest

revenue |

$ | 2,930 | $ | 1,787 | $ | 1,539 | 64 | % | ||||||||||

|

Interest

expense |

2,023 | 928 | 729 | 118 | ||||||||||||||

|

Net

interest revenue |

907 | 859 | 810 | 6 | ||||||||||||||

|

Provision

for loan losses |

– | (18 | ) | – | ||||||||||||||

|

Net

interest revenue after provision for loan losses |

$ | 907 | $ | 877 | $ | 810 | ||||||||||||

|

Net

interest revenue (taxable-equivalent basis) |

$ | 949 | $ | 904 | $ | 861 | 5 | % | ||||||||||

|

Excess

of rates earned over rates paid (taxable-equivalent basis) |

.82 | % | .95 | % | 1.04 | % | ||||||||||||

|

Net

interest margin (taxable-equivalent basis) |

1.08 | 1.08 | 1.17 | |||||||||||||||

| OPERATING EXPENSES | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 |

Change 2004–2005 |

|||||||||||||

| (Dollars in millions) | ||||||||||||||||

|

Years

Ended December 31, |

||||||||||||||||

|

Salaries

and employee benefits |

$ | 2,231 | $ | 1,957 | $ | 1,731 | 14 | % | ||||||||

|

Information

systems and communications |

486 | 527 | 551 | (8 | ) | |||||||||||

|

Transaction

processing services |

449 | 398 | 314 | 13 | ||||||||||||

|

Occupancy |

391 | 363 | 300 | 8 | ||||||||||||

|

Merger,

integration and divestiture |

– | 62 | 110 | (100 | ) | |||||||||||

|

Restructuring |

– | 21 | 296 | (100 | ) | |||||||||||

|

Other |

484 | 431 | 320 | 12 | ||||||||||||

|

Total

operating expenses |

$ | 4,041 | $ | 3,759 | $ | 3,622 | 8 | |||||||||

|

Number

of employees at year-end |

20,965 | 19,668 | 19,850 | |||||||||||||

Investment Servicing |

Investment

Management |

Business

Divestiture |

Other/One-Time |

Total |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

2003 |

2005 |

2004 |

2003 |

2005 |

2004 |

2003 |

2005 |

2004 |

2003 |

2005 |

2004 |

2003 |

||||||||||||||||||||||||||||||||||||||||||||||

| (Dollars

in millions, unless otherwise noted) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Years ended December 31, | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fee

revenue: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Servicing

fees |

$ | 2,474 | $ | 2,263 | $ | 1,950 | $ | 2,474 | $ | 2,263 | $ | 1,950 | ||||||||||||||||||||||||||||||||||||||||||||||||

Management

fees |

– | – | – | $ | 751 | $ | 623 | $ | 474 | $ | 59 | 751 | 623 | 533 | ||||||||||||||||||||||||||||||||||||||||||||||

Trading

services |

694 | 595 | 529 | – | – | – | – | 694 | 595 | 529 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Securities

finance |

260 | 211 | 206 | 70 | 48 | 39 | – | 330 | 259 | 245 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Processing

fees and other |

221 | 239 | 277 | 81 | 69 | 34 | 1 | $ | (13 | ) | 302 | 308 | 299 | |||||||||||||||||||||||||||||||||||||||||||||||

Total

fee revenue |

3,649 | 3,308 | 2,962 | 902 | 740 | 547 | 60 | (13 | ) | 4,551 | 4,048 | 3,556 | ||||||||||||||||||||||||||||||||||||||||||||||||

Net

interest revenue |

826 | 816 | 773 | 81 | 43 | 37 | – | – | 907 | 859 | 810 | |||||||||||||||||||||||||||||||||||||||||||||||||

Provision

for loan losses |

– | (18 | ) | – | – | – | – | – | – | – | (18 | ) | – | |||||||||||||||||||||||||||||||||||||||||||||||

Net

interest revenue after provision for loan losses |

826 | 834 | 773 | 81 | 43 | 37 | – | – | 907 | 877 | 810 | |||||||||||||||||||||||||||||||||||||||||||||||||

(Losses)

gains on sales of available-for-sale investment securities, net |

(1 | ) | 26 | 23 | – | – | – | – | – | (1 | ) | 26 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||

Gains

on sales of divested businesses, net |

– | – | – | – | – | – | – | $ | 16 | 345 | 16 | – | 345 | |||||||||||||||||||||||||||||||||||||||||||||||

Total

revenue |

4,474 | 4,168 | 3,758 | 983 | 783 | 584 | 60 | 16 | 332 | 5,473 | 4,951 | 4,734 | ||||||||||||||||||||||||||||||||||||||||||||||||

Operating

expenses |

3,363 | 3,115 | 2,706 | 678 | 582 | 473 | 37 | – | $ | 62 | 406 | 4,041 | 3,759 | 3,622 | ||||||||||||||||||||||||||||||||||||||||||||||

Income

from continuing operations before income taxes |

$ | 1,111 | $ | 1,053 | $ | 1,052 | $ | 305 | $ | 201 | $ | 111 | $ | 23 | $ | 16 | $ | (62 | ) | $ | (74 | ) | $ | 1,432 | $ | 1,192 | $ | 1,112 | ||||||||||||||||||||||||||||||||

Pre-tax

margin |

25 | % | 25 | % | 28 | % | 31 | % | 26 | % | 19 | % | ||||||||||||||||||||||||||||||||||||||||||||||||

Average

assets (in billions) |

$ | 96.9 | $ | 92.5 | $ | 80.6 | $ | 2.9 | $ | 2.6 | $ | 2.0 | $ | .1 | $ | 99.8 | $ | 95.1 | $ | 82.7 | ||||||||||||||||||||||||||||||||||||||||

OVERVIEW OF RESULTS OF OPERATIONS |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2004 |

2003 |

$

Change |

%

Change |

||||||||||||||||

| (Dollars

in millions, except per share data) |

|||||||||||||||||||

| Years

ended December 31, |

|||||||||||||||||||

| Total

fee revenue |

$ | 4,048 | $ | 3,556 | $ | 492 | 14 | % | |||||||||||

| Net

interest revenue |

859 | 810 | 49 | 6 | |||||||||||||||

| Provision

for loan losses |

(18 | ) | – | (18 | ) | – | |||||||||||||

| Gains

on sales of available-for-sale investment securities, net |

26 | 23 | 3 | 13 | |||||||||||||||

| Gains

on sales of divested businesses |

– | 345 | (345 | ) | (100 | ) | |||||||||||||

| Total

revenue |

4,951 | 4,734 | 217 | 5 | |||||||||||||||

| Total

operating expenses |

3,759 | 3,622 | 137 | 4 | |||||||||||||||

| Income

before income tax expense |

1,192 | 1,112 | 80 | 7 | |||||||||||||||

| Income

tax expense |

394 | 390 | 4 | ||||||||||||||||

| Net

income |

$ | 798 | $ | 722 | $ | 76 | 11 | ||||||||||||

| Earnings

Per Share: |

|||||||||||||||||||

| Basic |

$ | 2.38 | $ | 2.18 | $ | .20 | 9 | ||||||||||||

| Diluted |

2.35 | 2.15 | .20 | 9 | |||||||||||||||

| Return

on shareholders’ equity |

13.3 | % | 13.9 | % | |||||||||||||||

| TOTAL REVENUE |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2004 |

2003 |

$

Change |

%

Change |

|||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||

| Years

ended December 31, |

||||||||||||||||||

| Fee

Revenue: |

||||||||||||||||||

| Servicing

fees |

$ | 2,263 | $ | 1,950 | $ | 313 | 16 | % | ||||||||||

| Management

fees |

623 | 533 | 90 | 17 | ||||||||||||||

| Trading

services |

595 | 529 | 66 | 12 | ||||||||||||||

| Securities

finance |

259 | 245 | 14 | 6 | ||||||||||||||

| Processing

fees and other |

308 | 299 | 9 | 3 | ||||||||||||||

| Total

fee revenue |

4,048 | 3,556 | 492 | 14 | ||||||||||||||

| Net

Interest Revenue: |

||||||||||||||||||

| Interest

revenue |

1,787 | 1,539 | 248 | 16 | ||||||||||||||

| Interest

expense |

928 | 729 | 199 | 27 | ||||||||||||||

| Net

interest revenue |

859 | 810 | 49 | 6 | ||||||||||||||

| Provision

for loan losses |

(18 | ) | – | (18 | ) | |||||||||||||

| Net

interest revenue after provision for loan losses |

877 | 810 | 67 | 8 | ||||||||||||||

| Gains

on sales of available-for-sale investment securities, net |

26 | 23 | 3 | 13 | ||||||||||||||

| Gain

on sale of Private Asset Management business, net of exit and other associated costs |

– | 285 | (285 | ) | (100 | ) | ||||||||||||

| Gain

on sale of Corporate Trust business |

– | 60 | (60 | ) | (100 | ) | ||||||||||||

| Total

revenue |

$ | 4,951 | $ | 4,734 | $ | 217 | 5 | |||||||||||

| OPERATING EXPENSES |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2004 |

2003 |

$

Change |

%

Change |

|||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||

| Years

ended December 31, |

||||||||||||||||||

| Operating

Expenses: |

||||||||||||||||||

| Salaries

and employee benefits |

$ | 1,957 | $ | 1,731 | $ | 226 | 13 | % | ||||||||||

| Information

systems and communications |

527 | 551 | (24 | ) | (4 | ) | ||||||||||||

| Transaction

processing services |

398 | 314 | 84 | 27 | ||||||||||||||

| Occupancy |

363 | 300 | 63 | 21 | ||||||||||||||

| Merger,

integration and divestiture costs |

62 | 110 | (48 | ) | (44 | ) | ||||||||||||

| Restructuring

costs |

21 | 296 | (275 | ) | (93 | ) | ||||||||||||

| Other |

431 | 320 | 111 | 35 | ||||||||||||||

| Total

operating expenses |

$ | 3,759 | $ | 3,622 | $ | 137 | 4 | |||||||||||

income. Unearned income is recognized in interest revenue to yield a level rate of return on the net investment in the leases.

adjudicated by the court systems of the various tax jurisdictions or may be settled with the taxing authority upon examination or administrative appeal.

|

|

|

| 2005 | 2004 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

AAA(1) |

|

90 |

% |

|

93 |

% |

||||

AA |

5 |

2 |

||||||||

A |

3 |

3 |

||||||||

BBB |

1 |

1 |

||||||||

Non-rated |

1 |

1 |

||||||||

| |

100 |

% |

100 |

% |

||||||

(1) |

Includes U.S. Treasury securities |

| (Dollars in millions) |

2005 |

2004 |

2003 |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Available

for Sale: |

||||||||||||||

| U.S.

Treasury and federal agencies: |

||||||||||||||

| Direct

obligations |

$ | 10,214 | $ | 12,119 | $ | 18,986 | ||||||||

| Mortgage-backed securities |

11,138 | 9,147 | 3,762 | |||||||||||

| Asset-backed

securities |

23,842 | 10,056 | 9,885 | |||||||||||

| State

and political subdivisions |

1,868 | 1,785 | 1,999 | |||||||||||

| Collateralized

mortgage obligations |

5,527 | 1,719 | 1,333 | |||||||||||

| Other

debt investments |

1,695 | 922 | 310 | |||||||||||

| Money-market

mutual funds |

232 | 97 | 85 | |||||||||||

| Other

equity securities |

463 | 326 | 238 | |||||||||||

| Total |

$ | 54,979 | $ | 36,171 | $ | 36,598 | ||||||||

| Held

to Maturity: |

||||||||||||||

| U.S.

Treasury and federal agencies |

||||||||||||||

| Direct

obligations |

$ | 1,657 | $ | 1,294 | $ | 1,345 | ||||||||

| Mortgage-backed securities |

925 | – | – | |||||||||||

| Collateralized

mortgage obligations |

2,086 | – | – | |||||||||||

| Other

investments |

223 | 106 | 272 | |||||||||||

| Total |

$ | 4,891 | $ | 1,400 | $ | 1,617 | ||||||||

accounting standards do not allow for the change in economic value of our customer liabilities to offset unrealized losses on available-for-sale securities.

| Under

1 Year |

1

to 5 Years |

6

to 10 Years |

Over

10 Years |

|||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Amount |

Yield |

Amount |

Yield |

Amount |

Yield |

Amount |

Yield |

|||||||||||||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||||||||||||||||

| Available

for Sale: |

||||||||||||||||||||||||||||||||

| U.S.

Treasury and federal agencies |

||||||||||||||||||||||||||||||||

Direct

obligations |

$ | 2,614 | 2.32 | % | $ | 7,103 | 3.75 | % | $ | 497 | 4.22 | % | ||||||||||||||||||||

Mortgage-backed securities |

40 | 3.49 | 1,107 | 3.76 | 5,154 | 4.34 | $ | 4,837 | 4.75 | % | ||||||||||||||||||||||

Asset-backed

securities |

1,818 | 3.92 | 9,373 | 4.36 | 9,309 | 4.59 | 3,342 | 4.40 | ||||||||||||||||||||||||

State

and political subdivisions(1) |

321 | 3.56 | 783 | 4.93 | 627 | 4.60 | 137 | 4.34 | ||||||||||||||||||||||||

Collateralized

mortgage obligations |

97 | 3.60 | 1,948 | 4.32 | 2,404 | 4.89 | 1,078 | 4.99 | ||||||||||||||||||||||||

Other

investments |

685 | 3.24 | 613 | 4.64 | 389 | 4.99 | 8 | 5.86 | ||||||||||||||||||||||||

Total |

$ | 5,575 | $ | 20,927 | $ | 18,380 | $ | 9,402 | ||||||||||||||||||||||||

Held

to Maturity: |

||||||||||||||||||||||||||||||||

U.S.

Treasury and federal agencies |

||||||||||||||||||||||||||||||||

Direct

obligations |

$ | 856 | 2.30 | % | $ | 801 | 4.12 | % | ||||||||||||||||||||||||

Mortgage-backed securities |

— | — | — | — | $ | 226 | 4.70 | % | $ | 699 | 5.04 | % | ||||||||||||||||||||

Collateralized

mortgage obligations |

— | — | 354 | 4.61 | 1,007 | 4.99 | 725 | 4.97 | ||||||||||||||||||||||||

Other

investments |

73 | 2.29 | 65 | 2.69 | 81 | 3.42 | 4 | 3.16 | ||||||||||||||||||||||||

Total |

$ | 929 | $ | 1,220 | $ | 1,314 | $ | 1,428 | ||||||||||||||||||||||||

(1) |

Yields calculated for interest revenue on non-taxable investment securities include the effect of taxable-equivalent adjustments, a method of presentation in which interest income on tax-exempt securities is adjusted to present the earnings performance on a basis equivalent to interest earned on fully taxable securities, with a corresponding charge to income tax expense. The adjustment is computed using a federal income tax rate of 35%, adjusted for applicable state income taxes, net of the related federal tax benefit. The taxable-equivalent adjustment included in interest revenue to calculate the yields above was $42 million for the year ended December 31, 2005. |

| 2005 |

2004 |

2003 |

2002 |

2001 |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions) |

||||||||||||||||||||||

| U.S.: |

||||||||||||||||||||||

| Commercial

and financial |

$ | 2,298 | $ | 1,826 | $ | 2,344 | $ | 1,578 | $ | 2,479 | ||||||||||||

| Lease

financing |

404 | 373 | 395 | 403 | 413 | |||||||||||||||||

| Total

U.S. |

2,702 | 2,199 | 2,739 | 1,981 | 2,892 | |||||||||||||||||

| Non-U.S.: |

||||||||||||||||||||||

| Commercial

and industrial |

1,854 | 526 | 424 | 289 | 725 | |||||||||||||||||

| Lease

financing |

1,926 | 1,904 | 1,858 | 1,719 | 1,639 | |||||||||||||||||

| Banks

and other financial institutions |

– | – | – | 177 | 71 | |||||||||||||||||

| Other |

– | – | – | 8 | 14 | |||||||||||||||||

| Total

non-U.S. |

3,780 | 2,430 | 2,282 | 2,193 | 2,449 | |||||||||||||||||

| Total

loans |

$ | 6,482 | $ | 4,629 | $ | 5,021 | $ | 4,174 | $ | 5,341 | ||||||||||||

| Average

loans and lease financing outstanding |

$ | 6,013 | $ | 5,689 | $ | 5,568 | $ | 5,105 | $ | 6,081 | ||||||||||||

| YEARS |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Total |

Under

1 |

1

to 5 |

Over

5 |

|||||||||||||||

| (Dollars

in millions) |

||||||||||||||||||

| U.S.: |

||||||||||||||||||

| Commercial

and financial |

$ | 2,298 | $ | 2,257 | $ | 34 | $ | 7 | ||||||||||

| Lease

financing |

404 | 4 | 59 | 341 | ||||||||||||||

| Total

U.S. |

2,702 | 2,261 | 93 | 348 | ||||||||||||||

| Non-U.S.: |

||||||||||||||||||

| Commercial

and industrial |

1,854 | 1,853 | 1 | – | ||||||||||||||

| Lease

financing |

1,926 | – | 460 | 1,466 | ||||||||||||||

| Total

non-U.S. |

3,780 | 1,853 | 461 | 1,466 | ||||||||||||||

| Total |

$ | 6,482 | $ | 4,114 | $ | 554 | $ | 1,814 | ||||||||||

| (Dollars in millions) |

||||||

|---|---|---|---|---|---|---|

| Loans

and leases with predetermined interest rates |

$ | 2,327 | ||||

| Loans

and leases with floating or adjustable interest rates |

41 | |||||

| Total |

$ | 2,368 | ||||

| 2005 |

2004 |

2003 |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions) |

||||||||||||||

| Germany |

$ | 4,217 | $ | 3,971 | $ | 3,834 | ||||||||

| United

Kingdom |

2,696 | 2,355 | 4,243 | |||||||||||

| Canada |

1,463 | 1,383 | 1,175 | |||||||||||

| Australia |

1,441 | 1,760 | 1,528 | |||||||||||

| Netherlands |

992 | – | – | |||||||||||

| Japan |

– | 941 | 1,490 | |||||||||||

| France |

– | – | 1,346 | |||||||||||

| Total

outstanding |

$ | 10,809 | $ | 10,410 | $ | 13,616 | ||||||||

requirements and the evaluations of the major independent credit rating agencies that assign ratings to our public debt.

| REGULATORY GUIDELINES |

STATE

STREET |

STATE

STREET BANK |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Minimum |

Well Capitalized |

2005 |

2004 |

2005 |

2004 |

|||||||||||||||||||

| Regulatory

Capital Ratios: |

||||||||||||||||||||||||

| Tier

1 capital |

4 | % | 6 | % | 11.7 | % | 13.3 | % | 10.3 | % | 11.6 | % | ||||||||||||

| Total

capital |

8 | 10 | 14.0 | 14.7 | 12.5 | 12.5 | ||||||||||||||||||

| Tier

1 leverage ratio(1) |

4 | 5 | 5.6 | 5.5 | 5.4 | 5.3 | ||||||||||||||||||

(1) |

Regulatory guideline for well-capitalized applies only to State Street Bank. |

|

|

We have increased our quarterly dividend twice each year since 1978. Over the last ten years, dividends per share have grown at a 16% compound annual growth rate. Funds for cash distributions to our shareholders by the parent company are derived from a variety of sources. The level of dividends paid to shareholders on our common stock, which was $239 million in 2005, is reviewed regularly and determined by the Board considering our liquidity, capital adequacy and recent earnings history and prospects, as well as economic conditions and other factors deemed relevant. Federal and state banking regulations place certain restrictions on dividends paid by subsidiary banks to the parent holding company. In addition, bank regulators have the authority to prohibit bank holding companies from paying dividends if they deem such payment to be an unsafe or unsound practice. At December 31, 2005, the parent company had $9.63 billion of liquid assets with which to meet dividend declaration and other payment obligations. Information concerning dividends from our subsidiary banks is in Note 13 of the “Notes to Consolidated Financial Statements” included in this Form 10-K under Item 8.

• |

Market risk: the risk of adverse financial impact due to fluctuations in market prices, primarily as they relate to our trading activities |

• |

Interest-rate risk: the risk of loss in non-trading, asset and liability management positions, primarily the impact of adverse movements in interest rates on the repricing mismatches that exist between balance sheet assets and liabilities |

• |

Credit risk: the risk of loss that may result from the default or downgrade of a borrower or counterparty |

• |

Operational risk: the risk of loss from inadequate or failed internal processes, people and systems, or from external events, which is consistent with the Basel II definition |

• |

Business risk: the risk of adverse changes in our earnings from business factors, including changes in the competitive environment, changes in the operational economics of business activities, and the effect of strategic and reputation risks |

| Standard & Poor’s |

Moody’s |

Fitch |

DBRS |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| State Street Corporation: | ||||||||||||||

| Short-term

commercial paper |

A-1 | + | P-1 | F1 | + | R-1 | (mid) | |||||||

| Senior

debt |

AA | – | Aa3 | AA | – | AA | (low) | |||||||

| Subordinated

debt |

A | + | A1 | A | + | A | (high) | |||||||

| Capital

securities |

A | A1 | A | + | A | (high) | ||||||||

| State

Street Bank: |

||||||||||||||

| Short-term

deposits |

A-1 | + | P-1 | F1 | + | R-1 | (mid) | |||||||

| Long-term

deposits |

AA | Aa2 | AA | AA | ||||||||||

| Senior

debt |

AA | – | Aa2 | AA | – | AA | ||||||||

| Subordinated

debt |

AA | – | Aa3 | A | + | AA | (low) | |||||||

| Outlook |

Stable | Stable | Stable | Stable | ||||||||||

| CONTRACTUAL CASH OBLIGATIONS |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PAYMENTS

DUE BY PERIOD |

|||||||||||||||

| Total |

Less

than 1 year |

1–3

years |

4–5 years |

Over

5 years |

|||||||||||

| (Dollars

in millions) |

|||||||||||||||

| As

of December 31, 2005 |

|||||||||||||||

| Long-term

debt(1) |

$ | 4,083 | $ | 138 | $ | 276 | $ | 558 | $ | 3,111 | |||||

| Operating

leases |

1,167 | 180 | 292 | 227 | 468 | ||||||||||

| Capital

lease obligations |

925 | 51 | 103 | 104 | 667 | ||||||||||

| COVERS,

a component of SPACES |

2 | 2 | – | – | – | ||||||||||

| Total

contractual cash obligations |

$ | 6,177 | $ | 371 | $ | 671 | $ | 889 | $ | 4,246 | |||||

(1) |

Long-term debt above excludes capital leases (reported as a separate line item) and the effect of interest-rate swaps. Interest payments were calculated at the stated rate, with the exception of floating-rate debt for which payments were calculated using the indexed rate in effect at December 31, 2005. |

under Item 8. We have obligations under pension and other postretirement benefit plans, which are more fully described in Note 17 of the “Notes to Consolidated Financial Statements,” which are not included in the above table.

| OTHER COMMERCIAL COMMITMENTS |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TENURE

OF COMMITMENT |

|||||||||||||||||

| Total amounts committed(1) |

Less

than 1 year |

1–3 years |

4–5 years |

Over

5 years |

|||||||||||||

| (Dollars

in millions) |

|||||||||||||||||

| As

of December 31, 2005 |

|||||||||||||||||

| Indemnified

securities financing |

$ | 372,863 | $ | 372,863 | |||||||||||||

| Liquidity

asset purchase agreements |

24,039 | 19,956 | $ | 2,200 | $ | 1,402 | $ | 481 | |||||||||

| Unfunded

commitments to extend credit |

14,403 | 11,887 | 602 | 1,824 | 90 | ||||||||||||

| Standby

letters of credit |

4,689 | 1,249 | 1,595 | 1,259 | 586 | ||||||||||||

| Total

commercial commitments |

$ | 415,994 | $ | 405,955 | $ | 4,397 | $ | 4,485 | $ | 1,157 | |||||||

(1) |

Amounts committed are reported net of participations. |

Street. Chaired by the head of ERM, the MRC focuses on the review of business activities with significant risk content and the assessment of risk management programs and initiatives, and also serves as the credit policy committee for State Street. The Capital Committee, chaired by the Chief Financial Officer, oversees the management of our regulatory and economic capital, the determination of the framework for capital allocation and strategies for capital structure and debt and equity issuances. ALCO, chaired by the Treasurer, oversees the management of our consolidated balance sheet, including management of our global liquidity and interest-rate risk positions. The Fiduciary Committee reviews the criteria for the acceptance of fiduciary duties, and assists our business lines with their fiduciary responsibilities executed on behalf of customers. Several other committees with specialized risk management functions report to the MRC.

| VALUE-AT-RISK |

||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annual Average |

Maximum |

Minimum |

||||||||||||

| (Dollars

in millions) |

||||||||||||||

| Years

ended December 31, |

||||||||||||||

| 2005: |

||||||||||||||

| Foreign

exchange products |

$ | 1.3 | $ | 3.3 | $ | .5 | ||||||||

| Interest-rate

products |

1.1 | 3.0 | .3 | |||||||||||

| 2004: |

||||||||||||||

| Foreign

exchange products |

$ | 1.3 | $ | 3.5 | $ | .3 | ||||||||

| Interest-rate

products |

1.6 | 3.0 | 1.0 | |||||||||||

NIR-AT-RISK |

Estimated

Exposure to Net Interest Revenue |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

|||||||||

| (Dollars

in millions) Rate Change |

||||||||||

+

100 bps shock |

$ | (58 | ) | $ | (49 | ) | ||||

–

100 bps shock |

(5 | ) | 3 | |||||||

+

100 bps ramp |

(35 | ) | (39 | ) | ||||||

–

100 bps ramp |

9 | 18 | ||||||||

| ECONOMIC VALUE OF EQUITY |

Estimated

Exposure to Economic Value of Equity |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2005 |

2004 |

|||||||||

| (Dollars

in millions) Rate Change |

||||||||||

+

200 bps shock |

$ | (714 | ) | $ | (775 | ) | ||||

–

200 bps shock |

138 | 467 | ||||||||

| 2005 |

2004 |

2003 |

2002 |

2001 |

||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions) |

||||||||||||||||||||||

| U.S.: |

||||||||||||||||||||||

| Balance

at beginning of year |

$ | 14 | $ | 43 | $ | 43 | $ | 40 | $ | 41 | ||||||||||||

| Provision

for loan losses |

– | (15 | ) | – | 4 | 8 | ||||||||||||||||

| Loan

charge-offs — commercial and financial |

– | – | – | (3 | ) | (9 | ) | |||||||||||||||

| Recoveries

— commercial and financial |

– | – | – | 3 | – | |||||||||||||||||

| Transferred

upon sale(1) |

– | – | – | (1 | ) | – | ||||||||||||||||

| Reclassification(2) |

– | (14 | ) | – | – | – | ||||||||||||||||

| Balance

at end of year — U.S. |

14 | 14 | 43 | 43 | 40 | |||||||||||||||||

| Non-U.S.: |

||||||||||||||||||||||

| Balance

at beginning of year |

4 | 18 | 18 | 18 | 16 | |||||||||||||||||

| Provision

for loan losses |

– | (3 | ) | – | – | 2 | ||||||||||||||||

| Loan

charge-offs |

– | – | – | – | – | |||||||||||||||||

| Reclassification(2) |

– | (11 | ) | – | – | – | ||||||||||||||||

| Balance

at end of year — Non-U.S. |

4 | 4 | 18 | 18 | 18 | |||||||||||||||||

| Total

balance at end of year |

$ | 18 | $ | 18 | $ | 61 | $ | 61 | $ | 58 | ||||||||||||

| Ratio

of net charge-offs (recoveries) to average loans outstanding |

– | – | – | – | .14 | % | ||||||||||||||||

(1) |

In December 2002, we completed the sale of our Global Trade Banking business, which included the transfer of $1 million of the allowance for loan losses. |

(2) |

During 2004, we reclassified $25 million of the allowance for loan losses to other liabilities as a reserve for off-balance sheet commitments. Subsequent to the reclassification, the reserve for off-balance sheet commitments was reduced by $10 million, and recorded as an offset to other operating expenses. |

of the fair market value of the securities borrowed. The borrowed securities are revalued daily to determine if additional collateral is necessary. State Street held, as agent, cash and U.S. government securities totaling $387.22 billion and $360.61 billion as collateral for indemnified securities financing at December 31, 2005 and 2004, respectively.

analysis, stress-testing and management judgment to help assess the potential effect on State Street attributable to business risk. Management and control of business risks is generally the responsibility of the business units as part of their overall and strategic planning and internal risk management processes.

TO OUR SHAREHOLDERS

State Street delivered value in 2005.

We delivered value to our shareholders, our customers, our employees and the communities in which we operate. We achieved this value by focusing on delivering for our customers, executing our plan against our goals, performing consistently for our shareholders, providing more opportunities for our employees, and continuing to give back to the communities where we do business.

Our goals for 2005 included growth in operating earnings per share of between 10 and 15 percent, growth in operating revenue of between 8 and 12 percent, and operating return on shareholders’ equity of between 14 and 17 percent. We achieved these goals, increasing operating earnings per share from continuing operations by 14 percent and operating revenue by 10 percent and recording return on shareholders’ equity from continuing operations of 15.3 percent. Assets under custody hit an all-time high of $10.1 trillion and assets under management rose to a record $1.4 trillion.

2005 was our 28th consecutive year of operating earnings per share growth and our 27th consecutive year of dividend increases, which rose 12 percent. We also repurchased 13 million shares of our stock, putting our share count at 334 million shares outstanding, just as it was at the end of 2004.

I measure the year’s achievements in four ways.

Financial

We remained focused on the bottom line in 2005, carefully balancing revenue growth with continued expense management. This focus allowed us to generate positive operating leverage for the year, an objective I set out to accomplish when I took over as chairman and chief executive officer in July 2004, and one that I continue to target. I view our 2005 results as a start, and an indication that we are heading in the right direction.

Business growth across the company helped fuel our revenue increase in 2005. We added more than 2,000 new investment servicing and investment management wins in 2005, a result of our strong sales culture and our ability to execute. State Street Global Advisors (SSgA), our investment management arm and the largest institutional asset manager in the world, also posted significant growth in 2005 and improved its contribution to State Street overall. SSgA now represents 21 percent of State Street’s total pretax income, up from 17 percent a year ago.

We continued to deepen existing customer relationships and expand new product capabilities. These factors, combined with new business growth, enabled us to deliver what I consider to be better top-line performance than our peers.

We continue to see significant opportunities for growth outside of the United States, which accounted for 39 percent of State Street’s revenue in 2005, up from 37 percent at the end of 2004. I have set a goal of increasing this number to 50 percent over time, fueled in part by the growth of savings and retirement assets in Europe and the Asia-Pacific region and the globalization of investing.

In addition to revenue growth, positive operating leverage was achieved through expense control. By monitoring our headcount, adding mainly to support new business wins and by better aligning our real estate portfolio with our needs, we slowed our rate of expense growth. Our strengthened and more cost-effective global servicing model, shaped in part by new regulatory requirements, helped us to better serve our customers in the locations where they do business. We now have processing hubs in multiple locations around the world including Canada and India.

The centralized treasury group that we formed early in 2005 has improved management of our balance sheet, which is driven by customer liabilities. To better position State Street for rising interest rates, in 2005 we expanded the investment portfolio and adjusted the mix of investments to include higher yielding floating-rate securities, ending the year with a conservatively invested portfolio, 95 percent of which was AA rated or better.

Customer

State Street’s singular focus on providing large, global institutional investors with unparalleled service and value remained a differentiator for our company in 2005. Our ability to handle complex transactions, create innovative solutions and improve efficiencies helped us to attract new customers and add significant value to our existing customer relationships around the world.

|

2,086 |

14% |

|

new investment servicing and |

growth in operating earnings per share |

|

investment management wins |

from continuing operations |

Major wins that fell into the expanded business category in 2005 included a landmark investment manager operations outsourcing renewal from Scottish Widows Investment Partnership in Edinburgh, extending our relationship with this customer well into a second decade. The year’s biggest investment servicing win, from Columbia Management Advisors, LLC, the asset management arm of Bank of America, gave State Street a key role in one of the largest fund integrations in the history of the mutual fund industry. This piece of business expands upon our existing relationship with a fund family that was acquired by Bank of America and illustrates our ability to earn the trust and confidence of our customers, as does another investment servicing appointment from Charles Schwab Investment Management for $149 billion in assets. Two wins from Volkswagen Group – one in the United Kingdom and the other in Germany – are further proof of our ability to expand many of the custody and accounting relationships we established years ago.

We also established many new customer relationships in 2005 in all major geographies and across all our capabilities. These relationships include conducting one of the largest-ever transition management assignments for a customer in Japan and providing servicing and management for a wide range of pension and investment schemes in Europe and Asia-Pacific. State Street’s ability to develop new products and services for both new and existing customers continues to set us apart.

State Street Global Advisors played an important role during the year in helping to enhance Asia’s bond markets as manager of the ABF Pan Asia Bond Index Fund, a key component of the Asian Bond Fund 2, an initiative developed by a group of 11 central banks and monetary authorities designed to provide governments with an additional source of credit. The fund invests in the local currency debt of eight countries in Asia, increasing investors access to this vital region of the world.

|

10% |

28 |

|

increase in operating revenue |

consecutive years of growth in |

|

|

operating earnings per share |

Product innovation continues to be a focus for us. State Street Global Advisors developed several new strategies including Global Alpha Plus, an innovative investment strategy designed to achieve consistent excess returns. It also launched a number of liability-driven investment strategies aimed at better matching assets to liabilities for pension funds. SSgA’s growing active product array contributed to more than half of its net new revenue in 2005. With a renewed focus on exchange-traded funds, SSgA also launched nine new ETFs during the year, including the SPDR® Dividend, and saw strong growth in some of its innovative approaches such as the streetTRACKS® Gold Shares.

Our research and trading capabilities, including foreign exchange, equity execution, transition management and securities finance activities, also posted record results in 2005. Daily trading volume on FX Connect,® our multibank electronic trading system, surpassed $45 billion and State Street remained the unmatched leader in transition management, managing more than $380 billion in transitions during the year. Continued demand for our quantitative investment research led us to expand our successful State Street Investor Confidence Index®, which now includes regional views for Europe, North America and the Asia-Pacific region.

As we advance our effort to serve customers in all the markets where they do business, we strengthened our presence in 2005 in Switzerland, the Netherlands and Hong Kong, and opened a representative office in Beijing, China. These markets will play an important role in our goal to increase revenue outside the United States.

Governance

State Street has made several recent changes to its corporate governance policies. First, we created a new chief compliance officer position charged with centralizing and overseeing State Street’s compliance program. Our board of directors – 13 out of 14 of whom qualify as independent under the New York Stock Exchange listing standards – are now elected annually, eliminating three-year terms of the past. Shareholders also now annually ratify the appointment of our auditors, Ernst & Young LLP. In 2005, the board adopted a majority voting standard requiring a director or nominee who receives a “withhold” vote from the majority of outstanding shares in an uncontested election of directors to submit his or her resignation, to be considered by the Nominating and Corporate Governance Committee.

Talent

Great companies are built around extraordinary individual execution. We must continue to invest in State Street’s future by developing and leveraging our deep pool of talented professionals. Today, we are investing in our employees at a higher level than ever before. In 2005, we added more training, enhanced our salary and promotions process, and undertook several initiatives to move executives within State Street globally to provide a deeper bench of talent that supports our succession planning. One such example is the appointment in 2005 of Bill Hunt, an 11-year company veteran, to lead State Street Global Advisors.

State Street employees continue to give their time and money to improve the communities where we live and work. In a year of unprecedented natural disasters around the world, State Street colleagues offered their help and support to a variety of relief efforts, while continuing to support local charitable endeavors. More than a quarter of our workforce invested approximately 30,000 hours of volunteer time around the globe last year. Giving back is an inherent part of the State Street culture and a source of great corporate pride.

In 2005, I believe State Street became a stronger, more efficient and more focused company. As we move into 2006, I’m encouraged that our business pipeline remains strong, and that we’re executing well against our strategic objectives. For 2006, we have once again set financial goals of achieving revenue growth between 8 and 12 percent, earnings per share growth between 10 and 15 percent and return on shareholders’ equity between 14 and 17 percent. We are currently targeting the middle of those ranges.

In my 18 months as State Street’s chairman and CEO, conversations with our customers have assured me of one thing: When customers come to State Street, they get a value they cannot find anywhere else. We delivered that value in 2005, and I will keep working to build on that value for all of our stakeholders in the future.

Sincerely,

Ronald E. Logue

Chairman and Chief Executive Officer

STATE STREET CORPORATION

| 2005 |

2004 |

2003 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions, except per share data or where otherwise indicated) |

||||||||||||

| Years

ended December 31, |

||||||||||||

| Fee

Revenue: |

||||||||||||

| Servicing

fees |

$ | 2,474 | $ | 2,263 | $ | 1,950 | ||||||

| Management

fees |

751 | 623 | 533 | |||||||||

| Trading

services |

694 | 595 | 529 | |||||||||

| Securities

finance |

330 | 259 | 245 | |||||||||

| Processing

fees and other |

302 | 308 | 299 | |||||||||

| Total

fee revenue |

4,551 | 4,048 | 3,556 | |||||||||

| Net

Interest Revenue: |

||||||||||||

| Interest

revenue |

2,930 | 1,787 | 1,539 | |||||||||

| Interest

expense |

2,023 | 928 | 729 | |||||||||

| Net

interest revenue |

907 | 859 | 810 | |||||||||

| Provision

for loan losses |

– | (18 | ) | – | ||||||||

| Net

interest revenue after provision for loan losses |

907 | 877 | 810 | |||||||||

| (Losses)

gains on sales of available-for-sale investment securities, net |

(1 | ) | 26 | 23 | ||||||||

| Gain

on sale of Private Asset Management business, net of exit and other associated

costs |

16 | – | 285 | |||||||||

| Gain

on sale of Corporate Trust business |

– | – | 60 | |||||||||

| Total

revenue |

5,473 | 4,951 | 4,734 | |||||||||

| Operating

Expenses: |

||||||||||||

| Salaries

and employee benefits |

2,231 | 1,957 | 1,731 | |||||||||

| Information

systems and communications |

486 | 527 | 551 | |||||||||

| Transaction

processing services |

449 | 398 | 314 | |||||||||

| Occupancy |

391 | 363 | 300 | |||||||||

| Merger,

integration and divestiture costs |

– | 62 | 110 | |||||||||

| Restructuring

costs |

– | 21 | 296 | |||||||||

| Other |

484 | 431 | 320 | |||||||||

| Total

operating expenses |

4,041 | 3,759 | 3,622 | |||||||||

| Income

from continuing operations before income tax expense |

1,432 | 1,192 | 1,112 | |||||||||

| Income

tax expense from continuing operations |

487 | 394 | 390 | |||||||||

| Income

from continuing operations |

945 | 798 | 722 | |||||||||

| Loss

from discontinued operations |

(165 | ) | – | – | ||||||||

| Income

tax benefit from discontinued operations |

(58 | ) | – | – | ||||||||

| Net

loss from discontinued operations |

(107 | ) | – | – | ||||||||

| Net

income |

$ | 838 | $ | 798 | $ | 722 | ||||||

| Earnings

Per Share From Continuing Operations: |

||||||||||||

| Basic |

$ | 2.86 | $ | 2.38 | $ | 2.18 | ||||||

| Diluted |

2.82 | 2.35 | 2.15 | |||||||||

| Loss

Per Share From Discontinued Operations: |

||||||||||||

| Basic |

$ | (.33 | ) | $ | – | $ | – | |||||

| Diluted |

(.32 | ) | – | – | ||||||||

| Earnings

Per Share: |

||||||||||||

| Basic |

$ | 2.53 | $ | 2.38 | $ | 2.18 | ||||||

| Diluted |

2.50 | 2.35 | 2.15 | |||||||||

| Average

Shares Outstanding (in thousands): |

||||||||||||

| Basic |

330,361 | 334,606 | 331,692 | |||||||||

| Diluted |

334,636 | 339,605 | 335,326 | |||||||||

| 2005 |

2004 |

|||||||

|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions) |

||||||||

| As

of December 31, |

||||||||

| Assets |

||||||||

| Cash

and due from banks |

$ | 2,684 | $ | 2,035 | ||||

| Interest-bearing deposits with banks |

11,275 | 20,634 | ||||||

| Securities

purchased under resale agreements |

8,679 | 12,878 | ||||||

| Federal

funds sold |

– | 5,450 | ||||||

| Trading

account assets |

764 | 745 | ||||||

| Investment

securities available for sale (including securities pledged of $26,573

and $27,273) |

54,979 | 36,171 | ||||||

| Investment

securities held to maturity (fair value of $4,815 and $1,389) |

4,891 | 1,400 | ||||||

| Loans

(less allowance of $18 and $18) |

6,464 | 4,611 | ||||||

| Premises

and equipment (net of accumulated depreciation of $2,149 and $1,923) |

1,453 | 1,444 | ||||||

| Accrued

income receivable |

1,364 | 1,204 | ||||||

| Goodwill |

1,337 | 1,497 | ||||||

| Other

intangible assets |

459 | 494 | ||||||

| Other

assets |

3,619 | 5,477 | ||||||

| Total

assets |

$ | 97,968 | $ | 94,040 | ||||

| Liabilities |

||||||||

| Deposits: |

||||||||

| Noninterest-bearing |

$ | 9,402 | $ | 13,671 | ||||

| Interest-bearing — U.S. |

2,379 | 2,843 | ||||||

| Interest-bearing — Non-U.S. |

47,865 | 38,615 | ||||||

| Total

deposits |

59,646 | 55,129 | ||||||

| Securities

sold under repurchase agreements |

20,895 | 21,881 | ||||||

| Federal

funds purchased |

1,204 | 435 | ||||||

| Other

short-term borrowings |

1,219 | 1,343 | ||||||

| Accrued

taxes and other expenses |

2,632 | 2,603 | ||||||

| Other

liabilities |

3,346 | 4,032 | ||||||

| Long-term

debt |

2,659 | 2,458 | ||||||

| Total

liabilities |

91,601 | 87,881 | ||||||

| Commitments

and contingencies (Note 9) |

||||||||

| Shareholders’ Equity |

||||||||

| Preferred

stock, no par: authorized 3,500,000 shares; issued none |

||||||||

| Common

stock, $1 par: authorized 500,000,000 shares; issued 337,126,000 and 337,126,000

shares |

337 | 337 | ||||||

| Surplus |

266 | 289 | ||||||

| Retained

earnings |

6,189 | 5,590 | ||||||

| Accumulated

other comprehensive (loss) income |

(231 | ) | 92 | |||||

| Treasury

stock, at cost (3,501,000 and 3,481,000 shares) |

(194 | ) | (149 | ) | ||||

| Total

shareholders’ equity |

6,367 | 6,159 | ||||||

| Total

liabilities and shareholders’ equity |

$ | 97,968 | $ | 94,040 | ||||

| COMMON STOCK | TREASURY STOCK | |||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Shares |

Amount |

Surplus |

Retained Earnings |

Accumulated Other Comprehensive (Loss) Income |

Shares |

Amount |

Total |

|||||||||||||||||||||||||

| (Dollars

in millions, except per share data, shares in thousands) |

||||||||||||||||||||||||||||||||

| Balance

at December 31, 2002 |

329,992 | $ | 330 | $ | 104 | $ | 4,472 | $ | 106 | 5,065 | $ | (225 | ) | $ | 4,787 | |||||||||||||||||

| Comprehensive

Income: |

||||||||||||||||||||||||||||||||

| Net

income |

722 | 722 | ||||||||||||||||||||||||||||||

| Change

in net unrealized gains/losses on available-for-sale securities, net of

related taxes of $(20) |

(26 | ) | (26 | ) | ||||||||||||||||||||||||||||

| Foreign

currency translation, net of related taxes of $68 |

109 | 109 | ||||||||||||||||||||||||||||||

| Change

in unrealized gains/losses on cash flow hedges, net of related taxes of

$2 |

3 | 3 | ||||||||||||||||||||||||||||||

| Total

comprehensive income |

722 | 86 | 808 | |||||||||||||||||||||||||||||

| Cash

dividends declared — $.56 per share |

(187 | ) | (187 | ) | ||||||||||||||||||||||||||||

| Present

value of the estimated fees payable with respect to SPACES, pursuant to January 14, 2003 Registration Statement |

(57 | ) | (57 | ) | ||||||||||||||||||||||||||||

| Common

stock acquired |

80 | (3 | ) | (3 | ) | |||||||||||||||||||||||||||

| Common

Stock Issued Pursuant To: |

||||||||||||||||||||||||||||||||

| Public

stock offering |

7,153 | 7 | 260 | 267 | ||||||||||||||||||||||||||||

| Stock

awards and options exercised, including tax benefit of $13 |

(13 | ) | 4 | (2,025 | ) | 89 | 93 | |||||||||||||||||||||||||

| Debt

conversion |

(1 | ) | (21 | ) | 1 | – | ||||||||||||||||||||||||||

| Modified

stock awards and options for restructuring |

19 | (385 | ) | 17 | 36 | |||||||||||||||||||||||||||

| Other |

(56 | ) | 3 | 3 | ||||||||||||||||||||||||||||

| Balance

at December 31, 2003 |

337,132 | 337 | 329 | 5,007 | 192 | 2,658 | (118 | ) | 5,747 | |||||||||||||||||||||||

| Comprehensive

Income: |

||||||||||||||||||||||||||||||||

| Net

income |

798 | 798 | ||||||||||||||||||||||||||||||

| Change

in net unrealized gains/losses on available-for-sale securities, net of

related taxes of $(91) |

(130 | ) | (130 | ) | ||||||||||||||||||||||||||||

| Change

in minimum pension liability, net of related taxes of $(19) |

(26 | ) | (26 | ) | ||||||||||||||||||||||||||||

| Foreign

currency translation, net of related taxes of $17 |

85 | 85 | ||||||||||||||||||||||||||||||

| Change

in unrealized gains/losses on cash flow hedges, net of related taxes of

$(1) |

(3 | ) | (3 | ) | ||||||||||||||||||||||||||||

| Change

in unrealized gains/losses on hedges of net investments in foreign subsidiaries,

net of related taxes of $(14) |

(26 | ) | (26 | ) | ||||||||||||||||||||||||||||

| Total

comprehensive income |

798 | (100 | ) | 698 | ||||||||||||||||||||||||||||

| Cash

dividends declared — $.64 per share |

(215 | ) | (215 | ) | ||||||||||||||||||||||||||||

| Common

stock acquired |

4,098 | (178 | ) | (178 | ) | |||||||||||||||||||||||||||

| Impact

of fixing the variable-share settlement rate of SPACES |

(26 | ) | (26 | ) | ||||||||||||||||||||||||||||

| Common

Stock Issued Pursuant to: |

||||||||||||||||||||||||||||||||

| Stock

awards and options exercised, including tax benefit of $20 |

(6 | ) | (10 | ) | (3,128 | ) | 141 | 131 | ||||||||||||||||||||||||

| Debt

conversion |

(4 | ) | (104 | ) | 4 | – | ||||||||||||||||||||||||||

| Other |

(43 | ) | 2 | 2 | ||||||||||||||||||||||||||||

| Balance

at December 31, 2004 |

337,126 | 337 | 289 | 5,590 | 92 | 3,481 | (149 | ) | 6,159 | |||||||||||||||||||||||

| Comprehensive

Income: |

||||||||||||||||||||||||||||||||

| Net

income |

838 | 838 | ||||||||||||||||||||||||||||||

| Change

in net unrealized gains/losses on available-for-sale securities, net of

related taxes of $(150) |

(229 | ) | (229 | ) | ||||||||||||||||||||||||||||

| Foreign

currency translation, net of related taxes of $(54) |

(140 | ) | (140 | ) | ||||||||||||||||||||||||||||

| Change

in unrealized gains/losses on hedges of net investments in foreign subsidiaries,

net of related taxes of $20 |

37 | 37 | ||||||||||||||||||||||||||||||

| Change

in unrealized gains/losses on cash flow hedges, net of related taxes of

$6 |

9 | 9 | ||||||||||||||||||||||||||||||

| Total

comprehensive income |

838 | (323 | ) | 515 | ||||||||||||||||||||||||||||

| Cash

dividends declared — $.72 per share |

(239 | ) | (239 | ) | ||||||||||||||||||||||||||||

| Common

stock acquired |

13,130 | (664 | ) | (664 | ) | |||||||||||||||||||||||||||

| Common

Stock Issued Pursuant to: |

||||||||||||||||||||||||||||||||

| SPACES |

(73 | ) | (8,712 | ) | 418 | 345 | ||||||||||||||||||||||||||

| Stock

awards and options exercised, including tax benefit of $20 |

50 | (4,319 | ) | 197 | 247 | |||||||||||||||||||||||||||

| Other |

(79 | ) | 4 | 4 | ||||||||||||||||||||||||||||

| Balance

at December 31, 2005 |

337,126 | $ | 337 | $ | 266 | $ | 6,189 | $ | (231 | ) | 3,501 | $ | (194 | ) | $ | 6,367 | ||||||||||||||||

2005 |

2004 |

2003 |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| (Dollars

in millions) |

||||||||||||

| Years

ended December 31, |

||||||||||||

| Operating

Activities: |

||||||||||||

| Net

income |

$ | 838 | $ | 798 | $ | 722 | ||||||

| Adjustments

to reconcile net income to net cash provided by operating activities: |

||||||||||||

| Non-cash

adjustments for depreciation, amortization, accretion, provision for loan

losses and deferred income tax expense |

499 | 639 | 613 | |||||||||

| Write-down

of assets related to discontinued operations |

150 | – | – | |||||||||

| Gains

on sales of divested businesses, net of exit and other associated costs |

(16 | ) | – | (345 | ) | |||||||

| Securities

losses (gains), net |

1 | (26 | ) | (23 | ) | |||||||

| Change

in trading account assets, net |

(19 | ) | (340 | ) | 579 | |||||||

| Other,

net |

1,030 | (655 | ) | (57 | ) | |||||||

| Net

Cash Provided by Operating Activities |

2,483 | 416 | 1,489 | |||||||||

| Investing

Activities: |

||||||||||||

| Net

decrease in interest-bearing deposits with banks |

9,359 | 1,104 | 6,405 | |||||||||

| Net

decrease (increase) in federal funds sold and securities purchased under

resale agreements |

9,649 | (8,777 | ) | 7,664 | ||||||||

| Proceeds

from sales of available-for-sale securities |

3,299 | 8,035 | 13,676 | |||||||||

| Proceeds

from maturities of available-for-sale securities |

22,129 | 15,387 | 24,033 | |||||||||

| Purchases

of available-for-sale securities |

(44,758 | ) | (23,408 | ) | (46,799 | ) | ||||||

| Proceeds

from maturities of held-to-maturity securities |

1,132 | 1,107 | 1,362 | |||||||||

| Purchases

of held-to-maturity securities |

(4,623 | ) | (892 | ) | (1,440 | ) | ||||||

| Net

(increase) decrease in loans |

(1,801 | ) | 451 | (760 | ) | |||||||

| Proceeds

from sales of divested businesses, net |

16 | – | 347 | |||||||||

| Business

acquisitions, net of cash acquired |

(43 | ) | (100 | ) | (1,250 | ) | ||||||

| Purchases